Discovering the shared desire for an exceptional and harmonious living environment is a powerful catalyst that propels individuals into action. This collaborative aspiration, rooted in the notion of acquiring a residence with a special someone, unveils countless opportunities for growth, commitment, and the realization of collective dreams.

Embracing the idea of embarking on a journey towards a remarkable abode can be likened to cultivating a flourishing garden. With each step, the foundation is laid for a space that exemplifies individuality, love, and unwavering devotion. As partners join forces, their joint efforts become the fertile soil from which they plant the seeds of their shared vision, nurturing it with commitment and dedication.

The process of transforming their intangible desires into tangible reality requires a delicate balance of pragmatism and imagination. Honing in on their individual strengths, the partners embark on an awe-inspiring journey of exploration and discovery, seeking inspiration from various sources to shape the contours of their vision. It is within this intricate dance that they lay the groundwork for their future home, infusing it with the essence of their personalities and creating an environment that resonates with their souls.

As this shared journey unfurls, it is vital to navigate the vast realm of possibilities with intention and sensitivity, staying attuned to one another's desires and requirements. Through open communication and mutual understanding, the path to a harmonious dwelling becomes illuminated, allowing for the realization of a dream that surpasses individual expectations. The shared journey of acquiring a home embodies a profound testament to the love and commitment intertwining two souls on a path towards a joint fulfillment of aspirations.

Assessing Your Shared Vision

In the process of envisioning your future together, it is crucial to evaluate and understand the shared vision you both have for your ideal living space. This entails exploring your mutual aspirations and desires for a place to call home, without directly referencing specific notions of dreams, purchasing houses, or any particular individuals involved.

Assessing your shared vision involves delving into the core values and aesthetic preferences that both parties hold dear. It entails a comprehensive analysis of the ideas, goals, and concepts you both share when envisioning the perfect abode. By jointly assessing these elements, you can determine the common ground upon which you will build the foundation of your future home.

During this process, it is important to emphasize effective communication and active listening. Each person's voice should be equally valued and respected to ensure an equitable vision. Through open and honest discussions, you can explore the different aspects that contribute to your collective vision - such as location, architectural style, size, and interior design. By doing so, you can bridge any gaps and align your expectations, ultimately paving the way for a harmonious living environment.

Moreover, it is essential to comprehend each other's individual emotions and perspectives related to the vision. This includes acknowledging the emotional connections and personal experiences that shape your desires for a future home. By understanding and empathizing with each other's motivations, you can develop a holistic understanding of the shared vision and strengthen your bond as you work towards making it a reality.

In conclusion, assessing your shared vision involves exploring the feelings, values, and ideals that underpin your future living space. By engaging in open and respectful communication, considering each other's perspectives, and acknowledging emotional connections, you can construct a unified vision that guides you in the journey of turning your ideal home into a tangible reality.

Exploring Your Individual Preferences

Discovering and understanding your unique desires and inclinations is an essential step towards the realization of your vision for a shared home. By delving into the depths of your personal tastes and preferences, you can uncover the key elements that will make your future living space truly reflective of both your individuality and your collective dreams.

Begin by embarking on a journey of self-reflection, honing in on the aspects that are most important to you in a living environment. Consider your preferred aesthetics, whether you are drawn to contemporary minimalism or the timeless charm of classical architecture. Explore the nuances of your desired location, whether it be the tranquility of a suburban retreat or the vibrant energy of an urban metropolis.

As you delve deeper into your individual preferences, observe the elements that ignite your imagination and ignite a deep sense of satisfaction within you. Pay attention to the characteristics that evoke a feeling of comfort and serenity, whether it be the natural light streaming through large windows or the cozy warmth of a fireplace. Take note of the intricate details that excite your senses and spark your enthusiasm, such as the texture of wooden floors or the elegance of intricate moldings.

Remember that self-discovery is an ongoing process. Embrace the exploration of various design styles and architectural concepts, expanding your knowledge and expanding your horizons. Don't be afraid to experiment with different themes and ideas, allowing yourself to indulge in the boundless creativity that lies within you.

Ultimately, by exploring your individual preferences, you will embark on a transformative journey towards creating a shared home that is not only a sanctuary for both of you but also a physical manifestation of your dreams and aspirations.

Creating a Feasible Financial Plan

When envisioning the possibility of purchasing a property alongside a partner, it is essential to establish a realistic and achievable budget. This section delves into the process of setting a financial plan that aligns with your aspirations, emphasizing the importance of considering various factors before venturing into the realm of property ownership.

One of the initial steps in setting a realistic budget is evaluating your current financial situation. Analyzing your income, savings, and existing financial commitments allows you to gain a clear overview of your financial capabilities. By understanding your financial landscape, you can determine the amount of money you can allocate towards purchasing a property without jeopardizing your overall financial stability.

Equally significant is the identification of your long-term financial goals. Establishing a comprehensive financial plan involves considering factors such as your desired lifestyle, savings for emergencies, and retirement plans. By incorporating these objectives into your budget, you can ensure that purchasing a house remains aligned with your broader financial aspirations.

Researching the real estate market is a vital step in creating a feasible financial plan. Familiarizing yourself with property prices in different areas, considering market trends, and consulting real estate professionals can provide valuable insights into the overall costs involved in buying a property. It is essential to remember that the cost of a property extends beyond the purchase price, encompassing expenses such as property taxes, insurance, and maintenance.

Another aspect to consider when setting a realistic budget is the availability of financing options. Researching various mortgage lenders, understanding the different types of loans, and comparing interest rates can ensure that you secure the most favorable financial arrangement. Additionally, gaining knowledge about grants and government assistance programs can provide potential avenues for reducing the financial burden of acquiring a property.

| Considerations for Setting a Realistic Budget: |

|---|

| 1. Evaluating current financial situation |

| 2. Identifying long-term financial goals |

| 3. Researching the real estate market |

| 4. Exploring available financing options |

Exploring the Housing Market

When embarking on the journey of finding a new place to call home, it is crucial to thoroughly research and analyze the housing market. In this section, we will delve into the essential aspects of exploring the real estate market, discovering invaluable information that can help you make informed decisions about your future abode.

One of the first steps in researching the housing market is to understand the current trends and fluctuations in property prices. By examining the market conditions, you can gain insightful knowledge about the affordability and availability of homes in different areas. Identifying neighborhoods or regions with potential growth can present opportunities for a wise investment.

Furthermore, it is important to consider the specific features and amenities that are desirable to you and your potential co-buyer. Evaluating your needs and preferences can assist in narrowing down the options and finding properties that align with your vision of an ideal living space. Understanding the current market is vital in making informed decisions about the type of property and location that suit your lifestyle and aspirations.

In addition to analyzing the current state of the market and considering personal preferences, researching the housing market also involves exploring the historical data of an area. Examining past sales prices and market trends can provide invaluable insights into property values and the potential for future appreciation. This information can help guide your decision-making process and ensure that you are making a well-informed investment.

Furthermore, researching the housing market entails exploring the local amenities and resources available in a particular area. Factors such as schools, transportation options, recreational facilities, and proximity to essential services can greatly impact the quality of life in a chosen neighborhood. By understanding the surrounding amenities, you can determine if a specific location meets your lifestyle needs and preferences.

Overall, thorough research of the housing market is an essential step in turning your dream of buying a house into a reality. By examining market conditions, identifying desired features, exploring historical data, and considering local amenities, you can make informed decisions and find the perfect home to share with your partner. So, let us embark on this exploration together and make your dream home a reality!

Choosing the Perfect Location for Your Future Haven

When embarking on the journey of finding your ideal abode, one crucial aspect to consider is the selection of the right location. The location you choose will play a significant role in shaping your dream home and shaping the lifestyle you envision. Making an informed decision about the location can be a decisive factor in creating a haven that surpasses your expectations.

Discovering the Ideal Neighborhood:

First and foremost, it is essential to identify the neighborhood that aligns with your vision and requirements. A neighborhood embodies the sense of community, lifestyle, and amenities that will surround your future home. Analyzing factors such as proximity to schools, recreational facilities, shopping centers, healthcare services, and transportation networks will contribute to a better understanding of whether a specific neighborhood fits your aspirations.

Unraveling the Charms of the Surrounding Area:

Exploring the features of the surrounding area will enable you to grasp the essence of your potential dream abode. Investigate the nearby parks, green spaces, or natural landscapes that can enhance the overall quality of your life. In addition, delve into the local culture, entertainment options, and dining scene to ensure they resonate with your preferences and contribute to the ideal lifestyle you envision.

Assessing Future Developments and Investment Potential:

While evaluating various locations, it is vital to consider the possibility of future developments and the potential for investment. Researching the planned infrastructure projects or upcoming urban developments in the area can give you insights into the evolution of the neighborhood. Furthermore, analyzing the property market and trends can guide you towards a location that not only fulfills your dream but also holds long-term value.

Weighing the Practical Considerations:

In addition to the emotional aspects, it is crucial to weigh the practical considerations when choosing the right location for your dream home. Factors such as safety, accessibility, and daily conveniences must be taken into account. Assess the proximity to your workplace, public transportation options, and the overall safety record of the area to ensure your future home offers a harmonious blend of convenience and tranquility.

Embracing Your Individual Preferences:

Finally, one cannot disregard the significance of personal preferences when selecting the perfect location. Whether you seek a vibrant and dynamic urban setting or a peaceful and secluded retreat, allowing your own preferences to guide your decision-making process will contribute to transforming your dream of an ideal home into a tangible reality.

Collaborating with a Real Estate Agent

Engaging in a partnership with a professional real estate agent can be instrumental in materializing your aspirations of owning a perfect dwelling. These adept individuals possess the expertise and resources required to navigate the intricate process of property acquisition, ensuring a seamless experience for you and your companion. By enlisting the services of a knowledgeable real estate agent, you can tap into their comprehensive understanding of the market, gain valuable insights into the property options available, and receive guidance throughout every stage of the purchasing journey.

In collaboration with a real estate agent, you have the advantage of leveraging their vast network, which includes contacts in the industry such as architects, contractors, and home inspectors. This network can prove invaluable in terms of connecting you with the right professionals who can assist in assessing the condition of a potential home, estimating renovation costs, and ensuring regulatory compliance. The expertise and connections of your real estate agent can save you significant time and effort, as they diligently work to identify properties that align with your preferences and financial considerations.

A real estate agent is also well-versed in the art of negotiation, equipped with the skills to advocate for your interests. With their guidance, you can confidently navigate the intricate process of making offers, counteroffers, and ultimately securing a fair purchase price. Through their market knowledge, they can provide you with accurate property valuations and guide you in making informed decisions regarding the financial aspects of your investment. Furthermore, a trusted agent will safeguard your interests throughout the contract negotiations, ensuring that all legal obligations and contingencies are precisely addressed.

| Benefits of Collaborating with a Real Estate Agent |

|---|

| Comprehensive understanding of the market |

| Access to a network of industry professionals |

| Time and effort saved through expert guidance |

| Skilled negotiation for favorable terms |

| Accurate property valuations and financial guidance |

| Ensuring legal obligations and contingencies are addressed |

Navigating the Mortgage Process

Embarking on the journey towards your shared goal of homeownership involves more than just envisioning your dream home. While it may seem like a daunting task, navigating the mortgage process is a crucial step towards turning your vision into a reality.

Understanding the intricacies of obtaining a mortgage is essential for making informed decisions that fit your financial situation. This process entails evaluating various loan options, gathering the necessary documentation, and working closely with lenders to secure the best terms.

Evaluating Loan Options: When embarking on the path to homeownership, you'll encounter a myriad of mortgage options, each with its own advantages and considerations. It's essential to explore and compare various loan programs, such as fixed-rate mortgages, adjustable-rate mortgages, or government-backed loans, to determine the best fit for your unique circumstances and long-term financial goals.

Gathering Documentation: To streamline the mortgage application process, it's crucial to gather the necessary documentation beforehand. Typically, lenders will require proof of income, employment history, tax returns, bank statements, and information about your existing debts. Preparing these documents in advance will help expedite the approval process and demonstrate financial stability to lenders.

Working with Lenders: Securing a mortgage requires a collaborative effort between you and the lender. Engaging in open and transparent communication ensures that lenders have a clear understanding of your financial situation, enabling them to provide tailored mortgage solutions and guide you through the application process. It's important to ask questions, seek clarification, and carefully review the terms and conditions before making any commitments.

Navigating the Approval Process: Once you've submitted your mortgage application and all the required documentation, the approval process begins. During this time, lenders will review your financial information, assess your creditworthiness, and determine your eligibility for a mortgage. Patience is crucial in this phase, as it may take time for lenders to complete their evaluation and provide a final decision.

Understanding Mortgage Terms: As you progress through the mortgage process, it's essential to familiarize yourself with key mortgage terms. This includes understanding the interest rate, loan term, down payment requirements, closing costs, and any potential penalties or fees. Equipping yourself with this knowledge empowers you to make informed decisions and ensures that you are well-prepared for the future financial responsibilities associated with homeownership.

By navigating the mortgage process strategically, you and your partner can transform your shared vision of homeownership into a reality. Remember to approach each step with careful consideration and seek guidance from professionals when needed. Together, you can overcome the challenges and make your dream of owning a home a tangible and fulfilling achievement.

Making Your Vision of a Perfect Residence a Tangible Achievement

Introducing a roadmap to transform your aspirations of having an exceptional dwelling into a concrete accomplishment. This section aims to provide insightful strategies and practical tips for realizing your ideal living space collaboration with a partner. Whether you envision a charming abode brimming with character, a contemporary oasis adorned with sleek designs, or a cozy retreat filled with personalized touches, this guide will empower you to bring your dream home to life.

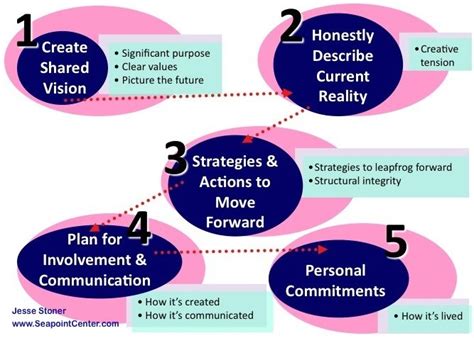

1. Crafting a Shared Vision: Start by engaging in open and constructive dialogues with your partner to establish a harmonious vision for your future residence. Synthesize your individual preferences, interests, and lifestyles to construct a coherent framework that reflects both your personalities. Consider elements such as architectural styles, interior designs, location, and amenities to ensure a shared understanding and direction.

2. Collaborative Planning and Budgeting: Develop a comprehensive plan that outlines the necessary steps and milestones to transform your vision into reality. Thoroughly research any legal or financial considerations, such as mortgages, loans, or rental expenses. Collaboratively establish a realistic budget that accommodates both your aspirations and financial capabilities. Prioritize essential elements and allocate funds accordingly to make the most of your investment.

3. Engaging Professionals: Leverage the expertise of architects, interior designers, and contractors to translate your shared vision into tangible blueprints and designs. Collaborate with professionals who understand your unique requirements and can transform them into a harmonious, functional, and aesthetically pleasing living space. Emphasize effective communication and ensure that all parties involved are aligned with your aspirations.

4. Sourcing Furnishings and Décor: Seek inspiration from various sources, including design magazines, online platforms, and local galleries, to curate a collection of furniture and décor that aligns with your vision of an ideal home. Take into account the functionality, comfort, and visual appeal of each item. Explore sustainable and ethical options, supporting artisans and makers with values that resonate with your vision.

5. Creating Personalized Spaces: Embrace the opportunity to infuse your unique personalities and interests into different areas of your home. Incorporate sentimental objects, artwork, and photographs that evoke cherished memories. Craft spaces that cater to specific hobbies, such as a reading nook, a home theater, or a gardening corner. Personal touches will create an atmosphere of warmth, individuality, and belonging.

Remember, the journey of transforming your dream home into reality is a collaborative endeavor that requires compromise, patience, and perseverance. Remain open to evolving ideas and be receptive to unexpected opportunities that may enhance your vision along the way. With careful planning, effective communication, and a shared commitment, you can turn your shared dream of a perfect dwelling into a beautiful reality.

FAQ

How can I turn my dream of buying a house with someone into a reality?

Turning your dream of buying a house with someone into a reality requires careful planning and consideration. First, you need to clearly define your goals and expectations for the house. Then, you should assess your financial situation and determine how much you can afford to spend on the house. It is important to save up for a down payment and consider the ongoing costs of homeownership, such as mortgage payments, property taxes, and maintenance expenses. Additionally, you may need to research and compare different neighborhoods, house styles, and amenities to find the perfect fit for you and your partner. Lastly, it is crucial to communicate openly and effectively with your partner throughout the process to ensure alignment and mutual understanding.

What factors should I consider when choosing the right house?

When choosing the right house, several factors should be taken into consideration. Firstly, location plays a crucial role, as it determines accessibility to schools, workplaces, amenities, and transport links. Secondly, the size of the house should be suitable for both you and your partner's needs, taking into account the number of bedrooms, bathrooms, and overall living space. Thirdly, budget is a vital factor, as you need to ensure the house you choose falls within your financial means. Other factors to consider include the condition of the house, the neighborhood's safety and reputation, proximity to green spaces, and the potential for future growth and development in the area.

How can I save up for a down payment on a house?

Saving up for a down payment on a house requires discipline and planning. Firstly, determine how much you need for a down payment, keeping in mind that it is typically recommended to save at least 20% of the house price. Calculate how much you need to save each month and create a budget that allows for regular savings. Consider cutting back on unnecessary expenses and finding ways to increase your income, such as taking on a part-time job or freelancing. Set up automatic transfers to a separate savings account to ensure a portion of your income goes directly into your down payment fund. Lastly, stay focused on your goal and remind yourself of the potential rewards of homeownership.

What are the benefits of buying a house with someone?

Buying a house with someone offers several benefits. Firstly, it allows you to share the financial burden of homeownership, making it more affordable and manageable. You can pool resources and potentially qualify for a larger mortgage, giving you more options when it comes to choosing a house. Secondly, it provides emotional support and companionship during the homebuying process and beyond. Having someone to share the joys and challenges of owning a home can enhance the overall experience. Additionally, buying a house with someone can open up opportunities for shared investment and long-term financial planning. It is important, however, to carefully consider the implications and responsibilities of co-ownership and ensure clear communication and agreements are in place.