Achieving Your Aspiration of Possessing a Cutting-Edge Automobile

Have you ever caught yourself gazing wistfully at sleek and stylish vehicles effortlessly cruising down the street, envisioning yourself behind the wheel? The desire to own a state-of-the-art automobile is a universally shared aspiration that transcends cultures and borders. Whether it's the thrill of navigating the open road or the sheer sense of accomplishment, the yearning to possess a new and innovative car is undeniably alluring.

Captivatingly modern and impeccably designed, a contemporary vehicle symbolizes much more than mere transportation; it represents a fusion of technology, craftsmanship, and individuality on wheels. With its advanced features, cutting-edge safety systems, and luxurious interior, a brand-new car offers an unparalleled driving experience that can elevate your everyday routine to new heights.

Yet, as with any ambitious goal, turning this dream into a reality requires careful planning, patience, and determination. It demands an unwavering commitment to financial discipline, resourceful thinking, and a steadfast focus on your ultimate objective. Despite the challenges that this endeavor may present, with the right mindset and a tailored strategy, you can make steady progress towards owning the remarkable vehicle you've always envisioned.

Setting Clear Goals and Budgeting

When it comes to achieving your aspirations and managing your finances, it is essential to establish clear objectives and create a well-defined budget. By setting specific targets and allocating your resources wisely, you can bring your desires closer to reality.

1. Identify Your Priorities: Determine what is most important to you in terms of car ownership. Consider factors such as brand, model, features, and other specific requirements that align with your preferences and needs.

2. Define Measurable Goals: Set realistic and attainable goals for car ownership. Break down your ultimate dream into smaller milestones that you can track and measure your progress towards. This will help you stay motivated and focused along the way.

3. Create a Budget Plan: Develop a comprehensive budget that encompasses all aspects of car ownership, including the purchase price, insurance, maintenance, and other related expenses. Ensure that your budget aligns with your financial capabilities and allows for any necessary savings.

4. Research and Compare: Conduct thorough research to gather information about different car models, prices, financing options, and available discounts or incentives. Compare various options and consider seeking advice from professionals or trusted individuals in the automotive industry.

5. Explore Financing Options: Determine whether you will purchase the car outright or opt for financing. If financing is the chosen route, explore different loan options, interest rates, and terms to find the most suitable arrangement for your financial situation.

6. Track Your Expenses: Monitor your spending and track your progress against your budget plan. Regularly review your finances and make adjustments as necessary to ensure you remain on track towards achieving your car ownership goals.

7. Stay Disciplined: Stick to your budget and resist the temptation to overspend or deviate from your financial plan. Stay disciplined and focus on your long-term goals, knowing that maintaining financial stability will bring you closer to owning your dream car.

By setting clear goals and effectively managing your budget, you can turn your aspiration of owning a brand new car into a concrete reality. Stay dedicated, stay focused, and watch as your dream becomes achievable.

Saving Money and Reducing Expenses: Achieving Your Goal of Car Ownership

When it comes to realizing your aspirations of obtaining a brand new vehicle, it's crucial to focus on the efficient management of your finances. By adopting a disciplined approach to saving money and cutting unnecessary expenses, you can make significant progress towards purchasing the car of your dreams.

One effective strategy for reaching your goal is to prioritize your spending and identify areas where you can reduce costs. Begin by examining your monthly budget and identifying any discretionary expenses that can be eliminated or reduced. This might include dining out less frequently, subscribing to fewer streaming services, or cancelling unnecessary club memberships.

Another way to save money is by carefully evaluating your current bills and expenses. Take the time to review your internet, cable, and phone service providers and compare the prices and packages offered by different companies. By switching to more cost-effective options, you can potentially save a substantial amount of money each month.

Additionally, consider exploring alternative methods of transportation or carpooling to reduce fuel and maintenance costs. Public transportation, cycling, or even walking can be viable options, depending on your location and daily commuting needs. Carpooling or ridesharing services can also help cut down on expenses while minimizing your vehicle's wear and tear.

Furthermore, adopt a mindful approach to shopping and avoid impulsive purchases. Make a habit of creating shopping lists and sticking to them, avoiding unnecessary items that can eat away at your savings. Prioritize quality over quantity and aim to buy items that will serve you well in the long run, rather than opting for cheap and disposable products.

In conclusion, achieving your dream of owning a new car can be made possible by implementing effective money-saving strategies and making conscious efforts to reduce your expenses. By taking control of your finances and prioritizing your spending, you can move closer to turning your aspiration into a reality.

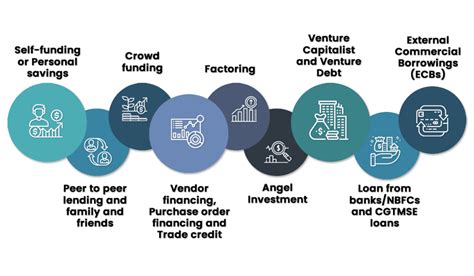

Exploring Different Financing Options

In the pursuit of turning your aspiration into a reality, it is pivotal to delve into the realm of various financing alternatives. In this segment, we will explore different avenues through which you can materialize your goal of acquiring a stunning, cutting-edge vehicle. By carefully analyzing and understanding the diverse financial options available, you can create a well-informed plan to make your dream car a tangible possession.

1. Financing through Auto Loan: One of the most common routes to car ownership is obtaining an auto loan. This entails borrowing funds from a financial institution or a bank, which you can then utilize to purchase your desired automobile. Once the loan is approved, you can repay the borrowed amount, along with interest, over a certain period of time in manageable installments.

2. Leasing: Another option to consider is leasing a car. Unlike buying, leasing allows you to enjoy the perks of driving a brand new vehicle without the long-term commitment of ownership. Leasing involves paying monthly installments for the duration of the lease agreement, typically ranging from two to five years. However, it is important to note that at the end of the lease, the car must be returned unless you choose to purchase it.

3. Personal Savings: Using your personal savings is a financially independent approach to fulfill your dream of owning a new car. By setting aside a portion of your income over time, you can accumulate enough funds to cover the cost of the car outright. This option eliminates the need for loan repayments or leasing agreements, providing a sense of ownership and financial freedom from the start.

4. Manufacturer Financing: Many car manufacturers offer financing plans directly to customers. These plans often come with competitive interest rates and flexible terms. By exploring the financing options provided by the car manufacturer, you may find exclusive deals and promotions that can help make your dream car more affordable and within reach.

5. Peer-to-Peer Lending: An alternative financing route to explore is peer-to-peer lending platforms. Through these online platforms, individuals can lend money to one another without involving traditional financial institutions. Peer-to-peer lending offers competitive interest rates and may provide more flexibility in terms of repayment schedules, making it a viable option to consider when pursuing your dream of owning a new car.

By considering these various financing options, you can evaluate the pros and cons of each approach and select the one that suits your financial situation and goals. Remember, making an informed decision about financing is essential to bring your dream of owning the perfect car one step closer to reality.

Exploring and Comparing Different Car Models

When it comes to realizing your aspiration of owning a brand new vehicle, it is crucial to thoroughly research and compare various car models. This step allows you to make an informed decision and choose the car that best fits your needs, preferences, and budget. By exploring and comparing different car models, you can gain valuable insights about their features, specifications, performance, and reliability.

To begin with, it is essential to identify the key requirements and priorities you have for your future car. Consider factors such as the size, type, and purpose of the vehicle. Determine whether you need a compact car for city commuting or a spacious SUV for family adventures. By understanding your personal preferences and lifestyle, you can narrow down the list of potential car models.

Next, utilize trusted online platforms, automotive magazines, and dealerships' websites to gather information about the car models that meet your criteria. Explore the extensive range of options available, including sedans, hatchbacks, crossovers, and luxury vehicles. Take note of the features and technologies offered by each car model, such as advanced safety systems, fuel efficiency, infotainment systems, comfort amenities, and customizable options.

- Pay attention to the performance aspects of different car models, such as engine power, acceleration, handling, and fuel economy. This information will help you understand how the vehicle performs on the road and whether it aligns with your driving preferences.

- Compare the interior space and cargo capacity of different car models to ensure they can accommodate your lifestyle and transportation needs. Consider factors such as legroom, headroom, storage compartments, and seating configurations, particularly if you frequently travel with passengers or require ample space for cargo.

- Scrutinize the safety features offered in each car model, including advanced driver-assistance systems, airbags, braking technology, and crash-test ratings. Safety should always be a top priority when selecting a car, particularly if you have a family or will be driving in challenging road conditions.

- Take into account factors such as maintenance costs, warranty coverage, reliability, and resale value when comparing car models. Reliable and well-built vehicles often offer peace of mind and can save you significant expenses in the long run.

Lastly, after conducting thorough research and creating a shortlist of potential car models, it is advisable to visit local dealerships and schedule test drives. Experiencing the vehicles firsthand will allow you to assess their comfort, driving dynamics, and overall satisfaction. As you compare the different car models, take into consideration factors such as pricing, financing options, available discounts, and negotiation possibilities.

By dedicating time to researching and comparing car models, you increase the likelihood of making a well-informed decision and achieving your dream of purchasing a vehicle that perfectly suits your desires and requirements.

Negotiating the Best Deal with Dealers

Securing the most favorable agreement with automobile dealerships is an essential step in achieving your aspiration of acquiring a brand new vehicle. This section will provide valuable insights and strategies for effectively negotiating with dealers to ensure you get the best possible deal.

| Research and Preparation | Building Rapport | Comparative Analysis |

|---|---|---|

| Before engaging in negotiations, it is crucial to conduct thorough research and preparation. Familiarize yourself with the market, pricing trends, and various financing options available. This knowledge will empower you during the negotiation process, enabling you to confidently discuss terms and options with the dealership. | Developing a strong rapport with the dealer can significantly enhance your chances of securing a favorable deal. Take the time to establish a friendly and professional relationship with the dealer as it can create a positive atmosphere during negotiations. Building trust and mutual understanding can help facilitate an agreement that satisfies both parties. | Performing a comparative analysis of different dealerships is a prudent approach to negotiating the best deal. Gather quotes from multiple dealers and compare prices, discounts, incentives, and additional services offered. This information will provide leverage during negotiations, allowing you to negotiate more effectively and potentially obtain a better deal. |

| Effective Communication | Exploring Options | Finalizing the Deal |

| Clear and concise communication skills are crucial when negotiating with dealers. Clearly express your preferences, expectations, and constraints to ensure the dealer understands your requirements. Active listening is equally important, as it enables you to comprehend the dealer's perspective and address their concerns effectively. | During negotiations, consider exploring various options available that can further enhance the deal. These options may include extended warranties, complimentary maintenance packages, or attractive financing plans. By discussing and evaluating these alternatives, you expand the range of possible benefits and achieve a more comprehensive agreement. | Once both parties have reached a mutually agreeable deal, it is essential to carefully review all the terms and conditions before finalizing the agreement. Ensure that all the agreed-upon details are accurately documented in writing. Thoroughly read and understand the contract, including the fine print and any potential hidden costs, before signing on the dotted line. |

By employing these strategies and approaches when negotiating with dealers, you can increase your chances of securing the best possible deal for your dream car.

Taking Advantage of Incentives and Discounts

Exploring the various opportunities to save money when purchasing a new vehicle can make your dream of owning a shiny, top-of-the-line car a more attainable reality.

When it comes to achieving your aspiration of owning a fabulous automobile, it's important to not overlook the potential benefits of incentives and discounts that are available. These options can significantly reduce the overall price of the vehicle, making it more affordable and within reach.

One way to take advantage of incentives and discounts is to look for manufacturer rebates. These rebates often provide a significant monetary amount that can be applied towards the purchase of a brand-new car. They can vary in value depending on the make and model, allowing you to save a substantial sum of money.

Another avenue to explore is special financing offers. Car manufacturers and dealerships frequently provide low-interest or even zero-interest financing options for certain models or during promotional periods. This can help you save on interest payments over the course of the loan, ultimately reducing the total cost of ownership.

Additionally, keep an eye out for loyalty programs and customer incentives. Some car companies offer rewards to customers who have previously purchased their vehicles, such as discounted prices, free maintenance services, or exclusive access to new features. These benefits can make upgrading to a new car more enticing and financially beneficial.

Furthermore, it can be advantageous to research any government or local incentives that are available. Some regions may provide tax credits or discounts to encourage the purchase of electric or hybrid vehicles, which not only contribute to a greener environment but also provide long-term savings on fuel costs.

Lastly, don't forget to negotiate with the dealer. Many dealerships are open to offering additional discounts or perks to close a sale. Being knowledgeable about the market value of the vehicle, current incentives, and your financing options can provide leverage during negotiations, potentially resulting in further savings.

- Research manufacturer rebates

- Explore special financing offers

- Take advantage of loyalty programs

- Look for government or local incentives

- Negotiate with the dealer

By being proactive and knowledgeable about the various incentives and discounts available, you can significantly reduce the financial burden associated with purchasing a brand-new car, making your dream a reality.

FAQ

Is it possible for someone with a limited budget to own a brand new car?

Yes, it is possible for someone with a limited budget to own a brand new car. There are various financing options available such as car loans and leasing, which allow individuals to purchase a car without paying the full amount upfront.

What are some smart financial strategies for saving money to buy a brand new car?

Some smart financial strategies for saving money to buy a brand new car include creating a budget and cutting back on unnecessary expenses, setting aside a portion of your income specifically for saving, exploring high-interest savings accounts, and considering additional sources of income, such as part-time jobs or freelance work.

Are there any alternatives to buying a brand new car?

Yes, there are alternatives to buying a brand new car. One option is to consider purchasing a used car, which is often more affordable than a brand new one. Another alternative is to look into car leasing, where you can rent a car for a certain period of time and then have the option to either buy it or return it.

What factors should I consider before purchasing a brand new car?

Before purchasing a brand new car, you should consider factors such as your budget, the cost of ownership (including insurance, maintenance, and fuel), your transportation needs, the value and resale potential of the car, and your personal preferences in terms of features and style.

How can I negotiate the best deal when buying a brand new car?

To negotiate the best deal when buying a brand new car, you should research the car's market value, compare prices from different dealerships, be prepared to walk away if the deal doesn't meet your expectations, consider financing options and incentives, and be confident in your negotiation skills. It can also be helpful to get pre-approved for a car loan to have better leverage during negotiations.

What are some tips for saving money to buy a brand new car?

One way to start saving money for a brand new car is by creating a budget and cutting expenses. Track your spending habits, and identify areas where you can reduce costs. Consider cutting back on non-essential expenses, such as eating out or entertainment. Additionally, set a savings goal and automate regular contributions to a separate savings account. This will help you stay disciplined and accumulated funds faster.

What are some alternative options for financing a brand new car?

If you don't have enough savings to purchase a brand new car outright, there are alternative financing options available. One option is to secure a car loan from a bank or a credit union. Make sure to compare interest rates and terms from different lenders to get the best deal. Another option is to consider leasing a car, where you essentially rent the vehicle for a specific period of time. Leasing allows for lower monthly payments, but you won't own the car at the end of the lease term.