Are you tired of unexpected setbacks when it comes to your personal finances? Imagine the frustration of facing a situation where your financial safety net suddenly becomes unstable. It's an all too familiar scenario for many, a reality that haunts our dreams and disrupts our daily lives. Whether it's a malfunctioning piece of plastic, an unexpected decline in your account balance, or unauthorized transactions, the uncertainty surrounding your debit card can leave you feeling vulnerable and helpless.

As we navigate through an increasingly digital and cashless society, our debit cards have become an integral part of our financial identities. They grant us access to our hard-earned money, enable countless online purchases and serve as our gatekeepers to financial security. But what happens when this seemingly infallible tool fails us? What measures can we take to prevent these unfortunate situations and protect ourselves from the potential havoc that a malfunctioning card can wreak?

Let's dive into the realm of problematic plastic and explore the strategies that will help you overcome these hurdles. Discover the crucial steps to take if your card goes astray, ensuring a swift resolution to any issues that may arise. Furthermore, stay one step ahead by learning the preventative measures that can shield you from this unwelcome dream altogether. Together, let us unlock the secrets of safeguarding our financial well-being and restoring peace of mind in this unpredictable realm of banking.

The Tale of a Shattered Plastic

In this section, we will delve into the captivating story of a fractured plastic instrument, recounting its journey and the challenges it faced along the way. Through this tale, we will explore the implications and consequences of such an incident, shedding light on the importance of taking preventive measures to avoid similar mishaps in the future.

Within the shattered fragments of this once reliable financial tool lies a cautionary tale for modern society. As this story unfolds, we will examine the impact of the incident not only on the cardholder but also on the financial institution involved. A closer look at the aftermath will reveal the potential for financial loss, inconvenience, and the need for prompt resolution.

Furthermore, as we navigate through this narrative, we will discover the importance of preventive measures to safeguard against such unfortunate incidents. We will explore strategies and best practices that can be implemented to mitigate the risk of a card shattering event, thus ensuring a more secure and seamless banking experience.

| Key Points | Subtopics |

|---|---|

| The Impact of a Shattered Card | - Financial loss |

| - Inconvenience | |

| - Resolving the aftermath | |

| Preventing a Card Shattering Event | - Safe card usage practices |

| - Protective measures |

This captivating tale serves as a reminder of the fragile nature of plastic cards and the need for vigilance to avoid unfortunate incidents. By understanding the potential implications and taking proactive steps, we can safeguard our financial well-being and ensure a smoother banking journey.

Panic Mode: What to Do When Your Card Malfunctions

When faced with an unexpected turn of events involving your financial instrument, it is crucial to remain calm and act promptly. Whether due to technical glitches, wear and tear, or unforeseen circumstances, encountering a malfunctioning card can cause considerable distress. In order to effectively overcome this challenging situation, it is important to be prepared and know what steps to take.

- Contact your card issuer: The first course of action is to promptly notify your card issuer about the issue. Reach out to their customer service helpline or use their online platform for reporting problems. Provide them with specific details such as the nature of the malfunction and any relevant transactions or occurrences leading up to it.

- Consider alternative payment options: In case your card is temporarily out of commission, it is advisable to have a backup plan. Explore alternative payment methods like cash, mobile payment apps, or linking another valid card to your account. This way, you will still be able to make purchases and meet your financial obligations without disruption.

- Review your transaction history: While awaiting resolution, it is essential to keep track of your transaction history. Regularly monitor your account statements and online banking platforms to identify any unauthorized or suspicious activities. Report any discrepancies or fraudulent charges immediately to your card issuer for further investigation and resolution.

- Document the issue: To ensure a smooth resolution process, it is vital to document the specifics of the card malfunction. Take note of the date, time, location, and any relevant details related to the incident. Additionally, it is recommended to keep copies of any communication exchanged with your card issuer or other parties involved in the resolution process.

- Follow up with your card issuer: If the issue persists or remains unresolved after your initial contact with the card issuer, it is important to follow up. Stay persistent and inquire about the progress of the investigation or the expected timeline for resolving the issue. Keeping open lines of communication will help expedite the resolution process.

Remember, encountering a card malfunction can cause inconvenience and potential financial implications, but by taking the appropriate steps and staying informed, you can minimize the impact and regain control over your financial transactions swiftly.

Assessing the Damage: Can Your Debit or Credit Card Be Repaired?

When facing a problematic financial situation caused by your damaged debit or credit card, it can be important to understand whether the damage is repairable or if a replacement card is necessary. Assessing the extent of the damage is crucial in determining the next course of action. In this section, we will explore different scenarios and provide insights into whether your card can be salvaged or not.

- Physical Damage: In cases where your card has suffered physical damage, such as bending or cracking, its usability may be compromised. An evaluation by your bank or card issuer is necessary to determine if the damages can be rectified.

- Magnetic Strip Issues: If the magnetic strip on your card has been damaged, it can significantly hinder its functionality. Depending on the extent of the damage, repairing the magnetic strip is often not feasible, and a replacement card may be needed.

- Chip Malfunction: The chip embedded in your card can also be subject to malfunctions, which can contribute to issues with payment or withdrawal. While some minor chip malfunctions can be resolved, more severe cases might require a new card.

- Security Concerns: In certain situations where the security of your card has been compromised, immediate card replacement becomes essential. This includes instances where there is evidence of tampering, suspected unauthorized transactions, or if your card has been lost or stolen.

- Non-Repairable Damage: Some damages, such as water or fire damage, can render a card irreparable. It is crucial to have a backup plan in such situations, as obtaining a new card will likely be necessary.

While it is important to assess the damage to your debit or credit card, prevention is always better than a cure. Regularly checking the condition of your card, keeping it in a safe place, and following card issuer guidelines can help prevent damage from occurring in the first place. Stay cautious and ensure the longevity of your banking tools to avoid potential inconveniences in the future.

Drowning in Debt: The Financial Consequences of a Faulty Payment Card

Discover the detrimental impact that a damaged or malfunctioning payment card can have on your financial well-being. The potential repercussions stretch far beyond simple inconvenience, potentially leading to a spiral of debt and financial instability.

1. Accumulation of Unpaid Bills

An unreliable payment card can disrupt your ability to make timely payments for essential expenses such as utility bills, rent or mortgage payments, and credit card bills. This leads to the accumulation of unpaid balances, which can quickly snowball into overwhelming debt.

2. Late Payment Penalties and Fees

Failure to make payments on time due to a dysfunctional card often results in late payment penalties and fees. These extra charges can add up significantly and worsen your financial situation.

3. Damaged Credit Score

The inability to manage your finances due to a faulty payment card can result in a negative impact on your credit score. Late or missed payments can be reported to credit bureaus, leading to a drop in your credit score and making it more challenging to secure loans or credit in the future.

4. Increased Interest Rates

If your credit score declines, lenders may view you as a higher-risk borrower, resulting in increased interest rates on any loans or credit you are able to obtain. This can make it even more difficult to repay debts and dig yourself out of financial trouble.

5. Limited Access to Funds

A broken payment card may restrict your access to your own money, which can hinder your ability to cover daily expenses or emergencies. This can force you to rely on expensive alternatives such as cash advances or payday loans, adding further to your financial burden.

Drowning in debt due to a malfunctioning payment card is a distressing situation that requires immediate attention. Taking proactive measures to maintain the functionality of your card and having a backup payment method ready can help prevent these detrimental financial consequences.

Road to Recovery: Steps to Take to Obtain a Replacement Card

In the unfortunate event that your debit or credit card becomes nonfunctional or unusable, it is important to take the necessary steps to regain access to your financial resources. This section will outline the process you should follow to ensure a smooth and efficient recovery, enabling you to obtain a new card without undue delay.

1. Contact Your Financial Institution

If you find yourself in possession of a damaged or lost card, the first step towards recovery is to promptly notify your bank or credit card issuer. This can typically be done through their customer service hotline or online banking portal. The issuer will guide you through the necessary steps to report the situation and request a replacement card.

2. Verify Your Identity

During the recovery process, it is essential to prove your identity to ensure that your account remains secure. Be prepared to provide your full name, account number, and any additional identifying information requested by the financial institution. This verification step helps protect against potential fraud and ensures that the replacement card is issued to the correct person.

3. Choose Your Card Type

Depending on your bank or issuer, you may have the opportunity to select a new card from various options. Consider factors such as the type of card (debit or credit), rewards programs, interest rates, and additional features offered. Take the time to review the available options and select a new card that best suits your financial needs and preferences.

4. Ensure Seamless Card Delivery

Once you have successfully requested a replacement card, confirm the address where it will be delivered. Verify that the mailing address is accurate to avoid any delays or potential misplacement. Some issuers may offer expedited delivery services for a nominal fee, which may be worth considering if you need access to your funds quickly.

5. Activate Your New Card

Upon receiving your replacement card, it is crucial to activate it before use. This can typically be done through the issuer's designated activation process, which may involve calling a specific number or completing the activation online. Follow the provided instructions carefully to activate your card and ensure its full functionality.

In conclusion, recovering from a broken or lost bank card requires prompt action and adherence to the necessary steps outlined above. By notifying your financial institution, verifying your identity, choosing a suitable replacement card, ensuring seamless delivery, and activating the new card, you can regain access to your finances and continue your financial transactions without interruption.

The Significance of Communication: Informing Your Financial Institution regarding the Inoperative Payment Card

Effective communication plays a crucial role when it comes to resolving issues related to a malfunctioning payment card. Addressing the situation promptly and notifying your bank about the situation is of utmost importance in safeguarding your finances and ensuring uninterrupted access to your funds.

When you encounter a defective or non-operational card, it is essential to establish a strong line of communication with your financial institution. Expressing your concerns clearly and providing detailed information will enable the bank to assist you efficiently in resolving the issue.

Timely Notification: Promptly notifying your financial institution about the issue with your card is vital. This allows them to take the necessary steps to protect your account from unauthorized activity and potential fraud.

Providing Accurate Details: While contacting your bank, make sure to provide accurate and detailed information about the malfunctioning card. This includes the date when the issue occurred, any specific transactions affected, and relevant account details. Thoroughly describing the problem will assist the bank in understanding the nature of the issue and devising an appropriate solution.

Utilizing Multiple Channels: Nowadays, banks offer multiple communication channels for reporting card-related problems. These channels may include phone calls, online chat support, and email. Select the most convenient method for you and initiate the conversation promptly to ensure a swift resolution.

Remaining Vigilant: Even after informing your financial institution, it is crucial to stay vigilant and monitor your account for any unauthorized transactions or suspicious activities. Regularly reviewing your bank statements and utilizing digital banking tools can help you identify any potential issues before they escalate.

In summary, promptly notifying your financial institution about the issue with your inoperative payment card is of utmost importance. By establishing effective communication, providing accurate details, utilizing appropriate channels, and remaining vigilant, you can ensure the necessary actions are taken to resolve the problem and safeguard your financial security.

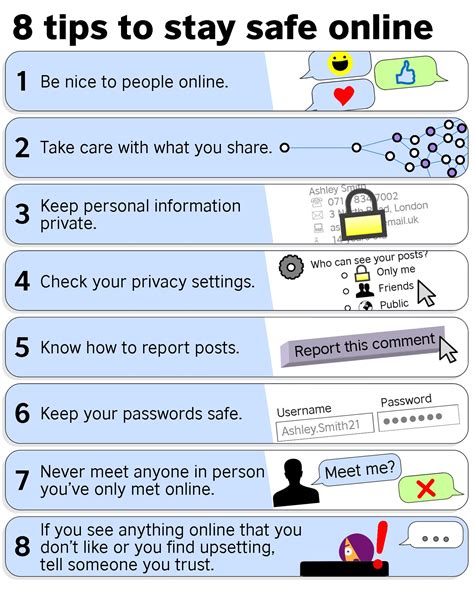

Safety Measures: Tips to Keep Your Payment Card Secure

In this section, we will discuss essential safety measures that you can adopt to ensure the longevity and proper usage of your payment card. By implementing these precautionary steps, you can minimize the risk of encountering issues or damage to your card.

First and foremost, it is crucial to handle your payment card with care. Treat it as a valuable possession and avoid subjecting it to unnecessary physical stress. Refrain from bending or scratching the card, as these actions can weaken the card's structure and render it vulnerable to breakage.

Another crucial aspect of protecting your payment card is safeguarding it from extreme temperatures. Exposure to excessive heat or cold can lead to the card's material becoming brittle or warping, making it prone to fracturing. Therefore, it is advisable to store your card in a secure place, away from direct sunlight or any heat sources.

Additionally, maintaining a clean card is vital for its longevity. Regularly inspect your card for any dirt, dust, or debris that may have accumulated. If necessary, clean it with a soft, lint-free cloth to prevent the build-up of grime, which could potentially damage the card's magnetic strip or chip.

Furthermore, it is important to be cautious while inserting your payment card into card readers or ATMs. Take your time and handle it with care to avoid forcing it into the slot or inserting it in the wrong direction. These actions can exert unnecessary pressure on the card and lead to breakage or damage.

Lastly, one of the most effective ways to prevent card breakage is to be mindful of where you store it. Avoid storing your card in tight places such as wallets or pockets where it can experience excessive bending or pressure. Instead, opt for a dedicated cardholder or organizer specifically designed to protect your payment card.

By following these safety measures and taking proactive steps to ensure the integrity of your payment card, you can enjoy hassle-free transactions and avoid the inconvenience of dealing with a broken or damaged card.

Beyond Plastic: Exploring Alternative Payment Options

Innovative Approaches for Financial Transactions

As technology continues to evolve, the realm of financial transactions is also undergoing a transformation. In this section, we will explore alternative payment options that go beyond the traditional concept of plastic bank cards. Discovering new methods and solutions for conducting transactions can provide individuals with more convenience, security, and flexibility in managing their finances.

Embracing the Digital Wallet Revolution

The emergence of digital wallets has revolutionized the way we make payments. With just a tap on a smartphone or wearable device, individuals can securely store their payment information and complete transactions effortlessly. Digital wallets offer a seamless and convenient experience for both online and in-person purchases, eliminating the need to carry multiple physical cards.

The Rise of Contactless Payments

Contactless payments have gained immense popularity in recent years, particularly in response to the global pandemic. This payment method enables users to make transactions simply by waving their enabled cards or devices near a contactless reader. The ease and speed of contactless payments make them a preferred choice for many consumers, providing a hygienic and efficient alternative to traditional payment methods.

Exploring Cryptocurrencies and Blockchain

The advent of cryptocurrencies and blockchain technology has opened up an entirely new frontier in finance. Cryptocurrencies, such as Bitcoin and Ethereum, offer decentralized and secure digital currency systems, allowing for peer-to-peer transactions without the need for intermediaries. Blockchain technology, on the other hand, provides a transparent and tamper-proof record of transactions, offering increased security and trust in financial operations.

Biometric Authentication for Seamless Transactions

Biometric authentication methods, such as fingerprints and facial recognition, are increasingly being utilized for payment authorization. These unique physiological characteristics provide an additional layer of security, ensuring that transactions are authorized by the rightful user. Biometric authentication offers a convenient and secure alternative to traditional methods, eliminating the need to remember passwords or carry physical identification.

Empowering the Unbanked with Mobile Payments

Mobile payments have significantly expanded access to financial services for individuals who are unbanked or underbanked. By leveraging mobile devices, individuals can send and receive funds, make purchases, and access basic financial services without the need for a traditional bank account. Mobile payment platforms empower individuals in underserved communities, fostering financial inclusion and economic empowerment.

Conclusion

While plastic bank cards have been a staple in the world of payments, exploring alternative options offers individuals a broader spectrum of possibilities. Embracing digital wallets, contactless payments, cryptocurrencies, biometric authentication, and mobile payments can revolutionize the way we conduct financial transactions, providing enhanced convenience, security, and inclusivity. As technology continues to evolve, it is essential to stay informed and open-minded, embracing the endless potential for innovation in the realm of financial transactions.

Lessons Learned: Stories from Individuals Who Experienced a Faulty Payment Card

In this section, we highlight personal accounts shared by individuals who have encountered unexpected issues with their financial transaction cards. These stories serve as valuable lessons, shedding light on the importance of being prepared for potential setbacks in order to prevent inconvenience and financial stress.

| Story Title | Key Takeaways |

|---|---|

| A Tale of Unexpected Decline | 1. Always carry backup payment methods. 2. Regularly monitor your account activity. 3. Contact your bank immediately if you encounter issues. |

| Lost in a Foreign Land | 1. Inform your bank about travel plans beforehand. 2. Keep copies of important card details in a secure location. 3. Be familiar with alternative payment options in the event of card loss. |

| An Unfortunate Online Shopping Experience | 1. Prioritize secure online shopping platforms. 2. Regularly update your card information. 3. Review your bank statements for any unauthorized transactions. |

| Stranded at the Gas Station | 1. Familiarize yourself with available emergency assistance. 2. Maintain a separate emergency fund for unexpected situations. 3. Keep contact information for your bank readily available. |

These stories emphasize the need for proactive measures to prevent and effectively handle incidents involving faulty payment cards. By learning from the experiences of others, you can better safeguard your financial transactions and maintain peace of mind in an increasingly digital world.

Future-proofing Your Finances: Strategies to Safeguard Your Payment Card from Potential Damage

Protecting your financial assets is a crucial aspect of managing your money effectively. With the increasing reliance on payment cards for transactions, it is essential to take proactive measures to secure them from potential damage or misuse. This section outlines practical steps that can help you future-proof your finances by safeguarding your payment card from any unforeseen circumstances.

1. Invest in a Protective Case: Shielding your payment card with a durable and sturdy protective case can minimize the risk of physical damage caused by accidents, spills, or mishandling. Consider using a protective case made of materials like metal or hard plastic that can provide an extra layer of defense against potential harm.

2. Stay Cautious of Magnetic Fields: Magnetic fields can potentially damage the magnetic stripe on your payment card, rendering it unreadable. To avoid this, be cautious when using your card near magnetic sources such as electronic devices, speakers, or magnets. Keep your card stored away from any magnetic objects to ensure its longevity.

3. Regularly Clean Your Card: Cleaning your payment card at regular intervals is vital to prevent debris or dust buildup that can interfere with card functionality. Use a soft, lint-free cloth slightly dampened with water or mild soap to gently wipe the card's surface. Avoid using harsh chemicals or abrasive materials, as they may damage the card's finish or strip the protective coating.

4. Memorize Your Card Details: Memorizing your payment card details, including the card number, expiration date, and security code, can be advantageous in case you misplace your card or it gets damaged. By knowing this information by heart, you can still make online transactions or provide necessary card details over the phone without physical access to the card.

5. Enable Transaction Notifications: Taking advantage of transaction notifications provided by your card issuer can help you quickly identify any suspicious or unauthorized activities. Set up alerts through email or SMS to receive real-time updates whenever a transaction is made using your payment card. This way, you can promptly report any fraudulent activity and prevent further damage to your finances.

By following these preventative measures, you can future-proof your finances and ensure the longevity of your payment card. Taking proactive steps to safeguard your card from potential damage or misuse will help you maintain financial security and peace of mind.

FAQ

What should I do if my bank card gets broken?

If your bank card gets broken, the first thing you should do is contact your bank or card issuer immediately. They will guide you on the steps to take, such as blocking your card and requesting a replacement. It's essential to act quickly to prevent any unauthorized transactions on your account.

Can a broken bank card still be used for online transactions?

No, a broken bank card cannot be used for online transactions. Even if it seems partially functional, it is recommended not to use it. A broken card may pose security risks, and it's better to get it replaced to prevent any potential fraud or misuse.

What are some preventive measures to avoid a broken bank card?

To prevent a broken bank card, you should handle it with care. Avoid bending or putting excessive pressure on the card. Keep it in a separate compartment of your wallet to prevent any potential damage from other items. Additionally, consider using a card protector or a sturdy cardholder to ensure its safety.

Is it necessary to inform the bank about a broken bank card if I don't want a replacement?

Yes, it is still necessary to inform the bank about a broken bank card, even if you don't want a replacement. By informing the bank, they can note it in their records and monitor your account for any suspicious activities. It's always better to keep your bank informed to ensure the security of your financial information.

How long does it usually take to receive a replacement bank card?

The time it takes to receive a replacement bank card may vary depending on your bank or card issuer. Typically, it takes around 7 to 10 business days to receive a replacement card. However, some banks offer expedited shipping options for an additional fee if you need the card urgently.

What should I do if my bank card is broken?

If your bank card is broken, you should contact your bank immediately. They will guide you on the next steps, which may include blocking your card, issuing a new one, or providing temporary solutions like a virtual card.