Intrigued by the allure of a precious substance that has captivated civilizations for centuries? Delve into the realm of sparkling treasures as we embark on an exceptional journey to understand the intricacies of capitalizing on the age-old fascination with the glamorous yellow metal. Embarking on this odyssey will allow us to uncover the concealed knowledge that holds the key to prudently navigating the thriving industry surrounding gold.

Prepare to unravel the enigmatic tapestry of gold sales and seize the opportunities that lie hidden within its gilded aura. By delving into the depths of this timeless market, we equip ourselves with a formidable arsenal of wisdom to decode the intricate mechanisms that shape this captivating sector. Whether you are an aspiring investor looking for a sound investment or a seasoned entrepreneur seeking to capitalize on the lucrative nature of gold sales, this exploration will empower you with the insights necessary to achieve your ambitions.

Guided by a thirst for knowledge, we place our bet on the resourcefulness of historical and contemporary anecdotes as we navigate through the labyrinth of gold sales. Through captivating tales of ancient civilizations and their insatiable thirst for this mesmerizing metal, we unravel the threads that illuminate the profound cultural significance that gold has held throughout the ages. By examining the actions and lessons learned by those who came before us, we fortify our understanding of the intricate web that intertwines gold and economic prosperity.

Embrace the opportunity to peer behind the alluring veil of gold sales, where fortunes can be made and lost in the blink of an eye. Equipped with the wealth of knowledge and understanding gleaned from studying the historical, economic, and sociopolitical aspects that influence the value of gold, we become ardent participants in this age-old dance, poised to profit from its constantly shifting rhythms and melodies. Join us as we embrace the mysteries, overcome the challenges, and unlock the secrets concealed within the entrancing world of gold sales.

Trends and Opportunities in the Gold Market

Exploring the ever-evolving landscape of the gold market unveils a plethora of trends and opportunities for savvy investors and enthusiasts alike. As the world's fascination with this precious metal continues to grow, understanding the current market dynamics and emerging trends can prove to be invaluable in making informed decisions.

1. Shifting Global Demand: An in-depth analysis reveals a shifting pattern in global demand for gold, influenced by various factors such as economic growth, geopolitical tensions, and investor sentiment. Keeping a pulse on these demand trends can help investors identify potential opportunities and navigate market fluctuations.

2. Technological Advancements: The gold industry is undergoing a technological revolution, with advancements in mining techniques, digitization, and refining processes. This presents opportunities for efficiency improvements, cost optimization, and the development of innovative products and services.

3. Environmental and Social Responsibility: Increasing awareness of environmental and social impacts has led to a growing emphasis on responsible and sustainable gold mining practices. Investors are increasingly seeking opportunities in companies that adhere to strict environmental standards and ethical mining practices.

4. Digital Gold Investments: The rise of digital platforms has democratized gold investment, allowing individuals to easily buy, sell, and store gold digitally. These technological advancements have opened new avenues for investors to participate in the gold market, offering flexibility and accessibility like never before.

5. Central Bank Policies: The gold market is influenced by central bank policies, particularly in relation to interest rates, inflation, and currency movements. Understanding the impact of these policies on gold prices can provide valuable insights into potential investment opportunities.

6. Emerging Markets: The ongoing economic growth and rising middle class in emerging markets have created a significant demand for gold. Investors monitoring these markets can identify emerging trends and capitalize on the increasing appetite for gold within these regions.

As the gold market continues to evolve, staying abreast of these trends and recognizing the opportunities they present can empower individuals to make informed decisions, unlocking the potential for success in gold investments.

Strategies to Maximize Profit when Selling Precious Metal

When it comes to selling valuable commodities, such as precious metals, having effective strategies in place can significantly impact the amount of profit you can make. By utilizing a combination of market analysis, pricing strategies, and understanding customer preferences, you can unlock ways to maximize your profit from gold sales.

| 1. Diversify Your Sales Channels |

|---|

Expanding your sales channels beyond traditional avenues can help you reach a wider customer base and increase your chances of selling gold at a higher price. Consider utilizing platforms such as online marketplaces, social media, and specialized gold trading platforms to tap into different market segments and attract potential buyers from diverse backgrounds. |

| 2. Stay Informed about Market Trends |

Monitoring market trends is crucial for determining the optimal time to sell gold. Stay updated on global events, economic indicators, and geopolitical factors that may impact the price of gold. This knowledge can help you identify favorable selling opportunities and avoid potential market downturns that could lead to lower profit margins. |

| 3. Assess the Gold Quality and Authenticity |

Before selling your gold, it is essential to assess its quality and authenticity accurately. Employ professional appraisers or use reliable testing methods to determine the purity and value of your gold. Selling genuine gold at its fair market value ensures you are not underselling your precious metal and enables you to maximize your profits. |

| 4. Set Competitive Pricing Strategies |

Establishing competitive pricing strategies can give you an edge when selling gold. Consider factors such as current market rates, demand-supply dynamics, and the uniqueness of your gold. Offering competitive prices while still ensuring a profit margin can attract potential buyers and increase the likelihood of successful transactions. |

| 5. Build Customer Trust and Loyalty |

Developing trust and loyalty with your customers can lead to repeat business and positive word-of-mouth referrals. Provide top-notch customer service, maintain transparency in your transactions, and communicate effectively to build strong relationships with your buyers. Satisfied and loyal customers are more likely to pay premium prices for your gold, ultimately maximizing your profit. |

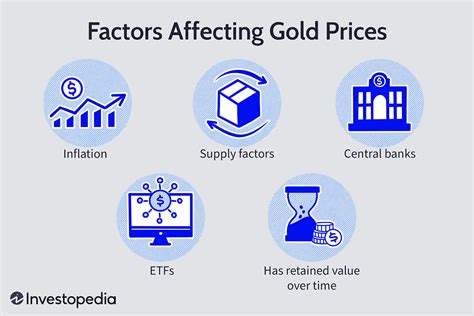

Factors Impacting Gold Prices

Understanding the various factors that influence gold prices is crucial for those interested in investing in this precious metal. The value of gold is influenced by a multitude of economic, geopolitical, and market-related factors, which play a significant role in determining its price fluctuations. By comprehending these key factors, investors can make informed decisions and potentially capitalize on the opportunities presented by the dynamic gold market.

1. Economic Factors:

- Economic growth and stability

- Inflation rates and monetary policies

- Interest rates and central bank policies

- Supply and demand dynamics

2. Geopolitical Factors:

- Political uncertainty and instability

- Geopolitical tensions and conflicts

- Government policies and regulations

- Trade disputes and international relations

3. Market-related Factors:

- Investor sentiment and risk appetite

- Stock market performance

- Currency exchange rates

- Demand from jewelry, technology, and industrial sectors

It is important to note that these factors do not act in isolation but rather interact with each other, creating a complex system that affects gold prices. The interplay between these different elements contributes to the volatile nature of the gold market and the potential opportunities it presents.

By closely monitoring and analyzing the economic, geopolitical, and market-related factors affecting gold prices, investors can gain insights into the possible future trends. However, it is essential to exercise caution and conduct thorough research before making any investment decisions as the gold market can be unpredictable and subject to sudden changes.

FAQ

What are the secrets to profit from gold sales?

The secrets to profit from gold sales involve understanding the market trends, timing the sales effectively, and knowing where to sell for the best prices. Additionally, being aware of the purity and quality of the gold being sold and staying updated with the global economic factors impacting the gold market also contribute to successful gold sales.

How can I determine the purity of gold before selling?

There are a few ways to determine the purity of gold before selling. The most common method is using an acid testing kit, which involves scratching the gold on a stone and applying different acid solutions to examine the reaction. Additionally, jewelers can also use electronic gold testers or X-ray fluorescence (XRF) technology to accurately measure the purity of gold.

Where can I sell gold to get the best prices?

To get the best prices for selling gold, you can consider selling to reputable jewelry stores, online gold buyers, pawnshops, or coin dealers. It is important to compare prices offered by different buyers and check their reputation and customer reviews. Additionally, selling gold directly to individuals, through auction platforms, or at gold exchange events can also provide opportunities for better prices.