Have you ever found yourself immersed in contemplation, envisioning the embodiment of your ultimate accomplishment? The fulfillment of that lifelong desire to acquire a place to call home, a sanctuary where memories are destined to be crafted, is a powerful notion that resonates with many. It encapsulates a quest to secure a personal retreat that is an embodiment of one's aspirations, values, and personality.

For those who yearn to transform aspirations into a tangible reality, there is a multitude of elements that warrant careful reflection. Astute preparation is crucial when navigating through the labyrinthine process of property acquisition. Acknowledging the significance of this endeavor is the initial step to honing in on an outcome that befits one's unique requirements.

Every individual's journey towards purchasing a flat is imbued with distinctive considerations, predicated on personal preferences and financial circumstances. From selecting the right location and determining the optimal size, to weighing various architectural styles and meticulously managing finances, the path to finding one's dream abode is riddled with crucial choices. These choices are invariably underpinned by the need for an informed decision-making process, bolstered by valuable tips and insights.

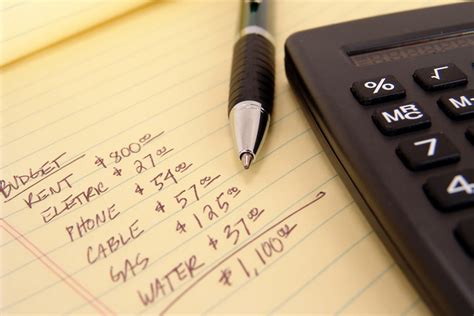

Setting Your Budget and Financial Planning

When it comes to realizing your aspirations of owning a property, it is essential to carefully consider your financial situation and develop a comprehensive budgeting plan. This section aims to help you navigate the financial aspects of purchasing a flat without relying on specific terms mentioned before.

1. Assess Your Finances:

Begin by evaluating your current financial status. Take into account your income, savings, investments, and any outstanding debts or liabilities. Having a clear picture of your financial standing will enable you to determine how much you can comfortably allocate towards purchasing a flat.

2. Determine Your Affordability:

Once you have assessed your finances, calculate a realistic budget that considers all associated costs. Include not only the cost of the flat itself but also expenses like property taxes, maintenance fees, insurance, and potential renovations. Consider working with a financial advisor or mortgage broker to gain a better understanding of the overall affordability.

3. Consider Your Funding Options:

Explore the various funding options available that align with your financial goals. This may involve obtaining a mortgage from a bank or financial institution or considering alternative financing options. Comparing loan terms, interest rates, and repayment options will help you make an informed decision about the most suitable funding source.

4. Save and Plan for Additional Costs:

Remember to account for additional costs that may arise during the home buying process. These could include legal fees, property inspection expenses, and moving costs. Planning and saving for these extra expenses will prevent any unforeseen financial burdens.

5. Track and Adjust Your Budget:

Throughout the home buying process, continuously track your expenses and adjust your budget accordingly. Prioritize your savings and limit unnecessary expenses to ensure you stay on track and maintain financial stability.

By setting a realistic budget and engaging in careful financial planning, you can take significant steps towards turning your dream of owning a flat into a tangible reality.

Researching the Real Estate Market and Location

When it comes to turning your vision of owning a perfect apartment into a reality, thorough research of the real estate market and location is crucial. By delving into carefully collected data and analyzing various factors, you can ensure that your investment meets your preferences and expectations.

One of the key aspects to consider is the real estate market itself. By examining market trends, you can gain insights into property values, fluctuations, and overall demand. This information will guide you in making informed decisions about the timing of your purchase and potential negotiation opportunities.

In addition, thoroughly researching the location is of utmost importance. It involves evaluating the neighborhood's amenities, such as schools, parks, shopping centers, and transportation options. Assessing the proximity to your workplace, local services, and recreational facilities will contribute to determining whether the area aligns with your lifestyle and long-term plans.

| Factors to Research | Importance |

|---|---|

| Crime rates and safety | High |

| Infrastructure and development plans | Medium |

| Accessibility to healthcare facilities | High |

| Noise pollution and environmental concerns | Low |

Furthermore, researching the local real estate market and location provides an opportunity to identify any upcoming events or projects that may impact property values. Road construction, planned zoning changes, or new commercial developments can significantly influence the appeal and future value of your chosen apartment.

Remember, investing time and effort into researching the real estate market and location is vital to ensure that you make the right decision. By evaluating both the macro and micro elements, you can find a home that not only matches your dreams but also aligns with your financial goals and lifestyle aspirations.

Exploring Mortgage Options and Achieving Loan Pre-Approval

When embarking on the journey towards owning your ideal property, it is crucial to have a comprehensive understanding of the various mortgage options available and to secure loan pre-approval. This section will delve into the different types of mortgages, highlight the significance of loan pre-approval, and guide you through the process of making informed decisions.

1. Understanding Mortgage Types:

- Fixed-Rate Mortgages: These mortgages offer stability as the interest rate remains constant throughout the loan term, ensuring predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs): ARMs feature an initial fixed-rate period, followed by periodic adjustments based on market conditions, offering potential savings initially.

- Government-Backed Mortgages: Options such as FHA loans and VA loans provide borrowers with more lenient criteria, lower down payment requirements, and other attractive benefits.

- Interest-Only Mortgages: With these loans, borrowers have the option to pay only the interest for a specified period before starting to repay the principal amount.

2. The Importance of Loan Pre-Approval:

Obtaining loan pre-approval before beginning your property search is highly advantageous. Not only does it demonstrate to sellers that you are a serious and qualified buyer, but it also gives you a clear idea of your budget and strengthens your bargaining power.

3. The Process of Loan Pre-Approval:

- Gather the necessary documents, including proof of income, tax returns, bank statements, and details of any outstanding debts.

- Contact lenders or mortgage brokers to initiate the pre-approval process.

- Fill out the application accurately, providing all the required information and documentation promptly.

- The lender will evaluate your financial situation, credit score, and debt-to-income ratio to determine your eligibility.

- If approved, you will receive a pre-approval letter stating the maximum loan amount you qualify for.

- Be prepared to provide updated documentation or information as required during the home buying process.

By understanding the various mortgage options and securing loan pre-approval, you empower yourself with the knowledge and financial readiness needed to pursue your dream property confidently. Remember that seeking professional advice from mortgage specialists can further enhance your understanding and help you make wise decisions.

Hiring Professionals for Expert Advice: Real Estate Agents and Lawyers

When it comes to turning your aspirations into reality and navigating the complexities of property acquisition, enlisting the help of qualified professionals can make all the difference. In this section, we will explore the significant role that real estate agents and lawyers play in providing guidance and expertise throughout the home buying process.

Real Estate Agents:

Real estate agents are skilled professionals who specialize in the buying and selling of properties, possessing in-depth knowledge of the real estate market and local neighborhoods. They act as intermediaries between buyers and sellers, ensuring a smooth and efficient transaction.

From conducting property searches based on your requirements and budget to arranging viewings and negotiating offers, real estate agents are there every step of the way. They provide valuable insights, offer guidance on pricing and market trends, and help you navigate the paperwork and legalities involved in purchasing a property.

By utilizing the services of a real estate agent, you can tap into their experience and expertise, making the process of finding and purchasing your dream home a well-informed and satisfying journey.

Lawyers:

While real estate agents focus on the practical aspects of buying a property, lawyers provide essential legal guidance and support. A real estate lawyer specializes in property law and ensures that your interests are protected throughout the purchasing process.

From reviewing and drafting contracts to conducting thorough due diligence, lawyers play a crucial role in identifying any potential legal issues or risks associated with the property. They ensure that all legal requirements are met, handle negotiations, and facilitate the smooth transfer of ownership.

With the guidance of a trusted real estate lawyer, you can confidently navigate the legal intricacies involved in purchasing a property, ensuring a secure and legally sound transaction.

By enlisting the services of both a real estate agent and a lawyer, you can benefit from their extensive knowledge and expertise, ensuring a well-informed and successful journey towards making your dream of owning a home a reality.

Examining and Assessing the Property prior to Purchase

Before finalizing the acquisition of your ideal living space, it is crucial to thoroughly inspect and evaluate the property to ensure it aligns with your expectations and needs. By carefully examining various aspects of the property, you can make an informed decision and avoid potential disappointment or costly repairs in the future.

One of the vital steps in this process is conducting a comprehensive visual inspection of the property. This involves observing the condition of the exterior and interior, paying close attention to the foundation, walls, roof, flooring, windows, doors, and any visible signs of damage or wear and tear. Additionally, assessing the structural integrity and identifying potential structural issues, such as cracks or dampness, is of utmost importance.

Another crucial aspect to consider is the functionality and condition of the property's essential systems. This includes inspecting the electrical, plumbing, and heating/cooling systems to ensure they are in proper working order. It is beneficial to engage the services of a professional inspector to conduct a thorough assessment of these systems and provide you with an expert evaluation.

In addition to examining the physical condition of the property, it is essential to evaluate its surroundings and amenities. Consider the neighborhood's safety, accessibility to essential amenities like schools, hospitals, and shopping centers, as well as the proximity to public transportation and major roadways. Examining these factors will help you determine if the property's location meets your lifestyle requirements.

Furthermore, it is advisable to review any documentation related to the property, such as its title deed, previous inspection reports, maintenance records, and any relevant legal or financial documents. This will provide you with a better understanding of the property's history and any potential legal or financial liabilities associated with it. Seeking legal advice may be necessary to ensure a smooth and transparent transaction.

| Key Considerations for Inspection: |

|---|

| Exterior and interior condition |

| Structural integrity |

| Functionality of essential systems |

| Surrounding neighborhood and amenities |

| Reviewing relevant documentation |

Overall, by thoroughly inspecting and evaluating the property before purchase, you can make an informed decision and increase the chances of turning your dream of owning a perfect home into a reality. Remember, taking the time to assess these aspects will provide you with the confidence and peace of mind needed to embark on this significant investment.

FAQ

What are some tips for saving up for a down payment on a flat?

Saving up for a down payment on a flat can be challenging, but there are several tips that can help. Firstly, set a budget and stick to it, cutting down on unnecessary expenses. Secondly, consider increasing your income by taking on a side job or freelancing. Additionally, explore government assistance programs or first-time buyer incentives that can help with the down payment. Finally, be patient and persistent with your savings plan and avoid dipping into your savings for other expenses.

Is it better to buy a flat or rent one?

The decision between buying and renting a flat depends on your personal circumstances and long-term goals. Buying a flat can be a good investment as you build equity over time, but it requires a significant upfront cost and responsibility for maintenance. Renting a flat offers flexibility and less commitment, but you don't build equity and may face rent increases. Consider your financial stability, location preferences, and long-term plans to make the best decision for yourself.

What should I consider when choosing a location for my dream home?

Choosing the right location for your dream home is crucial. Firstly, consider the proximity to your workplace or schools if you have children. Think about the amenities and facilities in the area, such as grocery stores, parks, and healthcare facilities. Safety and security should also be a priority. Additionally, research the potential for future development and property value appreciation in the chosen location. Lastly, visit the neighborhood at different times of the day to get a sense of the atmosphere and noise levels.

What are some common mistakes to avoid when buying a flat?

When buying a flat, there are some common mistakes to avoid. Firstly, don't rush into making a purchase without conducting thorough research and considering all the associated costs. It's important to also have a clear understanding of your budget and avoid stretching beyond your means. Additionally, don't overlook the importance of a home inspection to uncover any potential issues with the flat. Lastly, be cautious with any verbal agreements and ensure that all terms are put into writing.

Should I consider getting a mortgage for buying a flat?

Getting a mortgage for buying a flat can be a viable option for many. It allows you to spread out the upfront cost over a longer period. Before deciding, evaluate your financial situation, including credit score, income stability, and existing debts. Use online mortgage calculators to estimate your monthly payments and interest rates. It's advisable to shop around and compare offers from different lenders to find the most favorable terms. Consulting with a mortgage specialist can also provide valuable guidance.

How can I start saving for a flat?

Starting to save for a flat requires a disciplined approach. Begin by setting a budget and identifying areas where you can cut down on expenses. It's also advisable to open a separate savings account specifically for your flat purchase. Automate your savings by setting up a standing order to transfer a fixed amount of money into this account each month. Additionally, consider exploring investment options to grow your savings.