In a world where the notion of stagnation is becoming obsolete, it is essential to find innovative ways to thrive and secure a prosperous future. The contemporary landscape of investment opportunities presents an array of possibilities, and one sector stands out among the rest – real estate. With its potential to provide steady streams of income and long-term wealth accumulation, real estate has become an alluring avenue for those seeking financial prosperity.

Just imagine the power of harnessing the untapped potential of your valuable assets. As the world evolves, traditional property management is being revolutionized by the emergence of a visionary concept – the dream of creating a passive income through the astute collection of rentals. This groundbreaking approach allows property owners to effortlessly transform their holdings into highly lucrative investments, unlocking a realm of opportunities.

Picture a world where your property generates income while you sleep, where every square meter symbolizes a hidden goldmine waiting to be discovered. By embracing this innovative mindset, property owners are afforded the chance to witness their wealth multiply effortlessly, as tenants contribute to the consistent growth of their investment portfolios. Such a forward-thinking approach showcases the immense potential to capitalize on the ever-increasing demand for housing, simultaneously reaping phenomenal financial rewards.

Within this realm lies a myriad of strategies and techniques that can help maximize the returns on your property investment. From clever marketing tactics to strategic rental pricing, from responsive property maintenance to tailored tenant screening processes – each aspect plays a pivotal role in ensuring an attractive investment returns. These critical elements blend seamlessly together to create a harmonious ecosystem, where your property becomes a flourishing hub that not only provides roof and shelter but also serves as a gateway to prosperity.

Maximize Your Earnings with Rental Properties: An Excellent Investment Opportunity

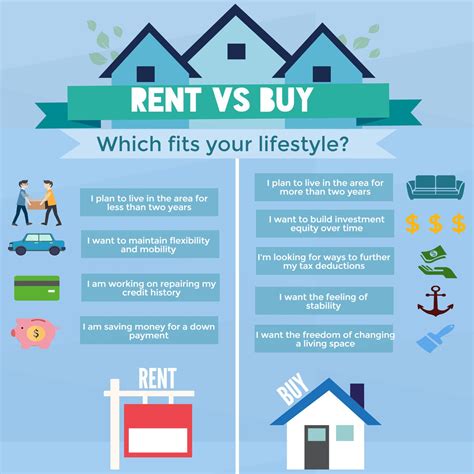

When it comes to increasing your income, exploring rental properties can prove to be a highly profitable venture. By diversifying your investment portfolio and venturing into the realm of real estate, you open doors to a multitude of financial opportunities. With careful planning and strategic decision-making, rental properties can become a key source of income, enabling you to enjoy the benefits of a lucrative investment.

Unlocking the Potential: Rental properties hold the potential to boost your earnings through steady cash flow and long-term appreciation. By investing in properties that are in high demand, you secure a reliable stream of passive income that can endure economic fluctuations. As property values increase over time, you stand to benefit from capital appreciation, further enhancing your overall return on investment.

Creating a Passive Income Stream: By converting your property into a rental unit, you tap into the power of passive income. Unlike active forms of income where you exchange time and effort for money, passive income from rental properties allows you to generate revenue with minimal ongoing effort. As a landlord, you can enjoy the financial rewards while simultaneously maintaining flexibility in other areas of your life.

Building Equity and Wealth: Investing in rental properties not only generates immediate income but also provides the opportunity to build long-term wealth. With each monthly rental payment, tenants contribute to the equity of your property, increasing your net worth. Over time, your real estate investment can serve as a valuable asset that appreciates in value, providing you with the potential to achieve substantial financial growth.

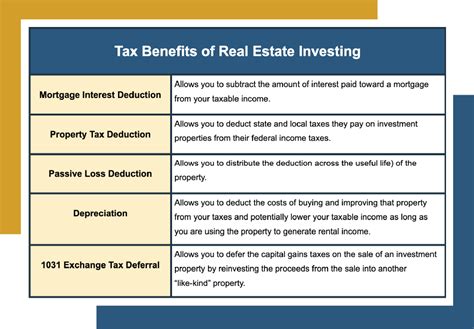

Benefiting from Tax Advantages: Rental properties offer attractive tax benefits that can significantly enhance your overall earnings. Through deductions such as mortgage interest, property taxes, and repair costs, you can lower your taxable income and potentially reduce your tax liability. These incentives make rental properties a highly tax-efficient investment option, allowing you to maximize your profits.

In summary, embracing the world of rental properties presents an exciting opportunity to boost your income and build long-term wealth. By embracing the potential of passive income, capital appreciation, and favorable tax advantages, you can transform your investment into a lucrative venture, providing you the financial freedom you desire.

Create a Passive Income Stream with Rental Properties

Discover how to generate a steady stream of passive income by investing in rental properties. Explore the potential financial benefits of owning a property that generates consistent cash flow without requiring significant ongoing effort. In this section, we will delve into the strategies and best practices to help you build a successful portfolio of rental properties and secure a reliable source of passive income for the long term.

1. Explore Investment Opportunities

- Research various locations and neighborhoods that offer promising rental markets.

- Identify properties that have the potential for high rental yields and long-term appreciation.

- Analyze market trends and gather information on rental demand and vacancy rates.

2. Assess Financial Considerations

- Evaluate your financial capacity and determine the amount you can invest in rental properties.

- Consider financing options such as mortgages and loans to leverage your investment.

- Calculate the potential rental income and expenses, including property management fees, maintenance costs, and property taxes.

3. Understand Property Management

- Learn the responsibilities and legal requirements of being a landlord.

- Consider hiring a property management company to handle day-to-day operations.

- Implement strategies to attract and retain quality tenants, such as conducting thorough tenant screenings and providing excellent customer service.

4. Maximize Rental Income

- Set competitive rental rates based on market research and property value.

- Consider offering additional amenities or services to attract higher-paying tenants.

- Maintain and enhance the property to ensure tenant satisfaction and minimize vacancies.

5. Mitigate Risks

- Obtain appropriate insurance coverage to protect your investment and mitigate potential liabilities.

- Stay updated on local landlord-tenant laws and regulations to avoid legal issues.

- Diversify your investment portfolio to reduce the impact of market fluctuations.

By implementing these strategies and applying sound financial management principles, you can create a passive income stream with rental properties that allows you to generate long-term wealth and financial security.

The Advantages of Investing in Rental Properties

Investing in rental properties offers numerous benefits that can help individuals grow their wealth and achieve financial stability. By entering the real estate market as a property owner, investors gain the opportunity to generate consistent passive income, build equity, and diversify their investment portfolio.

One of the primary advantages of investing in rental properties is the ability to earn passive income. Unlike traditional employment, rental income allows investors to generate money without the need for active participation. By collecting rent payments regularly, property owners can supplement their primary income and enjoy a steady cash flow. This form of income can provide financial security and serve as a reliable source of funds for various goals, such as saving for retirement or funding other investments.

Furthermore, investing in rental properties enables individuals to build equity over time. As tenants make monthly rent payments, property owners accumulate equity in their property, which can be leveraged for future investments or used as collateral. Additionally, property values tend to appreciate over time, further increasing the potential returns on investment. The appreciation of rental properties can provide significant long-term financial benefits and contribute to the overall growth of the investor's net worth.

Diversification is another key advantage of investing in rental properties. By allocating funds to real estate, investors can reduce their reliance on traditional investment vehicles, such as stocks and bonds. Real estate investments have historically exhibited lower volatility compared to the stock market, offering a more stable and predictable return on investment. This diversification can protect individuals from economic downturns and provide a hedge against inflation.

Moreover, investing in rental properties offers individuals more control over their investment compared to other investment options. Property owners have the ability to actively manage and increase the value of their investment by making property enhancements, maintaining attractive rental units, and ensuring tenant satisfaction. This hands-on approach allows investors to have a direct impact on their returns and overall success as property owners.

In summary, investing in rental properties presents individuals with a myriad of advantages, including the ability to generate passive income, build equity, diversify their investment portfolio, and exercise greater control over their investment. By reaping the benefits of rental properties, investors can take significant strides toward achieving financial prosperity and long-term wealth accumulation.

Choosing the Optimal Location for Your Rental Property

When it comes to real estate investing, one crucial factor that can greatly impact the success of your rental property is the location. The significance of choosing the right location cannot be overstated, as it dictates the desirability and profitability of your investment.

1. Identify an In-Demand Neighborhood: Seek out neighborhoods that are popular among potential tenants, ensuring a steady stream of rental inquiries and high demand. These neighborhoods may boast excellent amenities, such as schools, parks, shopping centers, and transportation options, making them attractive to renters. They often have a reputation for being safe and well-maintained.

2. Consider Proximity to Key Locations: Think about the proximity of your rental property to important destinations like universities, hospitals, and major employers. Being close to these key locations can make your property more appealing to potential tenants, especially students, healthcare professionals, and employees looking for convenience.

3. Evaluate the Rent Potential: Research the rental rates in the area to determine if the prospective income aligns with your financial goals. Look for areas with competitive rental rates and a low vacancy rate. Keep in mind that areas experiencing growth and development may present excellent opportunities for future rental income appreciation.

4. Analyze the Neighborhood's Economic Stability: Investigate the economic stability of the neighborhood by examining factors such as job growth, local businesses, and future development plans. A thriving job market and a diverse range of industries can contribute to a stable and secure rental market, reducing the risk of vacancy and potential income loss.

5. Consider Accessibility and Transportation: Assess the access to public transportation and major roadways in the area. Properties with easy transportation options and convenient access to highways can appeal to a wider range of tenants, including those who rely on public transportation for their daily commute.

6. Research the Demographic Profile: Understand the demographics of the area to align your property's features and amenities with the target audience. For example, if the neighborhood is predominantly families with young children, having nearby parks, schools, and child-friendly amenities can make your rental property more appealing.

7. Look at Long-Term Appreciation: Consider the potential for long-term property value appreciation. Areas with planned or ongoing infrastructure projects, revitalization efforts, or other positive developments typically experience an increase in property values over time. This can lead to higher rental income and potential capital gains in the future.

In conclusion, selecting the right location should be a top priority when aiming to maximize the success and profitability of your rental property investment. By carefully considering factors such as neighborhood demand, proximity to key locations, rental potential, economic stability, transportation accessibility, demographics, and long-term appreciation, you can make an informed decision that aligns with your investment objectives.

Maximizing Rental Income: Finding the Ideal Tenants

In this section, we will explore the strategies and considerations for effectively choosing tenants for your rental property in order to maximize your rental income. Finding the perfect tenants is crucial for ensuring a steady stream of revenue and maintaining the value of your investment.

1. Identify your target market:

- Understand the demographics and characteristics of the local rental market. Identify the type of tenants that are in high demand in the area.

- Consider the features and amenities of your property that would appeal to your target market.

2. Thoroughly screen potential tenants:

- Develop a screening process that includes background checks, credit history evaluations, and reference checks.

- Ensure that the screening process complies with local laws and regulations.

3. Set clear rental criteria:

- Establish specific rental criteria that potential tenants must meet.

- Consider factors such as income level, employment stability, and rental history.

4. Create attractive rental listings:

- Write compelling and accurate descriptions of your property listing.

- Highlight the unique selling points of the property that would appeal to potential tenants.

5. Advertise effectively:

- Select the most relevant advertising platforms for reaching your target market.

- Utilize both online and offline advertising channels to maximize exposure.

6. Conduct thorough interviews:

- Prepare a set of interview questions to assess the suitability of potential tenants.

- Ask about their rental history, employment status, and reasons for seeking a new rental property.

7. Establish strong landlord-tenant relationships:

- Maintain open communication with your tenants to establish trust and mutual respect.

- Respond promptly to tenant concerns and address maintenance issues in a timely manner.

By following these strategies and taking the time to find the ideal tenants, you can increase your rental income, minimize vacancies, and build a successful and profitable rental property business.

Strategies for Effective Property Management to Maximize Profits

Property management plays a vital role in ensuring the success and profitability of real estate investments. By implementing effective strategies, property owners can optimize their return on investment and generate steady income streams. In this section, we will explore key practices and techniques that can be employed to maximize profits through efficient property management.

- 1. Thorough Tenant Screening:

- 2. Strategic Rental Pricing:

- 3. Proactive Property Maintenance:

- 4. Efficient Expense Management:

- 5. Strong Communication and Relationship Building:

- 6. Leveraging Technology:

One of the fundamental aspects of effective property management is selecting high-quality tenants. Conducting a comprehensive screening process, including background checks, credit assessments, and employment verification, can help minimize potential risks and ensure long-term stability for the property.

Setting the right rental price is crucial for attracting tenants and maximizing returns. Conducting market research to evaluate comparable rental rates in the area, considering property amenities and location, and adjusting the price accordingly can help maximize occupancy rates while ensuring competitive returns.

Maintaining the property in excellent condition is key to retaining tenants and maximizing profitability. Implementing proactive maintenance strategies, such as regular inspections, prompt repairs, and preventive measures, can prevent costly damages and ensure tenant satisfaction, reducing turnover rates.

Monitoring and managing expenses associated with property maintenance, repairs, utilities, insurance, and taxes are essential for maximizing profits. Implementing effective expense tracking systems, seeking competitive bids for services, and identifying cost-saving opportunities can help optimize financial resources.

Establishing open and transparent communication channels with tenants fosters trust and promotes harmonious relationships. Promptly addressing tenant concerns, providing clear lease agreements, and fostering a sense of community can encourage loyalty and reduce vacancy rates, enhancing profitability.

Utilizing modern property management software and technology solutions streamlines administrative tasks, facilitates effective communication, and enhances efficiency. Automated rent collection, online portals for maintenance requests, and digital marketing tools can significantly contribute to maximizing profits while reducing manual workload.

By implementing these effective property management strategies, property owners can ensure long-term financial success, optimize their investments, and generate lucrative returns.

Utilizing Technology to Enhance Your Rental Property Success

In today's ever-evolving world, embracing technology is crucial for maximizing the potential of your rental property. Leveraging innovative tools and platforms can greatly enhance your chances of success and boost your property's profitability.

One way to harness technology for your rental property success is through the use of property management software. These advanced platforms provide a comprehensive suite of features, allowing you to streamline various tasks such as tenant screening, rent collection, maintenance requests, and financial tracking. With the automation and efficiency offered by these tools, you can save valuable time and ensure that your property is operating at its full potential.

Another technology-driven strategy to enhance your rental property success is by utilizing online listing platforms. By leveraging popular websites and applications, you can reach a wider audience, attract potential tenants, and increase the visibility of your property. Through eye-catching descriptions, professional photographs, and virtual tours, you can effectively showcase the unique features and amenities of your rental property, enticing prospective tenants to choose your offering over others.

Furthermore, implementing smart home technology within your rental property can also give you a competitive edge in the market. By integrating smart devices such as programmable thermostats, keyless entry systems, and security cameras, you can provide tenants with convenience, efficiency, and enhanced security. These modern amenities not only increase the desirability of your property but can also justify higher rental prices.

Additionally, leveraging digital payment platforms can streamline the rent collection process for both you and your tenants. By offering options for online payments and automated reminders, you can ensure a more efficient and timely collection of rent. This eliminates the hassle of handling physical checks and reduces the likelihood of late payments or disputes.

In conclusion, embracing technology has become a necessity for maximizing rental property success. Whether through property management software, online listing platforms, smart home technology, or digital payment solutions, incorporating these tools can significantly enhance your property's profitability, attract quality tenants, and ultimately bring you closer to achieving your investment goals.

Diversify Your Investment Portfolio with Rental Properties

Expanding your investment portfolio is a key strategy for maximizing returns and mitigating risk. One effective way to achieve diversification is by investing in rental properties. By adding rental properties to your portfolio, you can access a stable income stream and potential long-term appreciation.

One advantage of diversifying with rental properties is the ability to generate passive income. Unlike some other investment options, rental properties can provide a regular cash flow through monthly rental payments. This stream of income can help cover expenses and contribute to your overall financial well-being.

Additionally, rental properties offer the potential for long-term appreciation. As property values tend to increase over time, owning real estate can be a smart investment choice. By carefully selecting properties in desirable locations and managing them effectively, you can benefit from both rental income and potential capital appreciation.

Furthermore, investing in rental properties can serve as a hedge against inflation. Rental income has the potential to increase over time, keeping pace with rising living costs. This can help protect the purchasing power of your investment and provide a stable income source even in times of economic uncertainty.

Diversifying your investment portfolio with rental properties also allows you to tap into a different market segment. While stocks and bonds may be more volatile, real estate tends to have lower volatility and can provide stability during economic downturns. By diversifying across different asset classes, you can reduce the overall risk of your portfolio.

- Access stable income streams

- Potential for long-term appreciation

- Hedge against inflation

- Lower volatility compared to stocks and bonds

In conclusion, diversifying your investment portfolio with rental properties offers various benefits, such as generating passive income, potential appreciation, hedging against inflation, and reducing overall portfolio risk. By carefully selecting and managing rental properties, you can enhance your financial success and achieve a well-balanced portfolio.

Tax Advantages of Renting Out Your Property

When it comes to leasing your valuable assets, there are several attractive tax benefits that you can take advantage of. These incentives not only help you generate a passive income but also reduce your overall tax liability. Here, we explore the various tax advantages of renting out your property:

- Depreciation Deductions: Rental properties offer significant depreciation deductions, allowing you to deduct the cost of the property over its useful life. This deduction can be claimed every year and can offset a portion of your rental income.

- Tax Deductible Expenses: As a landlord, you are eligible to deduct various expenses related to your rental property, such as maintenance and repairs, property management fees, insurance premiums, property taxes, and mortgage interest. These deductions can significantly lower your taxable rental income.

- Capital Gains Tax Exemption: If you decide to sell your rental property after owning it for a certain period, you may qualify for a capital gains tax exemption. This allows you to exclude a portion, or all, of the capital gains from the sale of your property, reducing your tax burden.

- Pass-Through Deduction: If you own your rental property through a pass-through entity, such as a limited liability company (LLC) or partnership, you may be eligible for the pass-through deduction. This deduction allows you to deduct up to 20% of your net rental income, further reducing your taxable income.

- 1031 Exchange: A 1031 exchange, also known as a like-kind exchange, allows you to defer capital gains taxes when you sell a rental property and reinvest the proceeds into another qualifying property. This strategy can help you grow your real estate portfolio without incurring immediate tax liabilities.

By understanding and utilizing these tax advantages, renting out your property can not only provide you with a steady stream of income but also create a more tax-efficient investment strategy. It is crucial to consult with a tax professional to ensure you maximize all available tax benefits and adhere to relevant tax regulations.

Principles for Successful and Profitable Investments in Rental Properties

When it comes to achieving financial success through real estate investments, investing in rental properties can be a lucrative avenue. This section aims to provide practical tips and strategies for investors looking to maximize profits and ensure long-term success in the rental property market.

1. Thorough Research and Due Diligence: Before diving into any rental property investment, it is crucial to conduct extensive research and due diligence. This includes analyzing local real estate market trends, understanding the potential demand for rental properties in the area, and assessing the overall economic and demographic factors that could influence the rental market. By gaining a deep understanding of the market dynamics, investors can make informed investment decisions and minimize risks.

2. Property Selection and Evaluation: Choosing the right rental property is essential for maximizing profitability. Investors should consider factors such as location, property condition, rental rates in the area, and potential for property appreciation. Conducting property inspections, evaluating maintenance costs, and considering potential renovations or improvements are crucial steps in ensuring the property's value and attractiveness to tenants.

3. Effective Marketing and Tenant Screening: To maintain profitability, investors need to ensure a consistent stream of high-quality tenants. Implementing a robust marketing strategy to attract potential tenants is key. This includes creating compelling property listings, utilizing various marketing channels, and leveraging digital platforms. Additionally, implementing a thorough tenant screening process to assess creditworthiness, rental history, and references can help select reliable tenants, reducing the risk of rental income delays or property damage.

4. Ongoing Property Management: Successful rental property investments require ongoing management and maintenance. This entails promptly addressing tenant concerns, conducting routine property inspections, and handling repairs and maintenance. Investors can choose to manage the property themselves or enlist the services of a professional property management company to ensure smooth operations, enhance tenant satisfaction, and preserve the property's value.

5. Financial Planning and Analysis: To ensure profitability, investors should develop a comprehensive financial plan that includes budgeting for property-related expenses, determining optimal rental rates, setting aside reserves for unforeseen expenses, and understanding tax implications. Regularly monitoring and analyzing the financial performance of the investment property is crucial for identifying areas of improvement and making strategic decisions for maximizing returns.

By adhering to these principles and implementing effective strategies in rental property investments, investors can position themselves for long-term success and profitability in the real estate market.

FAQ

How can I turn my property into a lucrative investment?

To turn your property into a lucrative investment, you can rent it out to tenants. This will generate a regular rental income, increasing the overall return on your investment. Additionally, you can consider making renovations or improvements to attract high-paying tenants and increase the property's value.

What are the benefits of renting out a property?

Renting out a property comes with several benefits. Firstly, it provides a steady stream of income, which can help offset the expenses associated with the property. Secondly, it allows you to build equity and accumulate wealth, as the property value appreciates over time. Moreover, by renting out a property, a landlord can have someone else cover the costs of maintenance and repairs.

Should I hire a property management company to handle the rental process?

Hiring a property management company can be beneficial, especially if you own multiple properties or do not have the time and expertise to manage the rental process yourself. A property management company will handle tasks such as finding and screening tenants, collecting rent, property maintenance, and handling any tenant issues or disputes. However, it is important to consider the cost of hiring a property management company and weigh it against the potential benefits.

Are there any challenges or risks associated with renting out a property?

Yes, there are some challenges and risks involved in renting out a property. Firstly, there is always a risk of non-payment or late payment of rent by tenants, which can affect your cash flow. Secondly, there may be additional expenses for property maintenance and repairs. Additionally, dealing with difficult tenants or facing legal issues such as eviction can be stressful and time-consuming. It is important to be prepared for these challenges and take necessary precautions.

How can I turn my property into a lucrative investment?

There are several ways to turn your property into a lucrative investment. Firstly, you can rent it out to tenants who will pay you a monthly rent. This will provide you with a steady stream of income. Secondly, you can consider using your property for vacation rentals, which tend to generate higher income during peak seasons. Another option is to invest in property renovations and upgrades to increase its value and subsequently the rental income. Lastly, you can also explore the possibility of investing in real estate crowdfunding platforms to diversify your investment and potentially earn higher returns.