Within the realm of financial management lies an altruistic desire to extend the positive influence of wealth beyond one's personal sphere. This yearning emanates from a deep-rooted recognition that money possesses potential far beyond its immediate utility. The concept of giving back, while harnessing the fruits of meticulous investment, becomes an avenue to bolster societal progress and promote well-being among those less fortunate.

In this article, we delve into the intricacies of utilizing financial resources to empower others, exploring the manifold ways in which capital can be employed to transform lives. Delving beyond traditional philanthropy, this discussion encompasses a broad array of approaches that enable individuals to actively participate in propelling social change.

Widening the scope of financial philanthropy stretches far beyond the sporadic act of generosity, transforming it into a consistent and impactful force. By strategically investing time, energy, and resources, individuals can cultivate a symbiotic relationship between their wealth and its potential to elevate underserved communities. Through the mobilization of targeted investments, entrepreneurial ventures, and partnerships with nonprofit organizations, a profound and sustainable impact can be achieved.

Our exploration will uncover strategies to navigate the complex landscape of philanthropic endeavors, emphasizing the importance of ethical decision-making, rigorous due diligence, and collaboration. By embracing philanthropy as a means to bridge the gap between prosperity and disparity, we can forge a more empathetic society, where the wealth amassed does not exist in isolation but rather nurtures the wellbeing of all.

Creating Passive Income Streams: Assisting Others while Generating Earnings

In this section, we will explore the concept of building passive income streams that not only benefit yourself but also provide assistance to others. Instead of relying solely on traditional means of earning money, passive income allows you to generate revenues in a manner that requires less active effort on your part. By establishing diverse sources of passive income, you can contribute to the financial well-being of both yourself and those around you.

One effective way to create passive income streams is through investment portfolios. By carefully selecting a mix of stocks, bonds, real estate, and other financial instruments, you can generate income through dividends, interest payments, and capital gains. This not only enhances your personal finances but also enables you to support charitable causes or contribute to organizations that promote economic empowerment and social well-being.

Another avenue for creating passive income streams is by leveraging your skills and expertise. Whether you are a talented writer, a skilled graphic designer, or a knowledgeable consultant, you can offer your services on various online platforms or create digital products such as e-books or online courses. These assets can generate income continuously, benefiting both yourself and those who seek to acquire new knowledge or leverage your skills for their own goals.

Creating and monetizing a popular blog or YouTube channel is yet another avenue for generating passive income. By producing valuable content that attracts a large audience, you can earn revenue through advertising, sponsorships, and affiliate partnerships. The income generated can then be utilized to contribute to causes that align with your values, such as supporting underprivileged communities or funding educational initiatives.

| Advantages | Disadvantages |

|---|---|

| 1. Diversification of income sources | 1. Initial time and effort required to set up passive income streams |

| 2. Ability to support charitable causes | 2. Limited control over certain passive income sources |

| 3. Potential for long-term financial stability | 3. Market fluctuations affecting investment-based passive income |

| 4. Freedom to pursue personal interests and hobbies | 4. Maintaining consistency and quality in content creation-based passive income |

By embracing a mindset of creating passive income streams, you can simultaneously enhance your financial situation while making a positive difference in the lives of others. Whether it is through investing wisely, leveraging your skills, or producing valuable content, the potential to help others while earning money is within your reach.

Impact Investing: Creating Positive Change through Financial Influence

In today's society, the power of wealth extends beyond personal gain. Impact investing allows individuals to make a difference in the world and shape a better future for all. By strategically allocating funds to projects and businesses that align with their values, investors can achieve both financial returns and positive social and environmental impacts.

Impact investing goes beyond traditional philanthropy by leveraging the power of financial markets. It involves investing in companies and organizations that actively seek to address pressing social and environmental challenges, such as climate change, poverty, and inequality. These investments aim to generate measurable and beneficial social or environmental impact alongside financial returns.

One of the key principles of impact investing is the concept of "double bottom line" or "triple bottom line" returns. Instead of solely focusing on financial performance, investors also consider the social and environmental outcomes of their investments. This approach encourages the alignment of financial goals with positive societal change, challenging the notion that profits and impact are mutually exclusive.

By actively engaging with the investment process, impact investors have the opportunity to drive change in areas that truly matter to them. They can support innovative solutions, sustainable business models, and inclusive practices that conventional investment approaches might overlook. Whether it's investing in renewable energy projects, affordable housing initiatives, or social enterprises, impact investors have the ability to leave a lasting legacy and contribute to a more equitable and sustainable world.

Furthermore, impact investing is not limited to high-net-worth individuals or institutional investors. It is a practice that can be embraced by anyone who wants to make a positive impact with their financial resources. With the rise of crowdfunding platforms, impact investing has become more accessible, allowing individuals to pool their resources and collectively support projects that align with their values.

In conclusion, impact investing provides a unique opportunity for individuals to use their wealth as a force for good. By investing in projects and businesses that prioritize positive social and environmental outcomes, investors can make a meaningful difference in the world while still achieving financial success. It is a powerful tool that empowers individuals to actively shape the future they want to see.

Efficiency Matters: Maximizing the Impact of Your Charitable Donations

Giving to charitable causes allows individuals to make a positive difference in the world and help those in need. However, the effectiveness of these donations can vary greatly, depending on how they are utilized. In this section, we will explore strategies and considerations to ensure that your charitable giving has the greatest possible impact.

1. Research and Assess:

Before making a donation, it is important to research and assess the organizations or causes you are considering. Look for organizations that align with your values and have a track record of successfully achieving their mission. Utilize resources such as independent charity evaluators to gather information about an organization's financial transparency, governance, and program effectiveness.

2. Focus on High-Impact Areas:

Consider directing your donations towards areas that have high potential for impact. For example, supporting initiatives that address poverty, education, healthcare, or environmental sustainability can have far-reaching benefits for individuals and communities. By targeting systemic issues and supporting evidence-based interventions, your donations can lead to long-term positive change.

3. Engage in Strategic Giving:

"Strategic giving" involves thoughtful planning and targeted philanthropy. It goes beyond spontaneous donations and aims to maximize the overall impact of your giving. Consider creating a giving plan or setting specific goals for your donations. This approach can help you allocate your resources more effectively and ensure consistent support for causes you deeply care about.

4. Evaluate and Monitor:

Continuously evaluate the impact of your donations and monitor the progress of the organizations or projects you support. Regularly review financial reports, impact metrics, and updates from the organizations to ensure that your contributions are being used efficiently and effectively. Adjust your giving strategy if necessary to align with organizations that consistently demonstrate positive outcomes.

By following these guidelines, you can maximize the effectiveness of your charitable donations and contribute to creating meaningful and sustainable change in the world.

Philanthropy 2.0: Harnessing Technology to Disseminate Prosperity

In this digital era, innovative technologies have revolutionized various aspects of our lives, and philanthropy is no exception. Philanthropy 2.0 embodies a paradigm shift in the way we approach charitable endeavors, utilizing technology as a powerful tool to amplify the impact of wealth distribution. By leveraging the vast potential of technology, individuals and organizations can now reach a wider audience, facilitate collaboration, and create lasting change on a global scale.

With the advent of the internet and social media, philanthropy has transcended the traditional boundaries of geographic location and social circles. Online platforms provide accessible avenues for connecting with like-minded individuals, pooling resources, and mobilizing support for charitable causes. Through engaging storytelling, compelling visuals, and interactive features, technology empowers philanthropists to effectively communicate their mission and engage donors, inspiring them to contribute to the greater good.

Moreover, technology has facilitated the emergence of crowdfunding platforms, allowing individuals with limited resources to contribute to various causes. From micro-donations to crowdfunding campaigns, these platforms enable the democratization of philanthropy, empowering everyone to participate in creating positive societal change. By enabling transparency and traceability, technology ensures that donations are channeled efficiently and effectively, fostering trust between donors and recipients.

Furthermore, advancements in artificial intelligence and data analytics have enhanced the efficiency of philanthropic efforts. Through machine learning algorithms, philanthropists can identify patterns, trends, and gaps in existing systems, enabling targeted interventions for maximum impact. Data-driven philanthropy allows resources to be allocated strategically, addressing systemic issues and creating sustainable solutions.

As we embark on the era of Philanthropy 2.0, it is essential to embrace the potential of technology in spreading wealth and creating a more equitable society. By harnessing the power of digital platforms, crowdfunding, and data-driven insights, philanthropists are not only amplifying their impact but also inspiring a new generation of changemakers to join the pursuit of a better world. Together, we can leverage technology to create a ripple effect of positive change, ensuring a brighter and more inclusive future for all.

Social Enterprise: Combining Profit with Purpose

Innovative businesses around the world are redefining the way we think about success and financial growth. These socially responsible enterprises have emerged as a powerful force in changing the traditional notion that profit and purpose are mutually exclusive. By creating business models that prioritize positive social and environmental impact alongside financial sustainability, social enterprises are transforming the global economic landscape.

A social enterprise strives to address pressing societal issues while generating profits. Unlike traditional businesses that focus solely on maximizing financial gains, social enterprises utilize their resources and expertise to bring about positive change in their communities and beyond. They are driven by a dual mission of achieving economic success and creating a measurable, beneficial impact on society.

By combining profit with purpose, social enterprises create a meaningful synergy that goes beyond conventional philanthropy or corporate social responsibility initiatives. Instead of viewing social and environmental problems as externalities to be addressed separately, these enterprises embrace them as integral components of their core business strategies. They integrate sustainability practices, ethical sourcing, and responsible production methods into their operations, ensuring that every aspect of their business contributes to a better world.

What sets social enterprises apart is their commitment to reinvest a significant portion of their profits back into their social or environmental mission. This reinvestment ensures the sustainability and scalability of their impact, enabling them to tackle systemic issues effectively. By leveraging their financial success, social enterprises are able to enact lasting change, empowering marginalized communities, advocating for human rights, and spearheading innovative solutions to global challenges.

Furthermore, social enterprises foster a culture of empathy and compassion within their organizations. They prioritize the well-being and development of their employees, valuing their diverse perspectives and empowering them to become agents of change. By promoting an inclusive and purpose-driven work environment, these enterprises attract top talent and inspire loyalty among their stakeholders. This commitment to their employees and the communities they serve creates a virtuous cycle of success that benefits multiple stakeholders.

In conclusion, social enterprises represent the future of sustainable business practices. By aligning profit with purpose, they demonstrate that it is possible to create economic growth while addressing societal and environmental concerns. By supporting and championing social enterprises, individuals and organizations can contribute to a more equitable and prosperous world for all.

Investing in Education: Empowering the Visionaries of Tomorrow

Elevating the potential of future generations has always been a driving force in achieving vibrant and prosperous societies. One effective way to cultivate and amplify such potential is through investments in education. By directing resources towards education, we not only equip young minds with essential knowledge and skills but also empower them to become the leaders who will shape and revolutionize our world.

Investing in education opens doors to opportunity and unlocks the potential of individuals from diverse backgrounds. It goes beyond traditional classroom settings, encompassing a comprehensive approach that encompasses formal and informal learning environments. From early childhood education to higher learning institutions, each stage plays a crucial role in nurturing the curiosity, critical thinking, and problem-solving abilities of students.

- Emphasizing Innovation: Investing in education allows us to foster a culture of innovation and creativity. It provides students with the necessary tools and platforms to explore their passions, think critically, and develop solutions for emerging challenges.

- Promoting Equal Access: Allocating resources towards education ensures that every individual, regardless of their socioeconomic background or geographic location, has equal access to quality educational opportunities. This promotes inclusivity and paves the way for a more equitable society.

- Nurturing Global Perspectives: Education equips students with a broader understanding of the world, fostering multicultural awareness and promoting global citizenship. By investing in education, we enable future leaders to solve global issues collaboratively, transcending borders and creating a more interconnected world.

- Addressing Skills Gap: In an ever-evolving job market, investment in education is vital for equipping individuals with relevant skills and knowledge. By aligning educational programs with the demands of industries, we bridge the skills gap and pave the way for future workforce readiness and economic growth.

Investing in education is an investment in the future. It empowers individuals to become catalysts for change, unearths hidden talents, and drives innovation. By recognizing the transformative power education holds, we can collectively create a world where every individual has the opportunity to reach their full potential and lead us towards a brighter and more prosperous future.

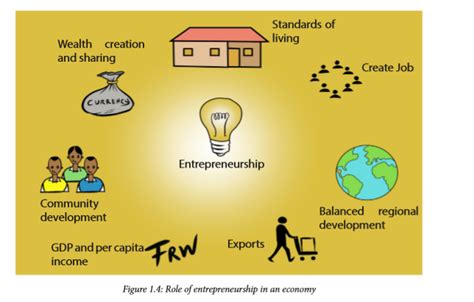

Supporting Entrepreneurship: Boosting Economic Development

In this section, we will explore the vital role of supporting entrepreneurship in driving economic growth and development. By fostering an environment that encourages and empowers aspiring entrepreneurs, we can create a thriving ecosystem for innovation, job creation, and socio-economic advancement.

Empowering the Visionaries

Entrepreneurs are the visionaries who dare to challenge conventional thinking and push the boundaries of what is possible. They often have innovative ideas and the drive to turn them into reality. By supporting these individuals, we can nurture their entrepreneurial spirit and provide them with the necessary resources and support to transform their ideas into successful businesses.

Fueling Innovation

Entrepreneurship fuels innovation by promoting creative problem-solving and out-of-the-box thinking. When entrepreneurs are empowered and given the necessary tools and resources, they can develop groundbreaking solutions to societal challenges, leading to technological advancements and enhanced productivity. As a result, economic growth is accelerated, and communities benefit from improved living standards.

Creating Jobs and Reducing Unemployment

Entrepreneurship plays a crucial role in job creation. When entrepreneurs start or expand their businesses, they often require a workforce, thereby providing employment opportunities to individuals in the community. Increased job opportunities contribute to the reduction of unemployment rates, stimulate local economies, and foster social stability.

Enhancing Local and Global Trade

Entrepreneurship encourages local and global trade by creating new markets and expanding existing ones. Entrepreneurs are key players in driving economic activity and increasing competitiveness. Through their businesses, they contribute to local economies by generating revenue, promoting exports, and attracting investments. This growth, in turn, positively impacts international trade by strengthening trade relations and improving the overall economic landscape.

Fostering Inclusive Economic Development

Supporting entrepreneurship is essential for fostering inclusive economic development. By providing opportunities to individuals from diverse backgrounds, regardless of their socio-economic status or education level, entrepreneurship can break traditional economic barriers and promote social mobility. This inclusivity ensures that wealth and opportunity are distributed more equitably, leading to a fairer and more sustainable society.

In conclusion, supporting entrepreneurship is a catalyst for economic growth, innovation, job creation, and inclusive development. By enabling and empowering entrepreneurs, we can create a prosperous future where wealth and opportunities are shared by all.

Empowering Individuals Through Small Loans: The Role of Microfinance

In today's world, where access to financial resources is often limited, microfinance emerges as a powerful tool to empower individuals and foster economic growth. Through the provision of small loans, microfinance institutions aim to alleviate poverty, promote entrepreneurship, and create sustainable development in communities. This article will explore the transformative impact of microfinance and how it enables individuals to break free from the cycle of poverty.

Microfinance: Empowering Individuals Towards Financial Independence

Microfinance refers to the practice of offering financial services, such as small loans, savings accounts, and insurance, to individuals who have limited access to traditional banking services. Unlike traditional financial institutions, microfinance institutions focus on providing services to low-income individuals, often in rural areas or developing countries.

Breaking Barriers: Enabling Entrepreneurs to Realize Their Potential

One of the essential elements of microfinance is the provision of small loans, also known as microloans or microcredit. These loans are typically granted to individuals who do not have collateral or a stable income, making it challenging for them to secure loans from traditional banks. By providing these small loans, microfinance institutions empower individuals to pursue entrepreneurship, start a small business, or invest in income-generating activities.

Impact on Poverty Reduction: Fostering Sustainable Development

The impact of microfinance goes beyond the mere provision of financial resources. By giving individuals the means to generate income and improve their financial standing, microfinance acts as a catalyst for poverty reduction. As individuals become self-sufficient and generate steady income streams, they not only improve their own livelihoods but also contribute to the overall development and economic growth of their communities.

Empowerment Through Financial Literacy: Beyond Loans and Credits

Microfinance institutions recognize that financial inclusion is more than just providing access to loans. They actively promote financial literacy and offer training programs that educate individuals on money management, business planning, and entrepreneurial skills. By equipping individuals with the necessary knowledge and skills, microfinance enables them to make informed financial decisions and develop sustainable businesses.

The Future of Microfinance: Expanding Opportunities for Economic Empowerment

The potential of microfinance is vast, with ongoing efforts to further expand its reach and impact. Governments, nonprofits, and international organizations are increasingly collaborating to create an enabling environment for microfinance institutions, ensuring they have the necessary resources and regulatory support to operate effectively. As microfinance continues to grow and evolve, it holds the potential to empower even more individuals, unlock economic opportunities, and create a more equitable and inclusive society.

Building Strong Local Economies through Community Investment Funds

Community Investment Funds are a powerful tool for fostering economic growth and stability within local communities. These funds allow individuals and organizations to pool their resources and invest in projects and initiatives that directly contribute to the development of their own neighborhoods, towns, and cities. By directing financial support towards local businesses, infrastructure, and social programs, these funds create a ripple effect that strengthens the overall economy and improves the quality of life for residents.

One of the key advantages of Community Investment Funds is their ability to mobilize capital from a variety of sources. Whether it be through individual contributions, grants from foundations, or partnerships with government entities, these funds bring together diverse stakeholders who share a common goal of revitalizing their communities. This collaborative approach not only enhances the fund's financial capacity, but also fosters a sense of collective responsibility and ownership among its participants.

A Community Investment Fund operates under the principle of "investing locally." This means that the funds are channeled towards businesses and organizations that are deeply rooted in the community and actively contribute to its well-being. By supporting local enterprises, the fund promotes job creation, encourages entrepreneurial growth, and stimulates increased economic activity within the community.

In addition to economic benefits, Community Investment Funds also play a crucial role in addressing societal challenges. They provide a means to finance social projects, such as affordable housing initiatives, education programs, healthcare facilities, and sustainable energy projects, which are essential for creating a more inclusive and equitable society. By investing in these areas, Community Investment Funds actively work towards improving the social fabric of the community.

| Benefits of Community Investment Funds |

|---|

| 1. Economic growth and development |

| 2. Job creation and entrepreneurial opportunities |

| 3. Increased investment in local businesses |

| 4. Addressing societal challenges |

| 5. Supporting social projects |

Overall, Community Investment Funds play a vital role in strengthening local economies by leveraging financial resources to support businesses, infrastructure, and social programs. Through collaboration and a focus on investing locally, these funds have the potential to create sustainable, inclusive, and prosperous communities for the benefit of all residents.

Paying It Forward: Educating Others on Financial Literacy and Skills

In this section, we will explore the concept of giving back by teaching others about financial literacy and skills. Without focusing on the specific aspects of our dreams, sharing, wealth, or how to make money work for others, we will delve into the importance of paying it forward and the benefits it brings to individuals and society as a whole.

1. Understanding the Value of Financial Literacy

- Exploring the significance of financial literacy and its impact on personal and professional life

- Providing examples of how a lack of financial knowledge can lead to financial challenges

2. Teaching the Basics: Budgeting and Saving

- Explaining the importance of budgeting and saving as essential components of financial well-being

- Sharing practical tips and strategies for creating and sticking to a budget

- Highlighting different saving techniques and their long-term benefits

3. Investing in Knowledge: Introduction to Investment

- Introducing the concept of investment and its potential for generating wealth

- Discussing various investment options, including stocks, bonds, and real estate

- Offering guidance on how to assess and manage investment risks

4. Building a Strong Financial Foundation: Credit and Debt Management

- Explaining the importance of responsible credit and debt management

- Discussing strategies for building and maintaining good credit

- Providing tips for managing and reducing debt effectively

5. Empowering the Next Generation: Financial Education for Children

- Emphasizing the significance of early financial education for children

- Highlighting age-appropriate activities and lessons to teach basic financial concepts

- Discussing the long-term benefits of instilling good financial habits at a young age

By sharing our knowledge and skills in financial matters, we can help individuals gain the necessary tools to make informed decisions and achieve financial stability. Instilling financial literacy in others not only benefits them personally but also contributes to the overall economic well-being of society.

FAQ

How can I use my money to help others?

There are various ways you can use your money to help others. One option is to donate to charities or non-profit organizations that support causes you believe in. You can also invest in socially responsible funds that prioritize positive social and environmental impact. Additionally, you can consider starting your own philanthropic foundation or trust to directly support projects and initiatives that align with your values.

What are the benefits of sharing wealth with others?

Sharing wealth with others can bring numerous benefits. Firstly, it allows you to make a positive impact in the lives of those in need and contribute to creating a better society. Secondly, it can provide a sense of fulfillment and purpose, knowing that your resources are being used for the greater good. Additionally, sharing wealth can help you build strong relationships with like-minded individuals and organizations, leading to potential collaborations and opportunities.

Are there any tax advantages to sharing wealth?

Yes, there are potential tax advantages to sharing wealth. In many countries, donations to registered charities or non-profit organizations can be tax-deductible, meaning you can reduce your taxable income by the amount donated. It is advisable to consult with a tax professional or financial advisor to understand the specific tax regulations and benefits applicable to your situation.

How can I ensure that my money is being used effectively when sharing it with others?

Ensuring the effective use of your shared wealth requires thorough research and due diligence. Before donating or investing in any organization or cause, it is important to gather information about their track record, financial transparency, and impact on the intended beneficiaries. Review their mission, goals, and past projects to evaluate if they align with your values and expectations. It can also be helpful to seek recommendations from trusted sources or consult experts in philanthropy and impact investing.