It has been an enduring desire embedded deep within the cores of individuals, a profound inclination that drives them towards a life of opulence and financial accomplishment. This fervent yearning to establish oneself in a realm of affluence and material abundance has been a prominent motivation for countless individuals throughout history.

Humans have forever been captivated by the allure of prosperity, endlessly reaching for the pinnacle of financial success. It is a dream that spans cultural boundaries and resonates deeply within the souls of individuals from all walks of life. Whether one seeks stability, abundance, or liberation, the aspiration for enduring wealth unites people in their pursuit of a better future.

Countless books have been written, conferences held, and theories proposed in an effort to unravel the secrets to harnessing financial success. Some may argue that it is simply a matter of luck or good fortune, while others may advocate for a disciplined approach and diligent work ethic. However, one thing remains clear - the desire for financial empowerment remains a driving force behind many of our actions and decisions.

The Significance of Establishing Clear Monetary Objectives

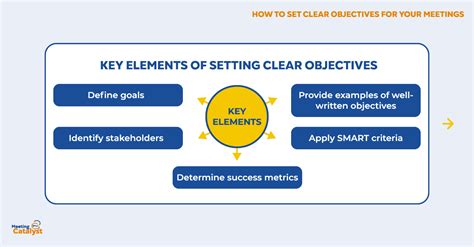

The pursuit of economic prosperity and the realization of one's financial aspirations entail setting explicit targets that serve as lighthouses guiding individuals towards their desired outcomes. By clearly defining monetary objectives, individuals are able to lay the groundwork for financial success by formulating effective strategies, making informed decisions, and staying focused on their long-term goals.

| 1. Enhanced Clarity and Direction |

| Setting clear financial goals brings clarity and direction to one's financial endeavors. It allows individuals to identify what they want to achieve financially and create a sense of purpose and determination. With predefined objectives in place, individuals can engage in proactive planning, allocate resources efficiently, and prioritize actions that contribute to their financial growth. |

| 2. Motivation and Persistence |

| Clear financial goals provide individuals with the necessary motivation and persistence to overcome obstacles and stay committed to their financial journey. When individuals have a clear vision of what they want to accomplish and a strong desire to attain financial success, they are more likely to persevere through challenges, maintain discipline, and make the necessary sacrifices required to reach their goals. |

| 3. Effective Decision Making |

| Establishing well-defined financial objectives allows individuals to make more effective decisions when it comes to managing their money. By having clear goals in mind, individuals can evaluate various options and determine which choices align with their financial aspirations. This clarity empowers individuals to make informed decisions that maximize their financial opportunities and minimize potential risks. |

| 4. Long-Term Vision and Focus |

| Having clear financial objectives cultivates a long-term vision and focus. It encourages individuals to think beyond immediate gratification and consider the bigger picture of their financial future. By setting specific and measurable goals, individuals can break down their long-term vision into actionable steps, allowing them to stay on track and make consistent progress towards their desired financial outcomes. |

| 5. Accountability and Evaluation |

| Clear financial goals help individuals establish accountability for their financial decisions and actions. By regularly evaluating their progress and comparing it against their predefined goals, individuals can assess their financial growth, identify areas for improvement, and make necessary adjustments. This self-assessment process fosters a sense of responsibility and empowers individuals to take control of their financial well-being. |

The importance of setting clear financial goals cannot be overstated. It serves as a compass that guides individuals towards their vision of financial success, providing them with focus, motivation, and the means to make sound financial decisions. By defining and pursuing their monetary objectives, individuals can transform their dreams into tangible realities.

Understanding the Significance of Establishing Specific Objectives for Attaining Abundance and Economic Triumph

In the pursuit of affluence and prosperity, it is imperative to comprehend the importance of setting clear and well-defined targets. Such objectives serve as a compass, guiding individuals towards their ultimate aspirations by providing focus and direction. By establishing specific goals, one can unlock the true potential for acquiring vast wealth and achieving financial triumph.

Emphasis on Clarity: A fundamental aspect of setting objectives is ensuring clarity in the desired outcomes. By clearly defining what one wishes to attain, the path towards obtaining it becomes much more apparent. Specific objectives enable individuals to identify the necessary steps, strategies, and actions required to reach their desired level of abundance and financial success.

Harnessing Motivation: Setting tangible and specific objectives generates a sense of motivation and drive within individuals. By envisioning the end result and breaking it down into achievable milestones, one becomes invigorated to pursue the necessary efforts and make the required sacrifices. Specific objectives ignite a fire of determination, propelling individuals towards the manifestation of their dreams.

Measuring Progress: Clear objectives provide a yardstick for measuring progress and evaluating one's advancement towards wealth and financial success. By setting specific targets, individuals gain the ability to monitor their accomplishments, identify areas for improvement, and make necessary adjustments to their strategies. This ensures that the journey towards prosperity remains on track and enables the active pursuit of opportunities for growth.

Fostering Accountability: Specific objectives instill a sense of accountability within individuals. By outlining precise goals, individuals become responsible for their own success, necessitating a commitment to taking action and making the necessary decisions. This self-imposed accountability encourages individuals to persevere through challenges and obstacles, ultimately leading to the realization of their dreams of financial abundance.

Conclusion: In order to embark on a journey towards wealth and financial success, it is crucial to understand and appreciate the significance of establishing specific objectives. By setting clear goals, individuals can navigate the path towards prosperity with clarity, motivation, and accountability, ensuring that their dreams of abundance become a tangible reality.

Cultivating a Prosperity Mindset: Essential Qualities and Strategies

In this section, we will explore the key attributes and approaches essential for fostering a mindset primed for prosperity. By adopting a positive and intentional mindset, individuals can pave the way for attaining financial abundance and long-term success.

Building a prosperous mindset begins with developing a strong sense of gratitude. Expressing gratitude for the present circumstances and resources sets the foundation for attracting greater opportunities and wealth. By appreciating what one already has, an individual opens themselves up to receiving more abundance.

Another critical element of cultivating a prosperity mindset is maintaining a growth-oriented outlook. Embracing a willingness to learn, adapt, and grow allows for continuous personal and professional development. Investing time and effort into acquiring new skills and knowledge expands one's potential for creating wealth and achieving financial stability.

Additionally, cultivating a proactive mindset is vital for making progress towards financial prosperity. Taking initiative, setting goals, and pursuing them with determination can greatly impact one's financial trajectory. Individuals who embrace a proactive approach consistently seek out new opportunities, make informed financial decisions, and actively take steps towards their desired financial outcomes.

Furthermore, cultivating resilience plays a significant role in developing a prosperous mindset. Navigating obstacles and setbacks is inevitable on the path to financial success. Resilient individuals maintain a positive attitude, remain adaptable, and leverage setbacks as learning experiences. They view challenges as stepping stones towards progress and use them to drive personal and financial growth.

Lastly, adopting effective financial strategies is crucial for converting a prosperous mindset into tangible wealth. This involves budgeting, saving, and investing wisely. Developing financial literacy and making informed decisions about money management empowers individuals to make the most of their resources and create sustainable pathways towards financial freedom.

In summary, cultivating a prosperity mindset involves cultivating gratitude, embracing growth, maintaining a proactive approach, developing resilience, and adopting effective financial strategies. By embodying these qualities and implementing the corresponding strategies, individuals can unlock their potential for wealth and long-lasting financial success.

Exploring the mindset and behaviors that contribute to accumulation of prosperity and financial triumph

In this section, we delve into the mindset and behaviors that play a pivotal role in the accumulation of prosperity and achieving financial triumph. By examining the attitudes and actions of individuals who have successfully built wealth, we aim to identify key factors that can guide others on their path to financial success.

| Mindset: | The way individuals perceive and approach wealth creation can significantly impact their financial outcomes. We analyze the mindset of successful individuals, exploring their beliefs about money, wealth, and abundance. By understanding and adopting a growth-oriented mindset, individuals can develop a positive relationship with money and open themselves up to opportunities for financial gain. |

| Goal Setting: | Successful individuals tend to set clear and attainable financial goals. By establishing specific targets, they create a roadmap that guides their financial decisions and drives them towards long-term prosperity. We explore effective goal-setting strategies and highlight the importance of regularly reviewing and adjusting goals to maintain focus and motivation. |

| Financial Education: | Acquiring a strong financial knowledge base is crucial for wealth accumulation. We examine the significance of financial literacy and the role it plays in making informed financial decisions, managing investments, and building sustainable wealth. We also explore the various resources and learning opportunities available for individuals to enhance their financial literacy skills. |

| Smart Decision-Making: | Successful individuals exhibit prudent decision-making when it comes to their finances. We discuss the importance of evaluating risks and rewards, conducting thorough research, and seeking expert advice when needed. By adopting strategic decision-making practices, individuals can minimize financial risks and maximize opportunities for growth. |

| Discipline and Persistence: | Consistency and commitment are key traits possessed by those who have achieved financial success. We explore the significance of discipline in maintaining healthy spending habits, saving consistently, and making wise investment choices. Additionally, we discuss the importance of persistence in overcoming obstacles and staying focused on long-term financial objectives. |

By exploring the mindset and behaviors that contribute to prosperity and financial triumph, individuals can gain valuable insights and tools to embark on their own journey towards wealth accumulation and financial success.

Investment Strategies for Long-term Financial Growth

Embarking on a journey towards attaining prosperity and lasting economic progress necessitates comprehensive planning and strategic decision-making. This section explores effective approaches to investing for sustained financial growth, without the inclusion of specific terms or concepts.

1. Establishing a Diversified Portfolio:

- Identify an array of investment opportunities across different sectors and asset classes.

- Allocate resources wisely to maximize potential returns while minimizing risks.

- Ensure that the portfolio does not heavily depend on a single investment or sector.

2. Long-term Investments:

- Take a patient and focused approach, considering investments with a long-term outlook.

- Allocate resources to ventures that have the potential for sustainable growth and consistent returns over time.

- Avoid impulsive decisions driven by short-term market fluctuations.

3. Regular Monitoring and Adjustments:

- Keep track of the performance of the investments and make necessary adjustments when required.

- Stay informed about market trends and economic conditions to mitigate risks and seize new opportunities.

- Consider seeking professional advice to ensure a well-informed decision-making process.

4. Compound Interest:

- Maximize the potential of compound interest by reinvesting earned returns.

- Allow investments to grow exponentially over time by harnessing the power of compounding.

- Regularly reinvesting dividends and interest can significantly enhance long-term financial growth.

5. Adequate Risk Management:

- Assess and manage risks associated with investments carefully.

- Consider diversifying the portfolio to minimize the impact of potential losses.

- Regularly review risk tolerance and adjust investment strategies accordingly.

By following these effective investment strategies, individuals can work towards achieving long-term financial growth and securing a prosperous future.

Understanding the Advantages and Tactics of Long-Term Investment for Wealth Building and Financial Objectives

Embarking on a journey towards attaining financial prosperity and realizing our aspirations necessitates comprehensive planning and a robust investment strategy. Here, we explore the significance of long-term investing as a potent tool for accumulating wealth and accomplishing our financial goals without merely relying on instantaneous gains or speculative ventures.

In today's fast-paced and unpredictable economic landscape, developing a long-term investment approach can offer numerous benefits. Firstly, it enables individuals to cultivate a patient and disciplined mindset, avoiding the pitfalls of impulsive decisions fueled by short-term market fluctuations. By adopting a long-term perspective, investors can harness the power of compounding returns, allowing their initial investments to grow exponentially over time. Moreover, long-term investing often leads to a more tax-efficient approach, reducing the impact of capital gains taxes and maximizing overall portfolio growth.

To effectively establish financial security through long-term investing, individuals need to embrace several key strategies. Diversification plays a vital role in mitigating risk and protecting against unexpected market downturns. By allocating investments across various asset classes, industries, and geographical regions, individuals can minimize the potential negative impact of a single investment's poor performance. Alongside diversification, a consistent contribution plan is essential. Regularly investing a fixed sum over an extended period ensures a steady buildup of wealth, taking advantage of market downturns and enabling the acquisition of shares at lower prices.

Additionally, the selection of suitable investment vehicles is crucial for long-term success. Stocks of established companies with a track record of stable growth, dividend-paying securities, and index funds are examples of assets that often generate solid long-term returns. While these investments carry varying degrees of risk, a well-researched and balanced portfolio can greatly enhance wealth accumulation prospects.

Long-term investing requires steadfastness and a focus on the future rather than short-term gains. By embracing this approach and implementing sound investment strategies, individuals can effectively build wealth, realize their financial goals, and secure a prosperous future.

Strategies for Overcoming Financial Challenges and Developing Resilience

When pursuing our aspirations for prosperity, we often encounter hurdles that obstruct our path. These obstacles can range from unexpected expenses and debt to economic downturns and job insecurity. However, by cultivating resilience and adopting effective strategies, we can overcome these financial challenges and continue on our journey towards financial stability and success.

1. Embrace a positive mindset: Developing a positive mindset is essential when facing financial obstacles. It allows us to maintain optimism and resilience, even in the face of adversity. By focusing on possibilities and opportunities rather than dwelling on setbacks, we can approach challenges with a proactive and determined attitude.

2. Create a realistic financial plan: A well-defined financial plan provides a roadmap to navigate obstacles and achieve long-term financial goals. Begin by assessing your current financial situation, defining your short and long-term objectives, and identifying potential obstacles. Set realistic targets and devise actionable steps to mitigate challenges along the way.

3. Build an emergency fund: Establishing an emergency fund is crucial for weathering unexpected financial setbacks. By setting aside a portion of your income regularly, you can create a safety net to cover unforeseen expenses or cope with periods of reduced income. This fund provides a sense of security and minimizes the impact of unexpected financial hurdles.

4. Seek financial education: Knowledge is power when it comes to overcoming financial challenges. Educate yourself about personal finance, investment strategies, and effective budgeting techniques. Consider attending workshops, reading books, or consulting with a financial advisor to enhance your understanding of financial concepts and develop effective money management skills.

5. Prioritize debt management: Debt can be a significant source of financial stress and can hinder progress towards wealth accumulation. Develop a debt repayment plan that focuses on reducing high-interest debts first and gradually eliminating outstanding balances. By prioritizing debt management and adopting disciplined repayment strategies, you can regain control of your finances and pave the way for long-term financial success.

6. Cultivate additional income streams: Diversifying your income sources can provide a cushion against financial setbacks and enhance your overall financial resilience. Explore opportunities for part-time work, freelance projects, or passive income streams, such as investments or rental properties. By generating multiple sources of income, you can increase your financial stability and accelerate your progress towards achieving your financial goals.

7. Seek support and guidance: Don't be afraid to ask for help when facing financial challenges. Seek advice from trusted mentors, financial professionals, or support groups. Their perspectives and expertise can offer valuable insights and guidance in overcoming obstacles. Additionally, discussing your financial journey with like-minded individuals can provide emotional support and motivation.

In conclusion, building resilience and overcoming financial obstacles is an integral part of the journey towards financial stability and success. By adopting a positive mindset, creating a realistic financial plan, building an emergency fund, seeking financial education, prioritizing debt management, cultivating additional income streams, and seeking support and guidance, we can navigate the challenges that come our way and achieve our dreams of financial prosperity.

Overcoming Financial Setbacks and Developing Resilience for Ultimate Financial Prosperity

In the pursuit of our aspirations to fulfill our financial potential, we all experience setbacks and obstacles along the way. These hurdles may take the form of unexpected expenses, failed investments, or unforeseen circumstances that can challenge our monetary stability. However, it is crucial to understand that setbacks are not equivalent to failure, but rather valuable learning opportunities that can pave the way for future success. By adopting a resilient mindset and implementing practical strategies, individuals can navigate financial setbacks and continue their journey towards achieving financial prosperity.

Undoubtedly, developing resilience plays a pivotal role in overcoming financial setbacks. Resilience allows individuals to bounce back from financial setbacks, adapt to changing circumstances, and persevere on their path to financial success. It involves recognizing the challenges faced, acknowledging emotions associated with setbacks, and actively seeking strategies to overcome adversity. Resilience is not an innate trait but rather a skill that can be developed through determination and practice, enabling individuals to emerge stronger and more prepared to face future financial challenges.

One practical piece of advice for overcoming financial setbacks is to create a comprehensive plan to manage finances effectively. This includes developing a budget to track income and expenses, prioritizing savings to establish an emergency fund, and exploring strategies to generate additional income streams. Creating a financial plan empowers individuals to regain control over their finances, make informed decisions, and mitigate the impact of unforeseen financial setbacks. It serves as a roadmap towards financial stability and ultimately contributes to realizing long-term financial goals.

Another essential aspect of overcoming financial setbacks is cultivating a positive mindset and reframing setbacks as opportunities for growth. Adopting a growth mindset allows individuals to view setbacks as temporary setbacks rather than permanent failures. It encourages individuals to learn from their mistakes, leverage their experiences, and seek alternative solutions. By maintaining optimism and embracing challenges as catalysts for personal and financial growth, individuals can effectively overcome setbacks and move closer to financial success.

In conclusion, setbacks are inevitable in the pursuit of financial success. However, by developing resilience, creating a comprehensive financial plan, and cultivating a positive mindset, individuals can overcome financial setbacks and continue their journey towards achieving ultimate financial prosperity. It is through the process of overcoming setbacks that individuals gain invaluable lessons and insights that propel them further on their path to financial success.

FAQ

What are some common misconceptions about achieving wealth and financial success?

One common misconception is that achieving wealth and financial success is solely based on luck. In reality, it requires hard work, determination, and discipline. Another misconception is that achieving wealth means sacrificing happiness and personal relationships. However, it is possible to have both financial success and a fulfilling life.

How can I start working towards achieving financial success?

Starting with a clear financial goal is crucial. Create a budget and track your expenses to gain control over your finances. Additionally, develop good saving habits and consider investing your money wisely. It's also important to continue educating yourself about personal finance and seek guidance from financial experts when needed.

Is it possible to achieve financial success without compromising one's values?

Absolutely! It is essential to define your values and ensure that your pursuit of wealth aligns with them. Prioritize ethical and sustainable practices in your financial decisions. By focusing on creating value for others and contributing to society, you can achieve financial success while staying true to your values.