Embarking on a remarkable journey towards financial well-being demands a deeper comprehension of an unsung element concealed within our lives. Within the realm of economic triumph lies an enigmatic linkage waiting to be explored, paving the way towards prosperity. Brace yourself to decode this cryptic association and unearth its tremendous potential to transform your financial fortunes.

As you delve into the intricate essence of this clandestine connection, brace yourself for the unfathomable. Prepare to venture beyond the shores of ordinary thinking and immerse yourself in the riveting intricacies of wealth accumulation. This hidden bond, meticulously guarded by the wisest of minds, holds the power to revolutionize your perception of financial success.

Wrapped in the cloak of obscurity, this elusive bond reveals itself only to those audacious enough to unravel its intricate mysteries. Enter the uncharted territory of financial enlightenment and discover the gateway to unimaginable riches, cleverly disguised in the background noise of everyday life. Harness the strength of your curiosity and embark on a journey towards unlocking your true potential.

The Ultimate Strategy for Achieving Financial Prosperity

In this section, we will explore a comprehensive and effective approach that can lead you to financial abundance and prosperity. By following this strategy, you will be equipped with the necessary tools and knowledge to attain financial success and create the life you desire.

1. Embrace a Wealth Mindset:

- Adopting a mindset focused on abundance and prosperity is crucial for achieving financial success.

- Cultivate a positive belief system that empowers you to attract opportunities and wealth.

- Train your mind to overcome limiting beliefs and doubts that hinder financial growth.

2. Set Clear Financial Goals:

- Define specific and measurable financial goals that align with your dreams and aspirations.

- Break down your goals into smaller milestones and create a plan of action to achieve them.

- Regularly review and adjust your goals as you progress towards financial success.

3. Develop Multiple Streams of Income:

- Create diverse sources of income to maximize your earning potential and secure financial stability.

- Explore various opportunities such as investments, entrepreneurship, and passive income streams.

- Continually seek ways to increase your income and reduce dependency on a single source.

4. Practice Smart Money Management:

- Implement effective budgeting techniques to control your expenses and prioritize savings.

- Build an emergency fund to safeguard against unforeseen financial setbacks.

- Make informed financial decisions and avoid unnecessary debt.

5. Invest Wisely:

- Educate yourself about various investment options and seek professional advice if needed.

- Diversify your investment portfolio to mitigate risks and optimize returns.

- Stay updated with market trends and make informed investment decisions.

By incorporating these strategies into your financial journey, you will be on the path to achieving ultimate financial success and building the future you've always dreamed of!

Unlocking the Potential of Your Thrifty Habits

Discovering the hidden potential of your money-saving habits is the key to achieving financial stability and abundance. By cultivating a disciplined approach towards saving, you can attain long-term financial success and freedom. This section will explore effective strategies and practical tips to unleash the power of your saving habits.

- 1. Prioritize Your Expenses: Understanding your needs versus wants is crucial in developing a sustainable saving habit. Assess your spending patterns and identify areas where you can cut back or eliminate non-essential expenses.

- 2. Set Clear Financial Goals: Define your objectives and aspirations in the short, medium, and long term. By having specific and measurable targets, you can stay motivated and track your progress towards financial success.

- 3. Automate Your Savings: Utilize technology to your advantage by setting up automatic transfers from your checking account to a separate savings account. This method ensures consistent and regular contributions, even during busy or hectic periods.

- 4. Embrace Frugality: Embracing minimalism and being mindful of your spending habits can significantly impact your saving potential. Opt for cost-effective alternatives, seek out discounts or sales, and avoid unnecessary impulse purchases.

- 5. Educate Yourself: Expand your financial knowledge by reading books, attending seminars, or following reputable online resources. Educating yourself about personal finance will empower you to make informed decisions and enhance your saving strategies.

- 6. Track Your Expenses: Implement a tracking system to monitor your expenses closely. This can be as simple as maintaining a spreadsheet or utilizing budgeting apps to gain a comprehensive understanding of your financial inflows and outflows.

- 7. Review Regularly: Regularly revisit your budget, financial goals, and saving strategies to ensure they align with your evolving circumstances and aspirations. Making necessary adjustments and optimizations based on your progress is vital in maximizing the potential of your saving habits.

By implementing these practical tips and adopting a proactive mindset towards saving, you can harness the untapped power of your saving habits. Remember, financial success is not an overnight achievement but a journey that requires dedication, discipline, and continuous self-improvement. Start taking small steps today and pave the way towards a prosperous financial future.

The Bank Account: Your Path to Financial Stability

In this section, we will discuss the importance of your bank account and how it can pave the way towards achieving financial stability and security. Understanding the significance of maintaining a healthy bank account is essential for anyone looking to improve their financial well-being and future prospects.

1. Building a Solid Financial Foundation

Having a bank account serves as the cornerstone for building a solid financial foundation. It provides a safe and secure place to store your money, and a means to easily access and manage your funds. With a bank account, you can effectively track your expenses, set financial goals, and plan for the future.

2. Budgeting and Financial Planning

A bank account provides a valuable tool for budgeting and financial planning. By analyzing your income and spending patterns, you can gain insights into your financial habits and make better decisions regarding your money. With the help of online banking and budgeting tools, you can create a realistic budget, track your expenses, and work towards achieving your financial goals.

3. Leveraging the Power of Interest

Another advantage of a bank account is the potential to earn interest on your savings. By keeping your money in an interest-bearing account, you allow it to work for you and grow over time. This can be particularly beneficial for long-term financial goals, such as saving for retirement or a major purchase.

4. Access to Financial Services

Having a bank account grants you access to a wide range of financial services that can simplify your life and improve your financial situation. From online and mobile banking to credit cards and loans, a bank account opens doors to various financial tools and resources. These services can help you manage your finances more effectively and achieve your financial objectives.

5. Security and Protection

A bank account offers security and protection for your money. With numerous security measures in place, such as encryption, fraud detection, and account monitoring, banks ensure the safety of your funds. In addition, many banks provide Federal Deposit Insurance Corporation (FDIC) coverage, which guarantees your deposits up to a certain limit, offering peace of mind regarding the safety of your money.

- By building a solid financial foundation through your bank account, you create a framework for future success and stability.

- Utilizing the tools and services provided by your bank account, you can effectively manage your finances and work towards achieving your financial goals.

- Earning interest on your savings and accessing various financial services further enhance your financial prospects and open doors to new opportunities.

- Lastly, the security and protection provided by a bank account ensure the safety of your funds, allowing you to confidently navigate your financial journey.

In conclusion, your bank account plays a crucial role in securing financial stability and success. By understanding and maximizing the potential of your bank account, you can take control of your finances, build a solid financial future, and ultimately achieve your financial dreams.

Unlocking the Potential: Maximizing your Wealth with a Savings Account

Did you know that you have the power to make your hard-earned money truly work for you? By utilizing a savings account, you can unlock the potential of your finances and take significant steps towards achieving long-term financial stability and prosperity.

One of the key advantages of a savings account is its ability to generate interest on your deposited funds. Rather than simply storing your money under the mattress or in a regular checking account, a savings account allows you to earn interest on your balance over time. This means that your money has the potential to grow and increase in value, providing you with an additional source of income that can contribute towards your financial goals.

Moreover, opening a savings account demonstrates a commitment to financial responsibility and discipline. By setting aside a portion of your income on a regular basis, you establish a solid foundation for future financial success. This practice not only helps you develop good saving habits, but it also provides a safety net for unexpected expenses or emergencies.

Another benefit of a savings account is the security it offers. Unlike keeping large sums of cash at home or carrying it around with you, a savings account provides a safe and secure place to store your money. Banks utilize advanced security measures to protect your funds, giving you peace of mind and reassurance that your hard-earned savings are in safe hands.

In addition to security, a savings account offers a level of accessibility that ensures your money remains easily accessible when needed. While it's essential to have an emergency savings fund, a savings account allows you to have funds readily available for various purposes, such as travel, investments, or future financial opportunities.

By recognizing the potential of a savings account and taking advantage of its benefits, you can empower yourself to build a solid financial foundation, facilitate future financial growth, and ensure the stability and security of your wealth. It's time to turn the power of your money into a force that works for you!

Unveiling the Path to Wealth Accumulation

Have you ever pondered the enigmatic means by which individuals amass significant wealth? This section aims to shed light on the elusive secrets surrounding the accumulation of financial prosperity. Through a comprehensive exploration of proven strategies and insightful guidance, this article aims to equip you with the knowledge required to unlock the doors to long-term financial abundance.

A Vision for Financial Growth

The journey towards wealth accumulation begins with a vision–a clear and compelling picture of the prosperous future you aspire to create. This vision acts as a guiding force, providing focus and direction as you navigate the complexities of the financial world. By articulating your financial goals and envisioning the life you desire, you set in motion a powerful manifestation process that propels you towards the realization of your dreams.

Cultivating a Wealth Mindset

Achieving lasting financial success necessitates the cultivation of a wealth mindset. This entails fostering a positive and empowering attitude towards money and abundance. By adopting an abundance mindset, you develop an unwavering belief in your ability to attract and create wealth. Embracing a mindset of abundance enables you to recognize opportunities for growth, embrace calculated risks, and persist in the face of adversity.

The Power of Financial Education

Education is a pivotal aspect of unlocking the secrets to wealth accumulation. Acquiring financial literacy and understanding the dynamics of various investment vehicles empowers you to make informed decisions and leverage opportunities in the ever-evolving financial landscape. By embarking on a continual journey of learning, you equip yourself with the knowledge needed to navigate complex financial systems, maximize returns on investments, and mitigate potential risks.

Strategic Wealth Building Strategies

While knowledge is essential, applying strategic wealth building strategies is an equally vital component of wealth accumulation. These strategies encompass prudent budgeting, disciplined saving habits, and diversified investment portfolios. By implementing these time-tested approaches, you can gradually build a solid foundation of financial security, laying the groundwork for future wealth growth.

Embracing a Wealth Accumulation Mindset

Embarking on a journey towards wealth accumulation requires embracing a long-term perspective. It demands patience, persistence, and a commitment to fiscal discipline. By adopting a mindset focused on wealth accumulation, you shift your focus from short-term gratification to long-term wealth creation. This shift in perspective allows you to weather financial storms, adapt to changing market conditions, and ultimately secure a prosperous future.

In conclusion, the path to wealth accumulation is not shrouded in mystery but rather resides in the adoption of specific principles and strategies. By envisioning your financial goals, cultivating a wealth mindset, prioritizing financial education, implementing strategic wealth building approaches, and embracing a long-term perspective, you can unlock the elusive secrets to financial success and pave the way for lasting abundance.

The Path to Financial Independence: A Practical Handbook

Are you seeking to gain control over your financial life and achieve true financial freedom? Look no further than The Bank Book - a comprehensive and practical guide that holds the key to unlocking your financial potential.

In this section, we will provide you with invaluable insights and strategies to help you take charge of your financial future. With a clear focus on actionable steps and realistic goals, you will learn how to navigate the complex world of personal finances and pave your own path to financial independence.

- Understanding the Basics: Gain a solid foundation by learning the fundamental concepts of personal finance, such as budgeting, saving, and investing. Discover how small changes in your daily financial habits can lead to significant long-term benefits.

- Creating a Financial Plan: Learn the importance of setting clear financial goals and developing a step-by-step plan to achieve them. We will guide you through the process of creating a comprehensive financial plan that aligns with your aspirations and values.

- Managing Debt Wisely: Debt can be a major obstacle on your path to financial freedom. Find out how to effectively manage your debt, reduce interest payments, and ultimately become debt-free. We will equip you with practical strategies for managing student loans, credit card debts, and mortgages.

- Investing for the Future: Discover the power of investing and how it can accelerate your journey to financial independence. Learn about various investment options, diversification, and risk management techniques to ensure a secure financial future.

- Building Multiple Streams of Income: Explore the concept of generating additional income streams beyond your primary job. We will discuss various methods to supplement your earnings, such as side hustles, real estate investments, and passive income sources.

Whether you are just starting your financial journey or looking to sharpen your existing financial skills, The Bank Book offers a wealth of knowledge and practical advice to help you achieve financial freedom. Take the first step towards a more prosperous future today.

Achieving your Financial Goals through Effective Money Management

Mastering the art of effective money management is a crucial step towards achieving your financial goals. It involves making informed decisions about how you earn, spend, save, and invest your money. By taking control of your finances, you can pave the way towards a secure and prosperous future.

Developing a solid financial plan is the first step towards effective money management. This involves setting clear and realistic goals that align with your long-term aspirations. Whether you aim to build an emergency fund, save for a down payment on a house, or plan for retirement, a well-defined plan will guide your financial decisions and help you stay on track.

Budgeting is a fundamental aspect of managing your money effectively. It entails keeping track of your income and expenses, and making conscious choices about how you allocate your resources. By creating a budget, you can identify areas where you may be overspending and find opportunities to save or invest more wisely.

Another crucial element of effective money management is reducing and managing your debt. Whether it's student loans, credit card debt, or mortgage payments, staying on top of your debt can help you avoid unnecessary interest charges and improve your overall financial health. Implementing strategies such as debt consolidation or negotiation can help you become debt-free sooner.

Building a savings habit is essential for achieving your financial goals. Set aside a portion of your income each month for emergencies, future expenses, and long-term investments. By consistently saving and investing, you can enjoy the peace of mind that comes with having a financial cushion and the potential for growth over time.

Lastly, educating yourself about personal finance is crucial in effective money management. Stay updated on the latest investment strategies, tax laws, and financial products to make informed decisions. Consider seeking guidance from financial advisors or attending financial literacy seminars to enhance your knowledge and skills.

In conclusion, achieving your financial goals through effective money management is within your reach. By creating a comprehensive financial plan, budgeting wisely, managing debt, saving consistently, and staying informed, you can pave the way towards a financially secure future.

The Art of Managing Your Money: Achieving the Perfect Balance between Income and Expenses

In this section, we will explore the essential skill of balancing your income and expenses to achieve financial stability. The art lies in finding the optimal equilibrium that allows you to live comfortably while also saving and investing for future financial goals. Understanding how to effectively manage your money is crucial for long-term success and peace of mind.

1. Prioritize your spending

- Create a budget that accurately reflects your income and necessary expenses, such as housing, utilities, and transportation.

- Identify discretionary expenses and prioritize them based on your personal values and goals.

- Consider cutting back on non-essential expenses or finding ways to reduce costs, such as cooking at home instead of eating out.

2. Track and analyze your income and expenses

- Maintain a record of all your earnings and expenditures to gain a clear understanding of where your money is going.

- Categorize your expenses to identify areas where you can potentially save or reduce costs.

- Regularly review your financial statements and make adjustments as needed.

3. Save and invest wisely

- Establish an emergency fund to cover unexpected expenses and provide a safety net in times of financial uncertainty.

- Explore different investment options that align with your risk tolerance and financial goals.

- Consider seeking professional advice when making investment decisions to maximize your returns.

4. Maximize your income potential

- Continuously enhance your skills and knowledge to increase your earning potential and open up new opportunities for advancement or entrepreneurship.

- Explore alternative sources of income, such as freelancing or starting a side business.

- Negotiate your salary or seek higher-paying job opportunities whenever possible.

By mastering the art of balancing your income and expenses, you can pave the way for a financially successful future while still enjoying the present. It is a skill that requires discipline, careful planning, and a constant evaluation of your financial habits. Take charge of your finances and unlock the potential for long-term financial stability and prosperity.

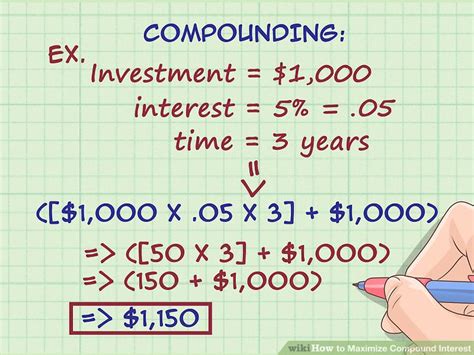

Maximizing the Advantages of Compound Interest with an Account Statement

In this section, we will explore the strategies and techniques to effectively leverage the power of compound interest through the use of an account statement. By examining the benefits and understanding the intricacies of compound interest, individuals can make informed decisions to optimize their financial growth and achieve long-term goals.

Compound interest, also known as interest on interest, is a phenomenon where the interest earned on an initial principal amount is added to the principal, resulting in interest being earned on the new total. This compounding effect can lead to significant growth over time, allowing individuals to make the most of their invested funds.

Maximizing Contributions: One key aspect of maximizing the advantages of compound interest is to consistently make contributions to the bank account. By regularly depositing funds, individuals can ensure a continuous growth of their principal, ultimately leading to greater interest earnings over time. Whether it is contributing a fixed amount each month or allocating a percentage of income, every contribution counts towards maximizing the benefits.

Optimizing the Interest Rate: Another crucial factor in maximizing compound interest is to explore options that offer attractive interest rates. By comparing different banks or financial institutions, individuals can identify opportunities to earn higher interest rates on their savings. Even a slightly higher interest rate can have a significant impact on the overall growth of the account balance.

Reinvesting Interest Earnings: Reinvesting the interest earnings into the account can accelerate the benefits of compound interest. Instead of withdrawing the interest earned, individuals can choose to let it compound along with the principal amount. This reinvestment increases the base for future interest calculations, allowing for exponential growth in the long run.

Time as a Powerful Ally: Lastly, time plays a crucial role in maximizing the benefits of compound interest. The longer the funds are left to grow, the greater the compounded returns. By starting early and maintaining a long-term investment perspective, individuals can harness the power of time to their advantage and achieve substantial financial success.

In conclusion, by understanding the concept of compound interest and implementing the strategies mentioned above, individuals can maximize the benefits of compound interest and accelerate their journey towards financial prosperity. Through consistent contributions, optimizing interest rates, reinvesting, and leveraging time, individuals can unlock the true potential of compound interest and secure a bright future.

Building Your Financial Empire: Strategies for Long-Term Success

Establishing a solid foundation for your financial future is essential for long-term success. In this section, we will explore a variety of strategies and techniques that can help you build your financial empire, allowing you to achieve your goals and fulfill your dreams without relying on luck or chance.

- 1. Setting Clear Financial Goals:

- 2. Developing a Budget:

- 3. Diversifying Income Streams:

- 4. Building an Emergency Fund:

- 5. Learning and Investing:

- 6. Seeking Professional Advice:

- 7. Practicing Discipline and Patience:

- 8. Monitoring and Adjusting:

Defining your financial objectives is the first step towards building your empire. By clearly identifying what you want to achieve, you can create a roadmap that will guide your actions and decisions.

A well-thought-out budget is a crucial tool in the journey to financial success. It will help you track your income and expenses, ensuring that you can allocate funds wisely and save for future investment opportunities.

Relying on a single source of income can be risky. To truly build a financial empire, it is important to explore additional avenues to generate revenue. This could include investing in stocks, starting a side business, or exploring passive income opportunities.

Financial challenges and unexpected expenses are inevitable. Having an emergency fund in place can provide you with a safety net during difficult times, allowing you to avoid falling into debt and stay on track with your long-term financial goals.

Continuously expanding your knowledge of personal finance and investment strategies is crucial for long-term financial success. By staying informed and making informed decisions, you can grow your wealth and make your financial empire flourish.

At times, navigating the complexities of financial planning and investment can be overwhelming. Seeking guidance from financial experts or advisors can provide valuable insights and enable you to make informed decisions.

Building a financial empire takes time and discipline. It is important to stay committed to your goals, resist impulsive spending, and have patience during periods of market fluctuations.

Regularly monitoring your financial progress and adjusting your strategies accordingly is essential for long-term success. Keeping track of your investments, reviewing your budget, and reassessing your goals will help ensure that you stay on the path to building your financial empire.

By implementing these strategies and techniques, you can lay the foundation for a strong financial future, empowering yourself to achieve your dreams and enjoy lasting prosperity.

FAQ

What is the secret to financial success?

The secret to financial success lies in having a dream about a bank book and understanding how to effectively manage your finances. By setting clear financial goals, creating a budget, saving money, investing wisely, and continuously educating yourself about personal finance, you can achieve financial success.

How can having a dream about a bank book help with financial success?

Dreaming about a bank book can serve as a powerful visualization tool. It can motivate you to develop a positive mindset towards money and financial success. By visualizing yourself having a healthy bank balance, you can focus your efforts on financial discipline, goal-setting, and making smart financial decisions.

Why is setting clear financial goals important?

Setting clear financial goals is important because it gives you something to strive for. When you have specific objectives, you are more likely to stay focused on your financial journey and make decisions that align with your goals. Additionally, clear financial goals help you measure your progress and celebrate milestones along the way.

How can I effectively manage my finances?

Managing your finances effectively involves several key strategies. First, create a budget to track your income and expenses. This will help you prioritize your spending and identify areas where you can save money. Second, establish an emergency fund for unexpected expenses. Third, pay off high-interest debt as soon as possible. Finally, continually educate yourself about personal finance to make informed decisions regarding saving, investing, and spending.

What are some tips for saving money?

Here are several tips for saving money: