Within the realm of human desires lies an enduring fascination with the pursuit of boundless success and unyielding prosperity. It is a journey that countless individuals embark upon, driven by an insatiable hunger to transcend the limits of their current circumstances and step into a world imbued with abundance and fulfillment. This quest, characterized by restless hearts and unwavering determination, has woven itself into the very fabric of human existence, propelling individuals to overcome obstacles, possess unwavering resilience, and realize their true potential.

As one ventures into the realm of pursuing and attaining prosperity, an intricate tapestry of strategies, habits, and mindsets emerges; each thread interwoven with the next, forming the blueprint for a life transformed. The pursuit of prosperity does not hinge solely upon financial accomplishment, but rather encompasses a holistic approach, encompassing physical, emotional, and spiritual well-being. It is an amalgamation of wealth creation, personal growth, and the cultivation of harmonious relationships.

Central to the realization of prosperity is the cultivation of a proactive mindset, one that harnesses the power of intention and embraces the inherent possibilities that lie within every moment. It requires a seismic shift in perception, transforming one from a mere spectator in the play of life into the creative director of their own destiny. By fostering an unwavering belief in one's unique abilities, coupled with a relentless drive to take inspired action, the path to prosperity becomes illuminated, guiding individuals towards the realization of their deepest desires.

However, the journey towards prosperity is not without its fair share of challenges and setbacks. It demands a willingness to embrace discomfort, to view failure as a stepping stone rather than a roadblock, and to persist in the face of adversity. It is within these moments of discord, these crucibles of transformation, that one's character is forged and the tenacity to push forward is honed.

Developing a Wealth Mindset: Nurturing the Correct Attitude for Achieving Prosperity

Within the realm of our aspirations for grandeur and plenty lies the intrinsic foundation of our success. It is not solely our strategies or endeavors that shape our path towards prosperity, but rather the mindset we cultivate along the way. Building a wealth mindset involves honing the right attitude, embracing a positive outlook on wealth accumulation, and fostering a deep-rooted belief in one's ability to achieve financial abundance.

One of the fundamental aspects of developing a wealth mindset is recognizing that wealth extends beyond an accumulation of material possessions. It encompasses a holistic approach that encompasses financial freedom, personal growth, and the ability to make a positive impact on others. By acknowledging wealth as a multifaceted concept, we create a foundation for our mindset to flourish and adapt to various circumstances.

Another crucial component of cultivating a wealth mindset is adopting a proactive approach to money management. This involves developing a keen financial intelligence, understanding the fundamentals of investment and saving, and constantly seeking growth opportunities. Embracing a mindset that values continuous learning and improvement allows us to navigate the complex world of wealth accumulation with confidence and efficiency.

Nurturing a wealth mindset also entails embracing an abundance mentality, which supplants scarcity with abundance at its core. Viewing the world through the lens of abundance empowers individuals to harness the potential of every opportunity, fostering an unwavering belief that there is always enough to go around. This fundamental shift in mindset enables us to adopt an optimistic and proactive approach towards creating wealth.

| BENEFITS OF A WEALTH MINDSET |

|---|

| 1. Enhanced motivation and determination to achieve financial goals |

| 2. Increased ability to identify and seize wealth-building opportunities |

| 3. Improved resilience in the face of financial challenges |

| 4. Cultivation of a positive relationship with money and wealth |

| 5. Greater capacity to make informed financial decisions |

Ultimately, building a wealth mindset requires consistent effort and self-reflection. It involves consciously rewiring our thoughts, attitudes, and beliefs to align with our aspirations for prosperity. By embracing the principles of a wealth mindset and adopting a positive attitude towards abundance, we set ourselves on a transformative journey towards achieving financial success and creating a life of plenty.

The Power of Visualization: Harnessing the Potential of Imagining Wealth to Manifest Prosperity

Introduction: Unlocking the Potential of Visualization

Within the realms of achieving success, a lesser-known yet potent tool awaits those who seek to manifest prosperity: the power of visualization. By tapping into the creative power of the mind, individuals can imagine and immerse themselves in the abundant life they desire, paving the path for the manifestation of success and wealth. Rather than relying solely on external circumstances, visualization allows individuals to reframe their mindset, cultivate a sense of clarity, and align themselves with the abundance they wish to attract.

Mapping Clear Financial Objectives: Sketching the Pathway to Prosperity

In this section, we will delve into the crucial task of setting clear financial goals that pave the way to a prosperous future. By establishing a well-defined roadmap, individuals can steer their financial endeavors towards a successful outcome, propelled by their aspirations for financial stability and abundance.

1. Aligning Aspirations: Identifying personal desires and ambitions is the first step towards creating clear financial objectives. Recognizing the things that truly matter and contribute to a fulfilling life lays the foundation for mapping out the pathway to prosperity.

2. Assessing Current Financial Standing: Conducting an honest evaluation of one's current financial situation is vital to gain a realistic understanding of the starting point. This assessment encompasses various elements such as income, expenses, assets, and debts, providing a comprehensive overview of the existing financial landscape.

- 2.1. Income Analysis: Analyzing sources of income, identifying stable income streams, and assessing possibilities for additional revenue generation.

- 2.2. Expense Evaluation: Evaluating expenses, distinguishing between essential and non-essential expenditures. Identifying areas for potential cost reduction.

- 2.3. Asset Assessment: Determining the value and potential growth of existing assets, such as properties, investments, or valuable possessions.

- 2.4. Debt Examination: Assessing any outstanding debts or financial obligations, developing strategies for debt management, and considering options for debt reduction and elimination.

3. Defining Specific Financial Goals: To navigate towards prosperity, it is essential to define specific financial goals. These objectives can be categorized into short-term, medium-term, and long-term goals, each contributing to the overall financial vision.

- 3.1. Short-term Goals: Setting achievable goals that can be accomplished within a year or less, creating a sense of immediate progress and motivating further financial growth.

- 3.2. Medium-term Goals: Outlining objectives that require a few years to accomplish, involving significant milestones and significant financial achievements along the way.

- 3.3. Long-term Goals: Establishing ambitious goals that span over several years or even decades, encompassing aspirations for financial independence, retirement planning, and creating a lasting legacy.

4. Developing a Strategic Plan: Once financial goals have been established, crafting a strategic plan is crucial for their realization. This plan should outline actionable steps and milestones, utilizing appropriate financial tools and resources to ensure progress towards the desired outcome.

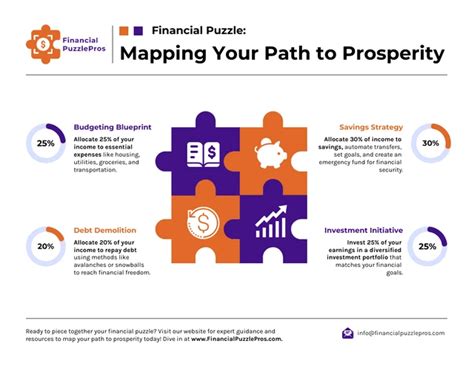

- 4.1. Budgeting: Creating a comprehensive budget that aligns with the defined financial goals, allocating funds accordingly and prioritizing areas that require sustained financial attention.

- 4.2. Saving and Investing: Implementing effective saving strategies and exploring appropriate investment opportunities to grow wealth and secure financial stability for the future.

- 4.3. Debt Management: Formulating a plan to manage and reduce any outstanding debts strategically, minimizing financial burden and freeing up resources for further wealth accumulation.

- 4.4. Regular Evaluation and Adjustment: Continuously evaluating progress towards financial goals, making necessary adjustments to the strategic plan when circumstances change or new opportunities arise.

By following these key steps and constantly reevaluating one's financial objectives, individuals can navigate towards prosperity, molding their dreams of financial abundance into a tangible reality.

Unlocking the Secrets of Wealthy Individuals: Learning from the Habits of the Affluent

Delving into the world of wealth and prosperity, we explore the key practices and behaviors adopted by successful individuals to attain their financial goals. By studying the habits of the rich, we can gain valuable insights into their mindset and strategies, enabling us to unlock the secrets to building our own wealth.

In this section, we will shed light on the lifestyle choices and routines that have contributed to the financial success of affluent individuals. By examining their daily habits, financial management techniques, and investment strategies, we can grasp the underlying principles behind their accumulation of wealth.

To facilitate our understanding, we will draw upon examples from a diverse range of wealthy individuals, including entrepreneurs, investors, and industry leaders. By analyzing their common traits and approaches, we can identify patterns that align with their financial prosperity.

- Goal Setting: One common characteristic among the affluent is their ability to set clear and aspirational goals. By methodically defining measurable targets, they create a roadmap that guides their actions towards financial success.

- Continuous Learning: Successful individuals place great importance on acquiring knowledge and staying updated with market trends. They seize opportunities to expand their financial literacy, seeking out educational resources and networking with like-minded individuals.

- Disciplined Financial Management: Wealthy individuals exhibit disciplined financial habits, including budgeting, tracking expenses, and living within their means. They prioritize saving and investing, making strategic decisions to grow their wealth steadily.

- Diversification of Investments: Instead of relying on a single income stream, wealthy individuals diversify their investments across various asset classes. This strategy helps mitigate risks and optimize returns, ensuring sustainable financial growth.

- Forming Strategic Partnerships: Successful individuals understand the value of collaboration and seek out opportunities to form strategic partnerships. By leveraging the strengths and expertise of others, they enhance their chances of achieving financial success.

By examining these key habits and principles, we can gain a deeper understanding of the strategies employed by wealthy individuals in their pursuit of financial abundance. This knowledge can serve as a guiding light on our own path to financial prosperity, helping us unlock our full potential and achieve our desired level of wealth.

Investing in Knowledge: The Power of Lifelong Learning for Financial Success

In today's dynamic and fast-paced world, achieving financial success requires more than just hard work and luck. It demands a continuous dedication to personal and professional growth. A key factor in attaining financial prosperity is investing in knowledge through lifelong learning.

Continuous learning expands our horizons, equips us with valuable skills, and sharpens our problem-solving abilities. By actively seeking out new knowledge and staying abreast of industry trends and advancements, we position ourselves for greater financial opportunities and success.

- Enhanced Professional Competence: Lifelong learning enriches our professional competence, helping us stay relevant and competitive in an ever-evolving job market. The more we invest in expanding our knowledge and skills, the more confidence and expertise we develop, which can lead to promotions, salary advancements, and new career opportunities.

- Adaptability in a Changing Economy: In a world characterized by rapid technological advancements and economic fluctuations, continuous learning enables us to stay adaptable. Through acquiring new knowledge and understanding emerging trends, we gain the flexibility needed to seize opportunities and navigate through uncertainties, fostering financial growth and resilience.

- Building Valuable Networks: Lifelong learning also provides opportunities to connect with like-minded individuals and experts in various fields. By attending conferences, workshops, and educational programs, we can build invaluable networks that may open doors to collaborations, joint ventures, and access to investments or financial resources.

- Financial Literacy: Investing in knowledge extends beyond industry-specific skills. It also includes developing financial literacy. By understanding personal finance, investing, budgeting, and savings strategies, we gain the necessary tools to make informed financial decisions, mitigate risks, and build a solid foundation for long-term financial success.

- Embracing Innovation: Continuous learning encourages an open mind and promotes innovation. By actively seeking out new knowledge and perspectives, we can identify emerging trends, disruptive technologies, and new markets. This enables us to adapt our strategies, seize innovative business opportunities, and stay ahead of the competition, fostering financial growth and prosperity.

Investing in knowledge through continuous learning is not only a pathway to personal growth and self-fulfillment, but it is also a key driver of financial success. By embracing lifelong learning, we empower ourselves to adapt to an ever-changing world, seize new opportunities, make informed financial decisions, and ultimately achieve our financial goals. So, let us embark on a journey of knowledge acquisition and continuous growth, as we pave the way towards a prosperous future.

Diversifying Income Streams: Maximizing Opportunities for Financial Success

Creating a robust and diverse portfolio of income streams is a vital strategy for individuals seeking to achieve financial prosperity. By spreading out sources of revenue and maximizing opportunities for income generation, individuals can enhance their financial stability, increase their earning potential, and unlock new avenues for success.

Expanding Revenue Sources: Diversifying income streams involves looking beyond traditional employment and exploring various avenues for generating revenue. This can include freelance work, investment income, rental properties, royalties, and entrepreneurship, among others. By expanding the range of revenue sources, individuals can reduce their reliance on a single income stream and capitalize on opportunities that may arise in different sectors or industries.

Maximizing Opportunities: Maximizing opportunities for prosperity involves actively seeking out and capitalizing on income- generating prospects. This may include identifying emerging trends, leveraging personal skills and expertise, pursuing additional education or training, and continuously adapting to market demands. By recognizing and seizing opportunities, individuals can stay ahead of the curve, increase their earning potential, and maximize their overall financial success.

Benefits of Diversification: Diversifying income streams not only mitigates risks associated with relying on a single source of income but also offers numerous other benefits. It can provide financial security during economic downturns, create a buffer against unexpected expenses, open doors for personal and professional growth, and foster a sense of empowerment and independence. Additionally, by diversifying income streams, individuals can optimize their earning potential and unleash the wealth of opportunities that exist in today's dynamic and ever-changing financial landscape.

In conclusion, diversifying income streams is a pivotal pathway to achieving financial success and prosperity. By expanding revenue sources, making the most of opportunities, and reaping the benefits of diversification, individuals can increase their financial stability, enhance their earning potential, and unlock a world of possibilities. Embrace the potential for abundance and seize the opportunities that lie ahead!

Leveraging Technology: Utilizing Digital Tools for Enhancing Financial Growth

Modern advancements in technology have revolutionized the way we approach our financial goals. This section explores how utilizing various digital tools can significantly impact and accelerate the growth of your financial resources.

One of the key advantages of leveraging technology is the access to a plethora of online platforms and applications designed to streamline financial processes. With the click of a button, individuals can now monitor their expenses, track investments, and even automate savings. Such digital tools offer a convenient and efficient way to manage finances, allowing for better control, organization, and optimization of financial resources.

| Benefits of Digital Tools for Financial Growth |

|---|

| 1. Increased Accessibility: Digital tools provide round-the-clock access to financial information and resources, empowering users to make informed decisions and take immediate actions. |

| 2. Improved Financial Analysis: Utilizing digital tools allows for comprehensive financial analysis, enabling individuals to identify patterns, trends, and areas for improvement in their financial strategies. |

| 3. Enhanced Efficiency: By automating tasks such as expense tracking, budgeting, and investment management, digital tools eliminate manual errors and save valuable time, allowing individuals to focus on other important aspects of their financial growth. |

| 4. Real-time Monitoring: With digital tools, individuals can continuously monitor their financial activities, ensuring they stay on track with their goals and promptly adjust their strategies if needed. |

| 5. Seamless Collaboration: Digital platforms enable individuals to collaborate with financial advisors, experts, and peers, fostering an environment for exchanging knowledge and ideas, ultimately contributing to better financial decision making. |

In addition to these benefits, the integration of technology in financial growth also presents some challenges. Privacy and security concerns arise as individuals share sensitive financial information online. It is crucial to select reliable platforms and implement strong security measures to safeguard personal wealth and maintain confidentiality.

In conclusion, leveraging technology through the use of digital tools can significantly augment financial growth by providing accessibility, analysis, efficiency, monitoring, and collaboration. However, it is essential to exercise caution and prioritize privacy and security to ensure a successful and prosperous financial journey.

Resilience in Overcoming Financial Challenges on the Path to Abundance

In this section, we will explore strategies and approaches that can help individuals overcome various financial challenges in their pursuit of prosperity. By developing resilience and adopting effective tactics, individuals can navigate the unpredictable nature of the financial landscape and continue forward on the path to abundance.

One key strategy for overcoming financial challenges is to establish a robust financial foundation. This involves creating a budget, setting financial goals, and effectively managing income and expenses. By understanding one's financial situation and mapping out a plan for growth, individuals can build a solid base that facilitates resilience when faced with unexpected obstacles or setbacks.

Furthermore, it is essential to diversify income streams and investments. Relying on a single source of income can be risky, especially during times of economic uncertainty. By exploring alternative avenues, such as freelancing, entrepreneurship, or investing in diverse asset classes, individuals can create a safety net and increase their chances of achieving long-term financial success.

| Tactic | Description |

|---|---|

| Building an Emergency Fund | By saving a portion of income consistently, individuals can create an emergency fund that serves as a cushion during unexpected financial emergencies. |

| Continuous Learning and Skill Development | Investing in knowledge and constantly honing skills equips individuals with a competitive advantage in the job market, increasing the likelihood of securing higher-paying opportunities. |

| Practicing Frugality | Adopting a frugal lifestyle by identifying and eliminating unnecessary expenses helps individuals save money and ensures financial resources are allocated efficiently. |

| Seeking Professional Advice | Consulting financial advisors or experts can provide individuals with valuable insights and guidance on managing finances and making informed investment decisions. |

Additionally, developing resilience requires individuals to have a positive mindset and a willingness to adapt. Financial challenges are an inevitable part of life, and being able to embrace change, learn from failures, and persist in the face of adversity is crucial. By maintaining a growth mindset, individuals can transform challenges into opportunities for personal and financial growth.

Overall, overcoming financial challenges on the journey towards abundance involves establishing a solid financial foundation, diversifying income streams, and cultivating resilience through continuous learning and adaptation. By implementing these strategies, individuals can navigate the financial landscape with confidence and increase their chances of achieving long-term prosperity.

Giving Back: The Role of Philanthropy in Attaining Genuine Wealth

In the pursuit of true prosperity, one essential element often overlooked is the act of giving back. Philanthropy is not merely an act of generosity; it plays a pivotal role in reaping substantial rewards, both personally and within society as a whole. While achieving financial wealth is a common aspiration, true wealth extends beyond material possessions and into the realm of making a positive impact on others. This section will explore the significance of philanthropy in attaining genuine wealth, examining how acts of giving can enrich our lives and contribute to a more prosperous world.

The Transformational Power of Philanthropy

Philanthropy holds the capacity to transform lives, not just for those in need, but also for those who embrace the spirit of giving. By extending a helping hand to those less fortunate, individuals can experience a sense of fulfillment and purpose that transcends the accumulation of wealth. Through acts of philanthropy, a cycle of empowerment is created, wherein the donations made have ripple effects, uplifting entire communities and creating opportunities for others to thrive.

When a business or individual engages in philanthropy, they not only improve the lives of recipients but also cultivate a sense of unity and compassion within themselves.

Shaping a Legacy of Empathy

Philanthropy enables the creation of a legacy that extends far beyond the accumulation of monetary abundance. By acting as catalysts for positive change, philanthropists leave a lasting impact on society, shaping a more compassionate and empathetic world for future generations. Whether through funding educational initiatives, supporting medical research, or addressing pressing social issues, philanthropists shape their legacy by actively contributing to the betterment of society. By intertwining success with acts of charity, individuals can define their mark on the world and inspire others to follow in their footsteps.

True wealth is not solely measured by the size of one's bank account, but by the enduring impact they have on the lives of others.

Fulfillment Beyond Material Riches

While monetary success can provide comfort and security, it is often the act of giving that brings true fulfillment. Philanthropy allows individuals to experience a deeper sense of purpose and gratitude for the abundance they possess. By supporting causes that align with one's values and passions, philanthropists discover a sense of personal fulfillment that surpasses material possessions. Through the act of giving, individuals not only enhance the lives of others but also cultivate a rich inner life and a deeper appreciation for the joys of generosity.

True wealth comes not just from the acquisition of material riches, but from the joy of sharing one's blessings with others.

As we embark on the journey of pursuing genuine wealth, let us recognize the vital role that philanthropy plays. By embracing an ethos of giving back, we can create a world where success is measured not just by personal gain but by the positive impact we make in the lives of others. Through acts of philanthropy, we can achieve a state of true prosperity, where the abundance we accumulate is shared, cherished, and used to create a better future for all.

Living a Balanced Life: Finding Happiness and Fulfillment Beyond Material Success

In our pursuit of prosperity, it is easy to become consumed by material wealth and success. However, true happiness and fulfillment lie in living a balanced life that extends far beyond the accumulation of wealth. This section explores the importance of finding happiness in experiences, relationships, personal growth, and contributing to society.

Cultivating Meaningful Relationships While financial success can provide a sense of security, it is the quality of our relationships that truly brings us joy and fulfillment. Investing time and effort into building and nurturing meaningful connections with family, friends, and loved ones enriches our lives and enhances our overall well-being. | Discovering Personal Growth Material success may satisfy our external desires, but personal growth fuels our inner fulfillment. Continuously exploring new interests, acquiring knowledge and skills, and challenging ourselves intellectually and emotionally allows us to develop into the best version of ourselves and find deeper satisfaction in life. |

Finding Happiness in Experiences While material possessions provide temporary pleasure, lasting happiness is often found in the experiences we have. Engaging in activities that bring us joy, whether it's traveling, pursuing hobbies, or engaging in new adventures, expands our horizons and provides a sense of fulfillment that no amount of wealth can match. | Serving and Contributing to Society Beyond accumulating wealth, true fulfillment stems from making a positive impact on the lives of others and the world around us. By being of service to our community, helping those in need, and contributing to meaningful causes, we can find purpose and a sense of fulfillment that goes far beyond material success. |

In conclusion, while pursuing material success is important, it is equally crucial to prioritize and develop other aspects of our lives that contribute to long-term happiness and fulfillment. By nurturing relationships, seeking personal growth, enjoying experiences, and giving back to society, we can find a balance that surpasses the temporary pleasures of material abundance.

FAQ

Why is achieving success important for people?

Achieving success is important for people because it gives them a sense of accomplishment, pride, and fulfillment. It allows individuals to reach their full potential and live a life of abundance and prosperity.

What are some strategies for achieving success?

There are several strategies for achieving success. Firstly, setting clear goals and creating a plan of action can help individuals stay focused and motivated. Secondly, cultivating a positive attitude and mindset is crucial for overcoming obstacles and setbacks. Additionally, continuously learning and acquiring new skills can enhance one's chances of success. Lastly, building a strong network of supportive individuals can provide guidance and opportunities for growth.

How can one maintain abundance and prosperity in their life?

Maintaining abundance and prosperity requires a combination of mindset, habits, and actions. It involves practicing gratitude and embracing an abundance mentality, focusing on opportunities rather than limitations. Developing good financial habits, such as budgeting, saving, and investing, can also contribute to long-term prosperity. Furthermore, taking care of one's physical and mental well-being is essential for sustaining abundance and success.

Is it possible to achieve success without encountering failures?

No, it is highly unlikely to achieve success without encountering failures. Failures are inevitable on the path to success as they provide valuable learning experiences and help individuals grow. Each failure presents an opportunity for reflection, self-improvement, and gaining resilience.

What are some common obstacles that hinder success?

There are various obstacles that can hinder success. Some common ones include fear of failure or rejection, self-doubt, lack of motivation or discipline, negative mindset, and external challenges such as financial constraints or limited resources. However, with determination and perseverance, these obstacles can be overcome.

How can I achieve success and abundance in my life?

Achieving success and abundance in life requires a combination of hard work, determination, and the right mindset. It is important to set clear goals for yourself and take consistent action towards achieving them. Surrounding yourself with positive and like-minded individuals can also help in creating a supportive network. Additionally, maintaining a positive attitude, practicing gratitude, and visualizing your success can contribute to achieving abundance in all areas of life.