Within the realm of wishes, aspirations, and unspoken desires, lies the yearning for a place to call one's own, where the heart finds solace and cherished memories are etched in time. This captivating quest for the ideal abode embodies a reflective journey, where individuals seek the harmonious convergence of their dreams and practicality, blending aspirations with attainability, and emotions with rationality. The pursuit of a dwelling that encapsulates one's essence, preferences, and individuality is a captivating endeavor that calls for discernment, resourcefulness, and perseverance.

Embarking upon this odyssey of identifying the perfect living space entails delving deep into the depths of one's desires and envisioning a sanctuary that resonates with their very core. It necessitates a profound understanding of oneself - a recognition of the desires that fuel their spirit, the sanctuary that ignites their inner glow, and the backdrop that shall bear witness to their unfolding journey. Considerations may range from architectural marvels that evoke a sense of awe to cozy nooks that exude warmth, from contemporary masterpieces that push boundaries to rustic retreats that celebrate simplicity.

Throughout this unwavering pursuit, it is crucial to grasp the harmony between one's aspirations and the practicalities of real estate, to navigate the vast sea of possibilities with grace and determination. Comprehending the numerous facets that shape the quest for the perfect dwelling, such as budgetary constraints, preferred location, and desired features, empowers individuals to make informed decisions and ensures that every inch of their future abode aligns harmoniously with their hearts' desires. It is a dance of practicality and passion, where dreams manifest into tangible realities and the walls echo with the whispers of fulfillment and contentment.

Unveiling the path towards uncovering a true haven demands an exploration of the resources and strategies available to aid in this transformative journey. From engaging the expertise of seasoned real estate agents to diligently scouring online platforms and local listings, the search for the perfect dwelling requires a tenacious spirit and a wide-ranging toolkit. By embracing these invaluable tools, individuals embark upon a quest fueled by resolve, intricate choices, and an unwavering belief that their dream habitat is not merely a figment of their imagination, but an imminent reality waiting to be unraveled.

Determining Your Needs and Priorities

Understanding your desires and setting your priorities are key elements in the quest for the ideal living space. By evaluating your individual needs and considering important factors, you can embark on a successful search for a home that fulfills your unique requirements.

| Factors to Consider | Description |

|---|---|

| Location | Assess the preferred geographic area or neighborhood where you want to live. Consider proximity to work, schools, amenities, and transportation. |

| Size | Determine the appropriate square footage for your future home. Consider the number of bedrooms, bathrooms, and living spaces required to accommodate your lifestyle. |

| Layout | Consider the architectural design that suits your preferences. Evaluate the flow of rooms, the amount of natural light, and the overall functionality of the layout. |

| Condition | Decide on the level of renovation or maintenance you are willing to undertake. Assess the present condition of the property and weigh it against your budget and abilities. |

| Features | Identify the desirable features and amenities that are important to you. This can include a backyard, garage, swimming pool, or specific appliances or fixtures. |

| Price | Establish a realistic budget and determine the price range you are comfortable with. Consider mortgage or financing options and be mindful of additional costs such as property taxes and maintenance fees. |

By carefully considering and prioritizing these factors, you can narrow down your search and increase the likelihood of finding a home that aligns with your lifestyle and preferences. Keep in mind that compromising on certain aspects may be necessary, but with a clear understanding of your needs, you can make informed decisions and find a place to call your own.

Understanding your Housing Requirements

Exploring and comprehending your housing needs is an essential step in the journey of discovering a home that aligns with your desires and lifestyle. By gaining a thorough understanding of what you truly require in a dwelling, you can effectively narrow down your options and find a house that fulfills your unique preferences.

When delving into the process of understanding your housing requirements, it is crucial to reflect on various aspects of your life to determine what is truly important to you. Consider factors such as the size of the property, the number of bedrooms and bathrooms needed, and the overall layout and functionality that will accommodate your daily routines and activities.

Furthermore, assess your personal style and aesthetic preferences in order to find a house that aligns with your taste. Pay attention to architectural styles, interior design possibilities, and any specific features or amenities that you deem crucial for enhancing your living experience.

Aside from physical attributes, take into account the location and neighborhood of your prospective home. Reflect on the proximity to essential facilities such as schools, hospitals, markets, and recreational areas. Additionally, consider the accessibility to transportation options and the overall safety and security of the area.

Another crucial aspect to consider is your budget and financial capabilities. Evaluate your affordability and identify the potential mortgage or rental expenses that you can comfortably manage. This will ensure that you find a home that not only meets your requirements but also fits within your financial means.

By diligently understanding and evaluating your housing requirements, you will be equipped with the knowledge and clarity needed to efficiently navigate the search for your dream home. Taking the time to consider all the essential aspects will increase your chances of finding a house that perfectly suits all your needs, creating a harmonious environment where you can truly thrive.

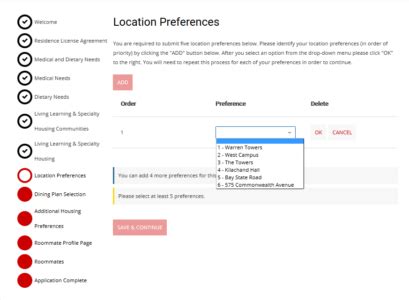

Identifying your Location Preferences

One crucial aspect when searching for the ideal abode is determining your specific location preferences. This section will enlighten you on the fundamental factors to consider that will help you uncover your perfect dwelling spot.

Setting a Realistic Budget

When it comes to finding your ideal living space, it is essential to establish a practical and attainable budget. Having a clear understanding of your financial limitations will help guide your search for a home that aligns with your needs and desires.

One of the first steps in setting a realistic budget is to evaluate your current financial situation. Take stock of your income, savings, and any outstanding debts or financial obligations. This will give you a clear picture of how much you can comfortably allocate towards housing expenses.

- Consider your monthly income: Calculate your net income after deducting taxes and other necessary expenses.

- Evaluate your monthly expenses: Take note of your regular bills, such as utilities, groceries, transportation, and any recurring payments.

- Assess your savings: Determine how much you have saved for a down payment and other potential costs associated with purchasing a home.

- Account for other financial obligations: Factor in any existing debts, such as student loans or car payments, that will impact your monthly budget.

Once you have a clear understanding of your financial situation, it's important to consider the additional costs associated with homeownership. This includes property taxes, insurance, maintenance, and potential renovations or repairs.

With your financial overview in mind, you can start researching the housing market to find homes that fall within your budget range. Keep in mind that it's essential to be realistic and practical in your search. While it's important to have a vision for your dream home, it's equally important to find a house that you can comfortably afford.

In conclusion, setting a realistic budget is a crucial step towards finding your dream home. By taking stock of your financial situation, considering additional homeownership costs, and being practical in your search, you can ensure that you find a home that meets both your needs and your financial capabilities.

Evaluating Your Financial Situation

In this section, we will explore examining your financial circumstances to determine your affordability for a potential residence. Understanding your financial position is crucial when embarking on the journey of finding a place that meets your requirements, preferences, and financial goals.

Assessing your monetary status: It is vital to evaluate your current financial status before making any decisions about purchasing a property. This involves taking an honest look at your income, expenses, savings, and outstanding debts. By assessing these factors, you can establish a clear picture of your financial capabilities and determine a realistic budget for your dream home.

Analyzing your creditworthiness: Another crucial element of evaluating your financial situation is assessing your creditworthiness. A good credit score is an essential factor that lenders consider when approving mortgages or loans. By obtaining a copy of your credit report and reviewing it thoroughly, you can identify any discrepancies or issues that may affect your ability to secure financing for your dream house. Additionally, taking steps to improve your credit score can enhance your chances of obtaining favorable terms and conditions.

Setting your financial goals: Before embarking on a house hunt, it is essential to define your financial goals. Determining the extent of your long-term financial commitments, such as saving for retirement or other significant expenses, will help you assess how much you can comfortably afford to allocate towards purchasing a home. Having clear financial goals will guide you in making informed decisions and ensure that your dream house aligns with your broader financial plans.

Considering additional costs: Evaluating your financial situation should also involve considering additional expenses related to homeownership. These may include property taxes, insurance, maintenance costs, and any hidden fees associated with buying a house in your desired location. Factoring in these expenses will provide you with a more accurate understanding of the overall costs and affordability of your dream home.

In conclusion, evaluating your financial situation is a critical step before embarking on the quest for your dream house. Taking the time to assess your monetary status, creditworthiness, financial goals, and additional costs will provide you with a solid foundation for making informed decisions about purchasing a home that is not only ideal but within your financial means.

Calculating Affordability Factors

In order to make your dreams of finding the ideal home a reality, it is essential to consider various factors that determine the affordability of a property. By conducting a thorough assessment of these elements, you can ensure that you are making a wise financial decision.

One of the key factors to consider when evaluating the affordability of a potential home is your personal financial situation. This includes assessing your monthly income, expenses, and overall financial stability. By understanding your financial limits, you can determine the maximum amount you can afford to spend on a house and avoid overextending yourself.

Another essential consideration is the current market conditions. Monitoring the real estate market and understanding trends in pricing is crucial in determining whether a property is reasonably priced. Factors such as the location, demand, and competition can all impact the affordability of a house. It is important to conduct research and consult with professionals to gauge the market value and avoid overpaying for a property.

In addition to the financial and market factors, it is necessary to examine the costs associated with owning a home beyond the purchase price. These costs include property taxes, insurance, maintenance, and utilities. Assessing these expenses will give you a comprehensive understanding of the ongoing financial commitments that come with homeownership.

Furthermore, it is essential to consider your future financial goals and plans. Evaluating your long-term financial objectives, such as saving for retirement or education costs, can help determine the amount you can comfortably allocate towards housing expenses. This forward-thinking approach will ensure that your dream home aligns with your overall financial strategy.

Calculating affordability factors requires a meticulous analysis of your personal financial situation, the current market conditions, ongoing expenses, and future financial goals. By considering these key elements, you can make an informed decision that will lead you to discover a home that not only meets your dreams but also aligns with your financial well-being.

FAQ

What are some tips for finding my dream house?

When it comes to finding your dream house, there are several tips that can help. First, make a list of your must-haves and prioritize them. Consider factors such as location, size, layout, and features. Second, work within your budget and get pre-approved for a mortgage if needed. Third, hire a real estate agent who specializes in the area you are interested in. They can provide valuable guidance and help you find the perfect home. Lastly, be patient and take your time. Finding your dream house may take some time, but it's worth the effort.

Should I focus on the location or the features of a house?

Both the location and the features of a house are important considerations. The location determines the amenities and services nearby, accessibility to transportation and schools, and property value. On the other hand, the features of a house determine its comfort and functionality. It is recommended to find a balance between the two. Focus on finding a house in a desirable location that also has the features you need and want in a dream home.

How can I determine the appropriate budget for my dream house?

Determining an appropriate budget for your dream house is crucial. Start by evaluating your financial situation, including your income, expenses, and savings. Consider how much you can afford for a down payment, monthly mortgage payments, and other costs such as maintenance and utility bills. It's advisable to consult with a financial advisor or a mortgage lender who can provide guidance on what you can realistically afford. Taking these factors into account will help you set a budget that ensures you can comfortably afford your dream home.

Is it necessary to hire a real estate agent when looking for a dream house?

While not mandatory, hiring a real estate agent can be extremely beneficial when looking for your dream house. Real estate agents have access to a wide range of properties and can provide valuable insights on the local market. They can help you narrow down your search based on your preferences, negotiate offers, handle paperwork, and guide you through the entire homebuying process. Their expertise can save you time, stress, and potentially money. Ultimately, the decision to hire a real estate agent depends on your individual needs and preferences.

How long does it typically take to find a dream house?

The time it takes to find a dream house can vary greatly depending on several factors. These factors include the current real estate market conditions, availability of properties that meet your criteria, and the effort you put into your search. Some people are fortunate to find their dream house within a few weeks, while others may take months or even longer. It's important to be patient and persistent in your search, as finding the perfect home often requires time and effort.