In our journey through life, we often come across profound desires to contribute meaningfully to the well-being of others. One such aspiration that resonates within many is the notion of extending a helping hand in the form of lending money. The act of providing financial support can act as a catalyst, empowering individuals to realize their untapped potential and achieve their goals.

However, the path to fulfilling this dream is a multifaceted one that requires thoughtful consideration and careful planning. It necessitates a profound understanding of the intricacies surrounding lending, as well as a keen awareness of the impact it can have on both the lender and the borrower. This article serves as a compass, guiding you through the labyrinth of lending, and illuminating the essential steps to take in order to actualize your desire of assisting others financially.

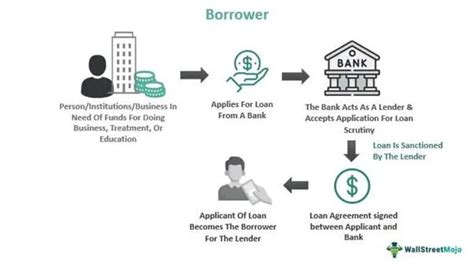

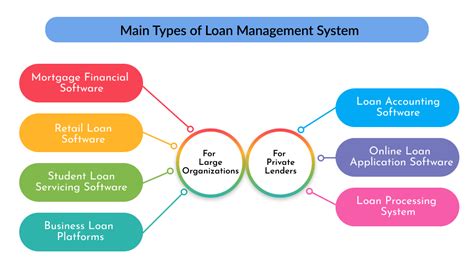

Strengthening your knowledge about the lending landscape is the initial crucial step towards becoming a reliable and effective provider of financial aid. Familiarize yourself with the diverse array of lending options, ranging from traditional bank loans to peer-to-peer lending platforms. Understanding the advantages and disadvantages of each avenue empowers you to select the most suitable approach for your unique circumstances.

Equally important is cultivating a comprehensive comprehension of the legal and regulatory frameworks that govern lending activities. This knowledge will safeguard both you and the borrower, ensuring that all transactions are conducted within the confines of the law. Researching applicable rights and obligations is paramount to navigate potential pitfalls, guarantee the protection of everyone involved, and set the stage for a successful lending experience.

Identifying the Suitable Borrower:

When considering lending money to someone, it is crucial to identify the most suitable borrower for your financial assistance. Finding the right person to lend money to requires careful evaluation and consideration of various factors.

1. Evaluate the Borrower's Financial Stability:

- Analyze the individual's income and employment history to determine their financial stability.

- Consider their credit history and credit score to assess their ability to repay the loan.

- Examine their existing debts and financial obligations to ensure they have the capacity to handle additional borrowing.

2. Assess the Borrower's Trustworthiness:

- Verify the borrower's personal information, including their identity, address, and contact details.

- Consider their reputation and reliability based on past interactions and feedback from others.

- Ensure the borrower has a genuine need for the loan and is not involved in any fraudulent activities.

3. Understand the Purpose of the Loan:

- Discuss and comprehend the borrower's intention for borrowing money.

- Evaluate the viability and potential returns of the borrower's planned use of the funds.

- Make sure the loan aligns with the borrower's long-term financial goals and aspirations.

4. Establish Clear Loan Terms and Agreements:

- Define the loan amount, interest rate, repayment period, and any additional conditions.

- Discuss and negotiate terms that are mutually beneficial and fair for both parties involved.

- Document the agreement in writing and have it legally reviewed, if necessary, to protect both parties' interests.

By rigorously assessing potential borrowers based on their financial stability, trustworthiness, purpose of the loan, and establishing clear loan terms and agreements, you can ensure that you lend money to deserving individuals who are likely to fulfill their obligations effectively.

Setting Financial Goals for Assisting Others with Loans:

Creating clear and realistic financial goals is an essential step towards fulfilling your aspiration of offering financial support through lending. By establishing measurable objectives, you can effectively plan and monitor the progress of your lending activities, enabling you to assist individuals or organizations in need.

- Identify the Purpose: Determine the specific reasons why you want to lend money to others. Whether it is to aid friends, family members, or invest in small businesses, clarifying your purpose helps shape your lending goals.

- Calculate Your Capabilities: Assess your financial resources and analyze how much you can afford to lend without jeopardizing your own financial stability. Consider factors such as your income, savings, and potential risks associated with lending.

- Set a Budget: Establish a budget for your lending activities to effectively allocate your funds. This includes determining the maximum amount you are willing to lend per person or project, as well as setting a timeframe or limit for lending.

- Outline Repayment Terms: Clearly define the terms and conditions for loan repayment, such as interest rates, payment schedule, and any penalties for late or missed payments. Ensure that the terms are fair and transparent for both parties involved.

- Create a Monitoring System: Develop a system to track and evaluate the progress of your loans. This can involve maintaining records of each loan, tracking repayment schedules, and regularly reviewing the financial status of borrowers to ensure successful lending outcomes.

- Consider Diversification: Explore various lending options and diversify your lending portfolio to minimize risks. This can include lending to different types of borrowers or investing in diverse areas such as microloans, education, or healthcare.

- Seek Professional Advice: Consult with financial experts or seek guidance from professionals experienced in lending and investments. Their knowledge and expertise can provide valuable insights into implementing effective lending strategies and managing potential risks.

By setting financial goals and following a well-defined plan, you can make a meaningful impact on the lives of others by providing them with the necessary financial assistance through lending.

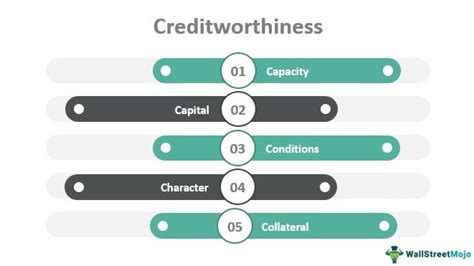

Assessing the Borrower's Creditworthiness:

When considering lending money to someone, it is crucial to assess the borrower's creditworthiness diligently. Evaluating their financial capability and trustworthiness enables you to make an informed decision that aligns with your own financial goals and ensures the safe return of your funds. Taking the time to assess the borrower's creditworthiness provides you with valuable insights into their past money management habits, current financial situation, and potential ability to repay the loan in a timely manner.

Credit History and Score:

One of the essential factors to consider when assessing a borrower's creditworthiness is their credit history and score. A credit history reveals the borrower's previous loan and payment records, demonstrating their commitment to meeting financial obligations. Additionally, a credit score provides a numerical representation of the borrower's creditworthiness, reflecting their credit risk level based on various factors such as payment history, outstanding debts, and credit utilization.

Income and Employment Stability:

Analyze the borrower's income sources and assess its stability. A steady and reliable income demonstrates the borrower's capacity to generate consistent funds for repaying the loan. Evaluating their employment history can shed light on their job stability, as frequent job changes may indicate a higher risk of financial instability. Notably, assessing the borrower's income-to-debt ratio can help determine if they have sufficient disposable income to cover loan repayments comfortably.

Debt-to-Income Ratio:

Examining the borrower's debt-to-income ratio is crucial in assessing their creditworthiness. This ratio compares the borrower's total monthly debt payments to their monthly gross income. A high debt-to-income ratio indicates a higher financial burden and may signify a decreased ability to handle additional loan repayments. Understanding the borrower's current debt load helps gauge their ability to manage additional financial obligations and make timely repayments.

Additional Factors:

While credit history, income stability, and debt-to-income ratio are vital indicators of creditworthiness, it is also essential to consider any additional factors that may affect the borrower's financial situation. For instance, evaluating their savings and investments can provide insight into their financial preparedness for unforeseen circumstances. Additionally, reviewing their spending habits and financial discipline can help assess whether they are likely to prioritize loan repayments.

Conclusion:

Assessing the borrower's creditworthiness requires a comprehensive analysis of various factors such as credit history, income stability, debt-to-income ratio, and additional financial aspects. By considering these factors, you can minimize the risk associated with lending money and increase the likelihood of a successful loan agreement. Remember, lending money involves careful evaluation and ensuring that the borrower possesses the necessary financial capabilities to fulfill their repayment obligations.

Determining the Loan Terms and Conditions:

Establishing and finalizing the loan terms and conditions is a crucial step in the process of lending money to someone. This section will guide you on how to effectively determine the specific details and requirements that will govern your lending agreement.

When determining the loan terms and conditions, it is important to consider various factors to ensure a fair and mutually beneficial arrangement. Firstly, you need to define the loan amount, which refers to the specific sum of money you are willing to lend. This can be influenced by multiple factors, including the borrower's financial needs, the purpose of the loan, and your own financial capacity.

Additionally, you should establish the interest rate, which is the percentage that will be charged on the loan amount as compensation for lending your money. It is essential to find a balance between a reasonable interest rate that reflects the risk involved in lending and a rate that the borrower can reasonably afford to repay.

Furthermore, you must determine the repayment schedule, which outlines the timeline and frequency of loan payments. This schedule should take into account the borrower's financial circumstances and provide a reasonable timeframe for repayment. Additionally, you may want to establish consequences for late or missed payments to protect your interests.

The loan agreement should also outline the collateral, if any, that the borrower is required to provide as security for the loan. Collateral can be in the form of assets such as property or vehicles, and serves as a guarantee that you will be repaid in the event that the borrower defaults on their obligations.

In addition to these key terms, it is important to clearly define any additional conditions or clauses that you deem necessary. This may include requirements for insurance, penalties for early repayment, or provisions for loan modification under certain circumstances.

Ultimately, determining the loan terms and conditions involves careful consideration and negotiation to ensure a fair and mutually beneficial agreement. It is essential to communicate openly and transparently with the borrower to establish clear expectations and avoid potential misunderstandings or conflicts in the future.

Utilizing Legal Contracts and Documentation:

Effectively managing lending transactions requires the use of appropriate legal contracts and comprehensive documentation. By ensuring that all financial agreements are properly documented, both lenders and borrowers can protect their interests and minimize the risk of disputes or misunderstandings.

One essential document in the lending process is the loan agreement, which defines the terms and conditions of the loan. This legally binding contract establishes the rights and obligations of both parties, including the loan amount, repayment schedule, interest rates, and any additional fees or penalties.

In addition to the loan agreement, lenders may also choose to use promissory notes, which are written promises to repay a specific amount of money on agreed terms. Promissory notes provide additional legal protection and can be used as evidence of the debt in case of default or legal action.

When lending to someone, it is crucial to conduct proper due diligence to assess the borrower's creditworthiness and ability to repay the loan. This involves obtaining and reviewing the borrower's financial statements, credit reports, and other relevant documentation.

Furthermore, lenders may consider using collateral agreements to secure the loan. Collateral agreements establish a legal claim on specific assets owned by the borrower, such as property, vehicles, or valuable possessions. By having collateral in place, lenders have a source of repayment if the borrower fails to fulfill their obligations.

To ensure legality and compliance with applicable regulations, it is advisable for both parties to seek legal advice when drafting and executing lending contracts. This can help identify potential pitfalls, ensure adherence to local laws, and provide guidance on how to handle specific situations, such as default or early repayment.

In conclusion, utilizing legal contracts and comprehensive documentation is paramount when fulfilling the dream of lending money to someone. By employing loan agreements, promissory notes, conducting due diligence, and considering collateral agreements, lenders can protect their interests and mitigate risks associated with lending. Seeking professional legal advice further enhances the transaction's legality and ensures compliance with relevant laws and regulations.

Establishing Effective Communication Channels:

In order to successfully support others financially and bring their aspirations to life, it is paramount to establish effective communication channels. Building strong and reliable lines of communication is essential for fostering understanding, trust, and transparency between the lender and the borrower.

Establishing Trustworthy Lines of Communication:

The foundation of any successful lending relationship lies in establishing trustworthy lines of communication. It is crucial to create an environment where both parties feel comfortable expressing their needs, concerns, and expectations openly and honestly. By cultivating an atmosphere of trust, borrowers will feel assured that their dreams are being understood and supported by the lender.

Promoting Transparent and Open Dialogue:

Transparent and open dialogue enables the lender and borrower to have a clear understanding of each other's objectives and limitations. By encouraging open communication, potential obstacles can be addressed and potential solutions can be discussed. This can lead to a shared understanding of financial terms, repayment conditions, and other important aspects of the lending process.

Utilizing Multiple Communication Channels:

Effective communication goes beyond traditional methods such as phone calls or face-to-face meetings. Utilizing various communication channels, such as email, messaging apps, or video conferencing, can provide flexibility and convenience for both parties involved. It is important to adapt to the borrower's preferences and leverage technology to foster efficient and convenient communication.

Active Listening and Empathy:

The ability to actively listen and empathize with the borrower's needs and concerns is critical for establishing effective communication channels. By truly understanding the borrower's aspirations, challenges, and financial situation, lenders can offer personalized guidance and support. This level of empathy can enhance the overall lending experience and strengthen the bond between the lender and borrower.

Regular Updates and Progress Reports:

Keeping borrowers informed about the progress of their loan application and the status of their finances is crucial for maintaining a healthy lending relationship. Regular updates and progress reports ensure that both parties are on the same page and can address any emerging issues promptly. This level of transparency fosters trust and reassures borrowers that their dreams and financial well-being are being taken seriously.

Managing and Monitoring the Loan:

Once you have successfully provided assistance to a borrower, it is crucial to establish effective strategies for managing and monitoring the loan. This ensures that the lending process remains smooth and both parties are satisfied with the arrangement.

- Set clear expectations: Establish a comprehensive agreement that outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and consequences for late payments.

- Maintain open communication: Regularly communicate with the borrower to address any concerns, clarify any misunderstandings, and provide guidance if needed. This helps to build trust and enhances the overall borrower-lender relationship.

- Create a repayment plan: Work with the borrower to develop a realistic repayment plan that suits their financial capabilities. Consider factors such as their income, expenses, and other obligations, while ensuring that the loan will be repaid in a timely manner.

- Track repayments: Keep a record of all repayments received from the borrower. This can be done through manual tracking or by utilizing loan management software or apps. By monitoring the repayment progress, you can identify any potential issues and take appropriate action.

- Offer support: If the borrower faces financial difficulties or challenges with repayment, consider offering guidance and support. Explore options such as adjusting the repayment schedule, providing loan extensions, or offering financial counseling to help them overcome obstacles.

- Enforce consequences: In case of persistent delinquencies, it may be necessary to enforce the consequences outlined in the loan agreement. This can include charging late fees, reporting delinquencies to credit bureaus, or engaging legal measures as a last resort.

Managing and monitoring the loan is essential to ensure a successful and mutually beneficial lending experience. By establishing clear expectations, maintaining open communication, creating a repayment plan, tracking repayments, offering support, and enforcing consequences when necessary, you can effectively manage and monitor the loan while safeguarding your interests as a lender.

FAQ

What are the steps to fulfill my dream of lending money to someone?

The first step is to have a clear plan and set a budget for the amount you are willing to lend. Next, find someone trustworthy and reliable who is in need of financial assistance. Communicate openly about the terms and conditions of the loan, including repayment plans and any interest involved. Lastly, document the agreement in writing to protect both parties and ensure a smooth lending process.

Is it possible to lend money to a friend or family member without straining the relationship?

Yes, it is possible if you approach the situation with caution and set clear expectations from the beginning. It is important to treat the loan as a formal transaction and outline the terms and conditions in a written agreement. Open and honest communication is key throughout the process, and both parties should be respectful of the agreed-upon repayment plan. By maintaining transparency and keeping the lines of communication open, you can minimize potential strain on the relationship.

What are some potential risks of lending money to someone?

When lending money to someone, there are a few potential risks to consider. One risk is the possibility of not being repaid on time or at all. This can strain the relationship and create financial difficulties for the lender. Another risk is the potential for misunderstandings or disagreements regarding the terms of the loan. It is essential to have a written agreement in place to resolve any disputes. Additionally, lending money can have legal and tax implications, so it is advisable to consult with a professional for guidance and to ensure compliance with applicable laws.