In the realm of personal desires and aspirations, few things captivate the human imagination quite like the allure of acquiring that which represents value and wealth. The pursuit of physical currency, a symbol of economic power and financial freedom, has long been a source of fascination for individuals across different cultures and generations.

It is within this realm of yearning that one can find a plethora of strategies and pathways to explore, each offering unique opportunities to transform dreams into tangible reality. This article delves into the captivating world of acquiring paper currency, providing you with insightful approaches that can help you navigate and conquer this elusive pursuit.

Embark on a journey where the boundaries of imagination and possibility are stretched, and where the acquisition of paper currency serves as a vessel to fulfill your deepest ambitions. With a blend of cunning, creativity, and perseverance, these strategies maximize your chances of obtaining an impressive collection of monetary treasures.

Diversify Your Investments: Include Paper Currency in Your Investment Portfolio

Expand your investment options by considering the inclusion of paper currency in your portfolio. By diversifying into this unique asset class, you can unlock new opportunities for growth and stability while ensuring a balanced and well-rounded investment strategy.

Enhance Stability:

Integrating paper currency into your investment portfolio can provide added stability, as it is considered a reliable and established form of legal tender. As financial markets fluctuate and economic conditions evolve, paper currency can serve as a secure anchor for your overall investment portfolio.

Protect Against Inflation:

By including paper currency in your investment mix, you can potentially safeguard your wealth against inflationary pressures. As the value of traditional assets fluctuates, certain currencies may retain their value or even appreciate, acting as an effective hedge against the erosive effects of inflation.

Diversify Geographically:

Exploring paper currency investments allows you to diversify geographically, spreading your risk across various economies and regions. By allocating funds across different currencies, you can reduce the impact of localized economic downturns and potentially benefit from the strength and stability of different monetary systems.

Take Advantage of Foreign Exchange:

Investing in paper currency allows you to tap into the vast foreign exchange market and potentially profit from currency fluctuations. By carefully monitoring currency trends and making strategic investments, you can seize opportunities for capital appreciation and generate returns through the buying and selling of currencies.

Consider Collectible Banknotes:

If you have an interest in history or enjoy collecting unique items, including collectible banknotes in your investment portfolio can add an additional layer of diversification. These rare and valuable banknotes often appreciate over time and can offer both financial and aesthetic satisfaction.

Remember, before embarking on any investment strategy, it is crucial to conduct thorough research, consider your risk tolerance, and consult with a qualified financial advisor. By diversifying your investments to include paper currency, you can potentially achieve a well-rounded portfolio and maximize your wealth-building potential.

Understanding the Advantages of Possessing Currency Notes

Exploring the numerous merits associated with owning physical currency is paramount in comprehending the value and allure it holds. By delving into these advantages, individuals can gain a deeper understanding of the significance it can bring to their financial stability and everyday life.

One of the primary advantages of possessing paper money is its universal acceptance. Currency notes are recognized and utilized worldwide, enabling individuals to freely engage in transactions across borders. This feature eliminates the need for currency conversion and facilitates seamless transactions, making it an essential tool for international travelers and businesses.

In addition to its global recognition, owning physical money offers a tangible representation of wealth. Holding currency notes in one's hand can provide a sense of security and reassurance, as the value of the money is immediately visible and accessible. Unlike digital currency or electronic transactions, physical money allows individuals to physically monitor and manage their financial situation, minimizing the risk of fraud or unauthorized access to funds.

Furthermore, possessing paper money encourages responsible spending habits. Unlike digital forms of payment that are often associated with impulsive buying and excessive debt, physical currency promotes conscious decision-making. The act of physically handing over money during a transaction requires individuals to evaluate the value of the purchase, fostering a more mindful approach towards expenses.

Last but not least, physical money holds historical and cultural significance. Currency notes are often representative of a nation's heritage, featuring iconic symbols, esteemed individuals, and artistic elements. Collecting and owning currency notes can be an engaging and educational hobby, allowing individuals to gain insight into the rich history and culture associated with different societies.

In conclusion, the advantages of possessing paper money extend beyond its monetary value. Understanding the benefits of physical currency helps individuals appreciate its universal acceptance, tangible nature, promotion of responsible spending, and historical significance. By recognizing these advantages, individuals can make informed decisions regarding their financial preferences and goals.

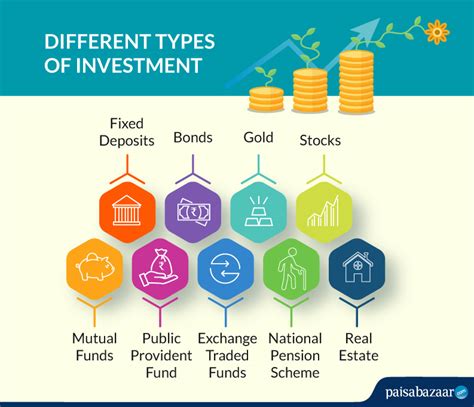

Exploring Different Types of Currency Investments

In this section, we will delve into the diverse range of opportunities available for investing in various forms of currency. By exploring the world of paper money investments, individuals can achieve their financial aspirations and expand their portfolios without relying solely on traditional investment options.

| Type of Currency | Description | Potential Benefits |

|---|---|---|

| Fiat Currency | Fiat currency refers to legal tender issued by a government that does not have inherent value but is widely accepted as a medium of exchange. Investing in fiat currency can provide stability and liquidity. | Preservation of wealth, ease of transaction, stability in economic fluctuations |

| Commemorative Currency | Commemorative currency includes limited edition banknotes or coins issued to celebrate special events or honor notable figures. Investing in commemorative currency can offer collectors' value and potential appreciation. | Collectible value, potential appreciation, unique historical significance |

| Obsolete Currency | Obsolete currency refers to money that is no longer in circulation. Investing in obsolete currency can be appealing to collectors and historians due to its rarity and historical context. | Rarity, historical significance, potential appreciation |

| Foreign Currency | Foreign currency involves investing in the legal tender of other countries. This type of investment can provide diversification and potential gains from currency exchange rate fluctuations. | Diversification, potential gains from currency exchange rate fluctuations |

| Specimen Currency | Specimen currency consists of samples or test notes that are often used for promotional or educational purposes. Investing in specimen currency can offer unique and limited edition collectibles. | Unique collectibles, limited edition, potential appreciation |

By exploring the different types of paper money investments, individuals can discover exciting avenues to diversify their investment portfolios and potentially achieve favorable returns. Whether investing in fiat currency for stability or delving into the realm of commemorative or obsolete currency for their collectible value, paper money investments offer a wide range of possibilities to fulfill financial goals and aspirations.

Tips for Developing a Successful Investment Portfolio in Currency

Creating a strong and profitable investment portfolio in currency requires careful planning and strategic decision-making. By diversifying your investments and staying informed about market trends, you can maximize your chances of achieving success in the world of paper money valuation.

- Research Different Currencies: One of the fundamental steps in building a successful investment portfolio in currency is to thoroughly research and understand the different currencies available for investment. Investigate the historical performance, current trends, and the economic stability of various currencies to make informed investment decisions.

- Embrace Diversification: Diversification is key to reducing risk and increasing the potential for returns in your investment portfolio. Spread your investments across different currencies, so that if one currency experiences a downturn, your overall portfolio will remain stable.

- Stay Updated with Global Economic News: Keep track of economic news and events happening around the world as they can significantly impact the value of currencies. Subscribe to financial news sources and follow economic indicators to stay informed about factors that could influence your investment portfolio.

- Monitor Central Bank Policies: Central bank policies, such as interest rate decisions and quantitative easing measures, can have a direct impact on currency valuation. Stay updated on the monetary policies of different countries to anticipate and react to potential market movements.

- Follow Exchange Rates: Regularly monitor exchange rates to identify profitable investment opportunities. Understanding the fluctuations in exchange rates can help you make informed decisions about when to buy, sell, or hold different currencies.

- Consider Investing in Stable Currencies: While investing in emerging market currencies may offer higher returns, they also come with increased risks. Consider balancing your portfolio with investments in stable and globally recognized currencies to maintain stability and mitigate risks.

- Consult with Financial Professionals: Seeking advice from experienced financial professionals who specialize in currency investments can provide valuable insights and help you navigate the intricate world of paper money valuation. They can assist in developing a customized investment strategy tailored to your goals and risk tolerance.

By following these tips, you can enhance your chances of building a successful investment portfolio in currency. Remember, patience, discipline, and continuous learning are essential to succeed in this dynamic market.

FAQ

What are some strategies for fulfilling your desires of owning paper money?

There are several strategies you can employ to fulfill your desires of owning paper money. One strategy is to start saving money regularly and set specific financial goals to save a certain amount each month. Another strategy is to invest in collectible paper money, such as rare banknotes or historical currency. You can also try your luck with currency trading or Forex market. Finally, consider exploring opportunities to earn extra income through side hustles or part-time jobs to accelerate your savings and investment journey.

Is it possible to fulfill my dreams of owning paper money even with a limited budget?

Absolutely! You don't need a huge budget to start fulfilling your dreams of owning paper money. Begin by creating a budget and identify areas where you can cut expenses and allocate more towards savings. Explore affordable options for collecting paper money, such as starting with lower denomination banknotes or purchasing replicas of valuable currency. Additionally, educate yourself about the market and look for good deals or discounts when investing in paper money. Persistence, patience, and smart financial decisions can help you build your collection even on a limited budget.

Are there any risks associated with investing in paper money?

Like any investment, there are risks associated with investing in paper money. The value of banknotes can fluctuate depending on various factors such as economic conditions, demand, market trends, and authenticity. It's essential to thoroughly research and acquire knowledge about the industry before making any investment decisions. Beware of counterfeit banknotes and buy from reputable sources to mitigate the risk. Diversifying your investment portfolio and consulting with experts or financial advisors can further help in managing potential risks.

Can I sell my paper money collection in the future?

Yes, you can sell your paper money collection in the future if you wish to. Many collectors see their collections as investments and choose to sell when the market conditions are favorable or when they reach their financial goals. The value of your collection will depend on factors such as rarity, condition, historical significance, and market demand. You can sell through various channels such as online marketplaces, auctions, or by connecting with other collectors. Proper documentation, preservation, and authentication of your banknotes can positively impact their resale value.

Are there any alternative ways to fulfill my desires of owning paper money without actually purchasing it?

Absolutely! If purchasing paper money is not feasible for you, there are alternative ways to fulfill your desires. One way is to visit museums or exhibitions that display historical and rare banknotes. You can also join numismatic clubs or online forums where you can engage with fellow collectors, learn about different currencies, and even exchange information or photographs of banknotes. Another option is to read books, articles, or watch documentaries about paper money to satisfy your interest and gain knowledge about the subject. Remember, you don't always have to physically own paper money to indulge in your passion for it.