Imagine a captivating journey towards a role that embodies wisdom, strategy, and influence within the realm of finance. The allure of steering the helm of a financial institution towards success is a dream many individuals ardently aspire to. This article delves into the captivating world of bank management, an indispensable key to unlocking a fruitful and prosperous future.

Embrace the allure of financial management, a position that expands horizons and presents countless opportunities for growth and success. As a financial institution operates within a dynamic environment, the role of a bank manager demands a diverse skill set which includes strategic planning, risk management, and leadership abilities.

The focal point of a financial institution lies within its bank management division. By skillfully navigating through the intricate interconnectedness of financial systems, bank managers hold the power to dictate the success and stability of an organization. They possess an acute understanding of the financial landscape, enabling them to maximize opportunities and mitigate potential risks.

Unlock the secrets to a successful financial future by exploring the intricacies of bank management. By possessing a steadfast determination to learn, adapt, and lead, one can master the art of ensuring the financial well-being of an institution and its clients. Embrace the challenges and rewards of this prestigious path, and be prepared to carve out a promising journey towards a prosperous future.

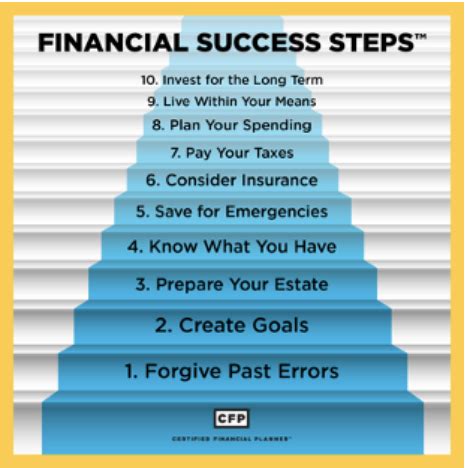

Unlocking the Essential Steps to Achieving Financial Success

Introduction: In this section, we will explore the key principles and strategies that are crucial for unlocking a pathway to financial success. By understanding and implementing these essential steps, individuals can take control of their financial future and achieve their dreams.

1. Building a Strong Foundation: Creating a solid financial foundation is the first step towards achieving success. This involves developing a budget, setting financial goals, and establishing an emergency fund. By carefully managing income and expenses, individuals can ensure they have a strong base from which to grow their wealth.

2. Investing Wisely: Investing is a key component of financial success. By carefully selecting investment opportunities and diversifying their portfolio, individuals can maximize their returns and build long-term wealth. Understanding the risks and rewards associated with different investment options is crucial for making informed decisions and achieving financial growth.

3. Managing Debt Effectively: Debt can be a significant obstacle in achieving financial success. By developing a plan to manage and reduce debt, individuals can avoid high interest payments and regain control of their finances. This involves prioritizing debt repayment, negotiating lower interest rates, and avoiding unnecessary borrowing.

4. Continual Learning and Adaptation: The financial landscape is constantly evolving, and individuals must stay informed and adapt to changes in order to achieve long-term success. This requires ongoing financial education, staying up to date with market trends, and adjusting strategies as needed. By continually learning, individuals can make informed decisions and navigate the ever-changing financial world.

5. Seeking Professional Guidance: In challenging financial situations, seeking the guidance and expertise of a bank manager or financial advisor can be instrumental in unlocking the key to success. These professionals can provide personalized advice, help individuals navigate complex financial situations, and provide valuable insights to help individuals achieve their financial goals.

Conclusion: Unlocking the key to financial success requires a combination of discipline, knowledge, and strategic decision-making. By following these essential steps, individuals can overcome financial obstacles and pave the way towards a prosperous future. With the right mindset and actions, anyone can unlock the door to financial success and turn their dreams into reality.

Rising Above Debt: How a Bank Manager Can Help

Overcoming financial burdens and achieving financial stability is a goal that many individuals strive for. One significant challenge that individuals face on this journey is debt. However, with the assistance and expertise of a bank manager, individuals can find the support and guidance needed to rise above their debt and pave the way towards a brighter financial future.

Empowering Financial Decisions: A bank manager plays a crucial role in assisting individuals with their debt by empowering them to make informed financial decisions. By thoroughly assessing their financial situation, a bank manager can provide personalized advice tailored to the specific needs and circumstances of each individual. This guidance can include debt consolidation strategies, budgeting techniques, and tips for effective money management.

Expert Negotiations: Dealing with creditors and debt collectors can be intimidating and overwhelming. However, a bank manager can act as a mediator and negotiator on behalf of the individual. With their expertise and knowledge of the financial industry, a bank manager can negotiate with creditors to potentially reduce interest rates, extend repayment periods, or even negotiate debt settlement options.

Access to Financial Resources: Bank managers have access to a range of financial resources that can assist individuals in overcoming their debt. They can provide information about various loan programs, debt consolidation services, or specialized financial products designed specifically for debt management. By tapping into these resources, individuals can find the right solution to address their debt and work towards a debt-free future.

Support and Accountability: Sometimes, the journey to financial freedom requires more than just financial advice. A bank manager can provide emotional support and accountability to individuals as they strive to overcome their debt. They can act as a mentor, offering encouragement and motivation throughout the process, ensuring that individuals stay on track towards their financial goals.

In conclusion, a bank manager can be a powerful ally in the journey towards rising above debt. Through their empowering guidance, expert negotiations, access to financial resources, and unwavering support, individuals can gain the necessary tools to conquer their debt and pave the way towards a prosperous financial future.

The Significance of Financial Planning: Insights from a Banking Executive

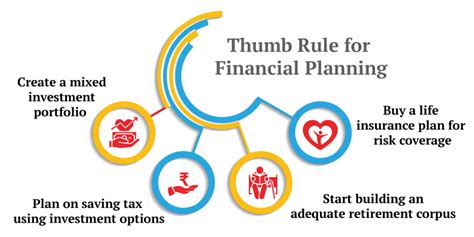

In today's fast-paced and unpredictable world, having a solid financial plan in place is crucial for everyone, regardless of their income level or age. Financial planning is not just about managing money; it encompasses a wide range of strategies and decisions that can help individuals and families achieve economic stability, meet their future goals, and ultimately, attain financial security.

When it comes to financial planning, no one understands its importance better than banking executives, who have a deep understanding of the intricacies and challenges associated with managing money. By relying on their extensive expertise and experience, they can provide valuable insights into the significance of financial planning and guide individuals towards making informed decisions about their financial future.

Creating a roadmap for success:

Financial planning serves as a roadmap that guides individuals in making wise financial decisions and achieving their desired outcomes. It involves setting clear goals, assessing current financial standing, and designing a personalized strategy to reach those goals effectively. With proper financial planning, individuals can identify potential risks, anticipate future expenses, and develop a clear path towards long-term financial success.

Ensuring financial security:

One of the primary objectives of financial planning is to ensure financial security, both in the present and for the future. By carefully evaluating income, expenses, and assets, individuals can create a safety net that protects them during unexpected circumstances and provides a sense of financial stability. This includes establishing emergency funds, insurance coverage, and investment portfolios that align with their risk tolerance and long-term goals.

Enhancing wealth accumulation:

Effective financial planning involves optimizing resources to maximize wealth accumulation over time. Through prudent investment strategies, individuals can grow their financial assets while managing risks. Banking executives can provide valuable insights into various investment opportunities, such as stocks, bonds, mutual funds, and real estate, helping individuals make informed decisions and optimize their portfolios to generate substantial returns.

Adapting to changing circumstances:

Another vital aspect of financial planning is its adaptability to changing circumstances. Life is full of unexpected events, such as job loss, health issues, or economic downturns, all of which may significantly impact an individual's financial well-being. However, a well-crafted financial plan can help individuals navigate through these challenges by providing flexibility and enabling them to make necessary adjustments in their money management strategies.

Empowering individuals to achieve their dreams:

Ultimately, financial planning empowers individuals to take control of their financial well-being, enabling them to pursue their dreams and aspirations. Whether it be buying a home, starting a business, saving for retirement, supporting children's education, or traveling the world, having a comprehensive financial plan in place equips individuals with the tools and confidence to turn their dreams into reality.

In conclusion, financial planning plays a critical role in securing a successful financial future. By seeking insights from banking executives who possess comprehensive knowledge of financial management, individuals can gain a better understanding of the importance of financial planning and utilize it as a powerful tool to attain economic stability, protect their assets, and turn their dreams into tangible achievements.

Maximizing Savings Opportunities with the Guidance of a Banking Expert

When it comes to securing a prosperous financial future, one crucial aspect is maximizing savings opportunities. While many individuals strive to save money, it can often be challenging to navigate the complex world of personal finance alone. By seeking the guidance of a knowledgeable bank professional, individuals can unlock a multitude of ways to make the most of their savings and achieve their financial goals.

A bank manager, with their extensive expertise and experience, can provide invaluable insights into various savings options available. From traditional savings accounts to innovative investment vehicles, they can help individuals identify the most suitable avenues to grow their savings. By understanding the individual's financial goals, risk tolerance, and timeline, a bank manager can tailor their advice to ensure the best possible outcomes.

Furthermore, a bank manager can assist in optimizing savings by offering advice on managing expenses. Through a comprehensive assessment of an individual's spending patterns and budget, they can identify areas where cutbacks or adjustments can be made, freeing up additional funds for saving. By working closely together, individuals can develop effective strategies to minimize unnecessary expenses without sacrificing their financial well-being.

In addition to strategic guidance, a bank manager can also provide access to exclusive savings opportunities. They are up-to-date with the latest financial products and services that may not be readily available to the general public. Through their extensive network and connections, they can introduce individuals to exclusive deals, special offers, and advantageous interest rates, maximizing their savings potential.

Ultimately, seeking the guidance of a bank manager can significantly increase an individual's chances of maximizing their savings opportunities. By drawing on their expertise, individuals can navigate the complexities of personal finance and make informed decisions that align with their long-term goals. Together with a bank manager, individuals can secure a prosperous and financially stable future.

Proven Investment Strategies: Expert Tips to Safeguard Your Financial Future

In this section, we will delve into a range of recommended investment strategies, curated by an experienced professional in the banking industry. These strategies offer valuable guidance on how to protect and grow your wealth, ensuring a secure financial future for yourself and your loved ones.

1. Diversify your portfolio:

- Spread your investments across multiple asset classes, such as stocks, bonds, and real estate, to mitigate risk and potentially maximize returns.

- Consider investing internationally to take advantage of global market opportunities, thereby safeguarding your portfolio against regional economic downturns.

- Regularly review your portfolio allocation to ensure it aligns with your financial goals and risk tolerance.

2. Take a long-term approach:

- Patience is key when it comes to investing. Adopt a long-term perspective rather than succumbing to short-term market fluctuations.

- Focus on quality investments that have the potential to deliver sustainable returns over time.

- Consider investing in index funds or exchange-traded funds (ETFs) to gain broad exposure to the market and minimize individual stock risk.

3. Stay informed and seek professional advice:

- Keep yourself updated on financial news and trends to make informed investment decisions.

- Consult with a trusted financial advisor or bank manager who can provide personalized guidance and help you navigate the complex world of investments.

- Take advantage of educational resources and seminars offered by financial institutions to enhance your financial knowledge.

4. Regularly reassess and rebalance your portfolio:

- Periodically review your investments and make adjustments as necessary to align with changing market conditions and your investment goals.

- Consider rebalancing your portfolio by buying or selling investments to maintain the desired asset allocation and manage risk.

- Take into account your investment timeframe and reassess your risk tolerance when rebalancing.

5. Don't let emotions drive your investment decisions:

- Avoid making impulsive investment choices based on fear or greed.

- Stick to your well-thought-out investment plan and avoid chasing short-term gains.

- Keep a calm mindset and focus on your long-term financial goals.

By adopting these proven investment strategies, securing your financial future can be a reality. Remember, investing wisely and staying informed are fundamental steps towards achieving your long-term financial goals.

Navigating the Path to Homeownership: Valuable Mortgage Insight from a Banking Professional

Embarking on the journey towards homeownership can be both exciting and overwhelming. When it comes to securing a mortgage, there are various factors to consider, from interest rates and loan terms to credit scores and down payments. In this section, we will explore expert tips from a seasoned bank manager who has extensive knowledge in navigating the complex world of mortgages.

1. Building a Strong Financial Foundation:

One of the first steps in preparing for a mortgage is to establish a solid financial foundation. This involves managing your finances responsibly, such as paying bills on time, reducing debt, and maintaining a good credit score. The bank manager emphasizes the importance of being financially stable before diving into the mortgage process.

2. Understanding Mortgage Options:

With various mortgage options available, it's crucial to have a clear understanding of each one. The bank manager will provide insights into different types of mortgages, such as fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans. By understanding these options, potential homeowners can make informed decisions based on their specific needs and financial goals.

3. Determining Affordability:

Before starting the mortgage application process, it's essential to determine how much house one can afford. The bank manager will share valuable tips on analyzing income, expenses, and personal financial goals to accurately calculate an affordable monthly mortgage payment. This step helps prevent individuals from taking on a mortgage that exceeds their financial capabilities.

4. Securing a Competitive Interest Rate:

Interest rates significantly impact the cost of a mortgage over time. The bank manager will discuss how potential homeowners can negotiate for a competitive interest rate, understand interest rate fluctuations, and consider factors that affect rates. This information will empower individuals to make informed decisions and potentially save thousands of dollars over the life of their mortgage.

5. Streamlining the Application Process:

Completing a mortgage application can be a paperwork-intensive process, but the bank manager will provide tips on streamlining the process and ensuring all necessary documents are collected efficiently. This insight will help potential homeowners navigate through the application process smoothly and reduce the chances of delays or complications.

In this section, we have explored valuable advice from a seasoned bank manager on how to navigate the world of mortgages successfully. By building a strong financial foundation, understanding different mortgage options, determining affordability, securing a competitive interest rate, and streamlining the application process, individuals can pave the way towards homeownership with confidence and ease.

FAQ

How can I unlock the key to a successful financial future?

To unlock the key to a successful financial future, it is important to start by setting clear financial goals and creating a budget. This will help you track your expenses, save money, and avoid unnecessary debt. Additionally, having a solid understanding of personal finance concepts such as investing, saving for retirement, and managing credit will contribute to long-term financial success. It is also crucial to seek professional advice from a bank manager or financial advisor who can provide guidance tailored to your individual needs.

What role does a bank manager play in achieving financial success?

A bank manager plays a significant role in achieving financial success by providing valuable advice and guidance on various financial matters. They can help you open and manage bank accounts, provide information on different types of loans and credit options, and assist in setting up savings and investment plans. A bank manager can also help you understand the importance of financial discipline and how to make informed decisions based on your financial goals. Their expertise can greatly contribute to unlocking the key to a successful financial future.

How does setting financial goals contribute to a successful future?

Setting financial goals is crucial for achieving a successful future as it provides a clear direction and purpose for managing your finances. When you have specific goals in mind, such as saving for a down payment on a house, starting a business, or retiring early, it becomes easier to make informed financial decisions and prioritize your spending and saving habits. By setting goals, you have something to work towards, which provides motivation and helps you stay focused on your financial journey.

Why is it important to seek professional advice for financial matters?

Seeking professional advice for financial matters is important because it ensures that you receive guidance that is tailored to your individual needs and goals. A bank manager or financial advisor has the knowledge and expertise to provide personalized solutions and strategies for managing your money effectively. They can help you navigate complex financial concepts, minimize risks, and maximize opportunities for growth. Professional advice is especially valuable when it comes to investing, retirement planning, and making major financial decisions that can have long-term implications.