Many individuals possess a fervent desire to entrust their resources to banking establishments, envisioning a future of financial stability and growth. Acquiring the skill of systematically setting aside funds can lead to a range of advantages, enabling individuals to achieve their goals, fulfill aspirations, and overcome unforeseen challenges.

Developing the habit of accumulating monetary assets showcases sagacity and prudence, enabling individuals to respond effectively to various life circumstances. Saving money establishes a solid foundation for individuals to secure their financial well-being, whether it be for purchasing a dream home, embarking on an exciting adventure, or simply preparing for unforeseen circumstances.

Furthermore, cultivating the habit of saving fosters a sense of empowerment and control over financial matters. When individuals have a growing fund of financial resources, they gain the confidence and freedom to make independent choices based on personal preferences and priorities. Saving money also serves as a buffer against unexpected financial setbacks, providing individuals with peace of mind and a sense of security in the face of uncertainties.

By embracing the art of saving, individuals pave the way towards a more prosperous future. Whether starting with small contributions or actively seeking additional means of income, commencing the journey towards financial stability is a crucial step. The initial steps may require dedication, discipline, and perhaps some sacrifices, but the long-term benefits are invaluable.

The Significance of Building Financial Reserves

Creating a financial cushion for the future is an essential practice for individuals looking to secure their financial stability. By setting aside funds regularly, individuals can establish a safety net that provides peace of mind and opens up opportunities for personal growth and long-term financial goals.

having a financial backup allows individuals to tackle unexpected expenses and emergencies without resorting to borrowing or incurring debt. This not only helps in maintaining financial independence but also safeguards against unforeseen circumstances that may adversely affect one's quality of life.

Furthermore, saving money fosters a sense of discipline and self-control. It encourages individuals to make wise financial decisions, prioritize expenditures, and differentiate between needs and wants. By cultivating these habits, individuals develop resilience and become better equipped to weather financial storms and achieve financial success in the long run.

In addition to providing security, saving money opens doors to a myriad of opportunities. It enables individuals to pursue their dreams, whether that involves traveling, starting a business, furthering education, or investing in assets that appreciate over time. By accumulating savings, individuals gain the flexibility and freedom to make choices that align with their personal values and aspirations.

Starting the journey towards building financial reserves may seem daunting at first, but it is never too late to begin. By taking small, consistent steps, such as setting a budget, reducing unnecessary expenses, and committing to regular contributions to a savings account, individuals can gradually achieve their savings goals. The key is to start early, stay committed, and be mindful of the progress made along the way.

In conclusion, saving money plays a pivotal role in achieving financial security and creating opportunities for personal growth. It provides a safety net during unforeseen circumstances and fosters discipline and resilience. By making saving a priority and persistently working towards building financial reserves, individuals can work towards a brighter and more prosperous future.

Building a Secure Financial Future

Creating a stable and protected financial future is a goal that many individuals strive for. By implementing effective strategies and making wise decisions, you can take control of your finances and build a solid foundation for years to come.

Planning for the long term: Developing a comprehensive financial plan is essential for building a secure future. This involves setting clear goals, identifying potential risks, and creating strategies to mitigate them. By considering various aspects such as income, expenses, investments, and retirement planning, you can establish a roadmap that aligns with your aspirations and secures your financial well-being.

Cultivating financial literacy: Gaining knowledge about personal finance is crucial in navigating the complexities of the financial world. By educating yourself on topics such as budgeting, saving, investing, and managing debt, you can make informed decisions that contribute to your long-term security. Additionally, understanding concepts like interest rates, inflation, and market trends empowers you to make intelligent financial choices and optimize your wealth growth.

Embracing the power of savings: Saving money is a cornerstone of building a secure financial future. By creating a habit of regularly setting aside a portion of your income, you can accumulate funds for emergencies, major purchases, and retirement. Saving not only provides a safety net during unexpected circumstances but also enables you to achieve your financial goals and enjoy a comfortable lifestyle in the future.

Diversifying your investments: Putting all your eggs in one basket can be risky when it comes to investments. By diversifying your investment portfolio, you spread your risk and increase the likelihood of earning stable returns. This can involve investing in a variety of assets such as stocks, bonds, real estate, or mutual funds. Additionally, staying updated on market trends and seeking professional advice can help you make informed investment decisions.

Protecting yourself and your assets: Safeguarding your financial well-being involves taking measures to protect yourself and your assets from unforeseen events. This includes obtaining appropriate insurance coverage for your health, home, vehicle, and other valuables. Furthermore, ensuring the security of your personal information and being vigilant against fraud and identity theft helps you maintain your financial stability.

Building a secure financial future is a journey that requires discipline, knowledge, and proactive planning. By following these strategies and making informed decisions, you can pave the way for long-term financial success and enjoy peace of mind knowing that you are prepared for whatever the future may hold.

The Power of Compound Interest

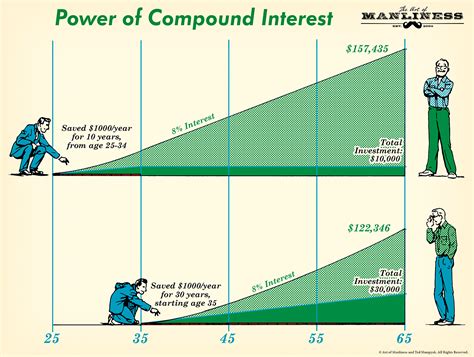

When it comes to growing your wealth, there is a powerful force that can work in your favor - compound interest. This financial concept has the potential to significantly amplify your savings over time, allowing your money to work harder for you.

Compound interest can be thought of as a snowball effect, where your initial investment generates returns that are reinvested and earn even more returns. By consistently adding to your savings and allowing them to grow, you can harness the power of compounding and watch your wealth multiply.

One of the key advantages of compound interest is that it allows for exponential growth. As your money continues to earn returns on both the initial investment and the accumulated interest, the growth becomes increasingly accelerated. This compounding effect can lead to substantial wealth accumulation over the long term.

Another important aspect of compound interest is the ability to harness the time factor. The earlier you start saving, the more time your money has to compound and grow. This means that even small contributions made early on can have a significant impact on your financial well-being in the future.

It's also worth mentioning that compound interest is not limited to traditional savings accounts. It can be applied to various investment vehicles such as stocks, bonds, mutual funds, and even real estate. By diversifying your investments and understanding the power of compounding, you can create a well-rounded portfolio that maximizes your wealth-building potential.

In conclusion, the power of compound interest is undeniable. By harnessing this concept and making regular contributions to your savings or investments, you can set yourself on a path to financial success and achieve your long-term goals.

Preparing for Unexpected Expenses

Life is full of surprises, and not all of them are pleasant. We often encounter unexpected expenses that can throw our carefully planned budgets off track. To ensure financial stability and peace of mind, it is essential to be prepared for these unforeseen circumstances.

One way to prepare for unexpected expenses is by setting up an emergency fund. This fund acts as a safety net, providing you with a financial cushion when you need it the most. Start by determining how much you can comfortably save each month, and then set aside a portion of your income specifically for this fund.

Another important step in preparing for unexpected expenses is to have insurance coverage. Whether it's health insurance, car insurance, or home insurance, having the right policies in place can protect you from unforeseen financial burdens in case of accidents, illnesses, or damages. Make sure to review your insurance policies regularly to ensure they still meet your needs and cover any new assets or changes in your circumstances.

It's also a good idea to establish a budget that includes a category for unexpected expenses. By allocating a portion of your monthly income towards this category, you can build up a buffer for any surprise costs that may arise. This will help prevent you from dipping into your savings or relying on credit cards when unexpected expenses occur.

- Consider automating your savings by setting up an automatic transfer from your checking account to your emergency fund or a separate savings account. This way, you won't have to rely on willpower alone to save for unexpected expenses.

- Research and compare different insurance policies to find the ones that offer the best coverage at the most affordable rates. Don't overlook the importance of having adequate coverage, as it can save you from significant financial stress in the long run.

- Regularly review your budget and make adjustments as necessary. As your financial situation evolves, your budget should reflect these changes to ensure you are allocating enough funds towards unexpected expenses.

- Explore other options for additional income, such as freelance work or part-time jobs. Having multiple sources of income can provide you with a greater financial buffer for unexpected expenses.

By taking these steps to prepare for unexpected expenses, you can minimize their impact on your financial well-being and maintain a sense of security. Remember, it's not a matter of if unexpected expenses will occur, but when. Being proactive and prepared will ensure that you can handle any financial curveballs that come your way.

Achieving Your Long-Term Aspirations

Setting and striving towards long-term goals is an integral part of securing a prosperous future. By envisioning your aspirations and diligently working towards them, you can create a pathway that leads to success and fulfillment. In this section, we will explore some effective strategies to help you achieve your long-term goals while ensuring financial stability.

- Develop a Clear Vision: Begin by clearly defining your long-term goals. Whether it's owning a home, starting a business, or pursuing higher education, having a crystal-clear vision will provide you with the motivation and direction needed to stay on track.

- Create a Plan of Action: Break down your long-term goals into smaller, manageable steps. This will allow you to track your progress and make adjustments along the way. A well-thought-out plan will keep you focused and organized, ensuring that you are constantly moving forward towards achieving your aspirations.

- Establish a Savings Strategy: Saving money plays a crucial role in achieving long-term goals. Assess your current financial situation and develop a budget that allows you to allocate funds towards your objectives. Consider utilizing different savings accounts or investment options to maximize your returns and build wealth over time.

- Cultivate Discipline and Patience: Long-term goals require perseverance and patience. Avoid getting discouraged by setbacks or delays. Remain disciplined in sticking to your plan and trust the process. Remember that success rarely happens overnight and that the journey towards your aspirations may require time and effort.

- Seek Support and Accountability: Surround yourself with a supportive network of individuals who encourage and understand your long-term goals. Regularly communicate your progress and challenges to receive valuable feedback and guidance. Having a support system can provide motivation during challenging times and hold you accountable for staying on track.

By implementing these strategies and maintaining a focused mindset, you can set yourself up for long-term success and turn your dreams into reality. Remember, achieving your long-term goals is not a one-time event but rather an ongoing process that requires dedication and perseverance.

Embarking on Your Savings Journey

Beginning your venture towards financial security starts with taking the first steps towards saving. By establishing a solid foundation for your savings, you can cultivate a brighter future for yourself and your loved ones.

| Step 1: Set Clear Financial Goals |

| Start by defining realistic and specific financial goals that align with your aspirations. Whether you are saving for a down payment on a house or a dream vacation, having a clear target in mind will help you stay motivated and focused throughout your savings journey. |

| Step 2: Track Your Spending |

| Understanding where your money goes is crucial in controlling your spending habits. Keep a record of your expenses to identify areas where you can cut back and redirect those funds towards your savings. This simple practice will allow you to make informed financial decisions and prioritize your long-term goals. |

| Step 3: Create a Realistic Budget |

| Developing a budget is key to managing your finances effectively. Take the time to analyze your income and expenses, and allocate a portion of your earnings towards savings. Strive to strike a balance between your current needs and your future financial security. |

| Step 4: Automate Your Savings |

| Make use of technology and set up automatic transfers from your checking account to a dedicated savings account. By automating your savings, you remove the temptation to spend the money immediately, ensuring consistent progress towards your financial goals. |

| Step 5: Prioritize Debt Repayment |

| If you have outstanding debts, allocate a portion of your savings towards their repayment. By tackling your debts alongside your savings, you avoid accumulating unnecessary interest expenses and pave the way for a stronger financial future. |

| Step 6: Explore Saving Options |

| Research different saving options available to you, such as high-yield savings accounts or certificates of deposit (CDs). Understanding the potential returns and benefits of various saving vehicles will enable you to make informed decisions and maximize the growth of your savings. |

| Step 7: Stay Committed to Your Savings Plan |

| While the road to financial security may have its challenges, remain committed to your savings plan. Regularly review and adjust your budget, celebrate milestones along the way, and seek support and guidance from financial professionals, if necessary. With dedication and perseverance, you will steadily progress towards your savings goals. |

Creating a Budget and Setting Goals

Developing a financial plan is a fundamental step towards achieving your desired financial future. By creating a budget and setting clear goals, you can gain control over your finances and work towards your dreams.

1. Constructing a budget:

An essential aspect of effective financial management is creating a budget. A budget acts as a roadmap, helping you track your income and expenses, and enabling you to make informed decisions regarding your finances. By allocating your income to different categories, such as housing, transportation, food, and entertainment, you can prioritize your spending and ensure that you are saving for your goals.

2. Setting financial goals:

Setting clear and realistic goals is crucial for staying motivated and focused on your financial journey. Whether your goals involve saving for a down payment on a home, starting a business, or funding your retirement, having specific targets will help you stay on track. Take some time to reflect on what you want to achieve and establish both short-term and long-term goals, ensuring they are measurable and attainable.

3. Monitoring and adjusting:

Regularly monitoring your budget and progress towards your goals is essential for successful financial management. Review your budget periodically to assess whether you are sticking to your allocations, adjust as needed to accommodate changes in your income or expenses, and ensure that you are making progress towards your goals. Stay adaptable and be willing to make necessary adjustments along the way.

4. Seeking professional advice:

If you find yourself struggling to create an effective budget or unsure of where to start, consider seeking assistance from a financial advisor. A professional can provide personalized guidance, help you develop a comprehensive financial plan, and offer valuable insights to optimize your financial situation.

By creating a budget and setting goals, you can take control of your finances and pave the way towards a prosperous financial future.

Automate Your Savings for a Stress-Free Financial Future

Discover the power of automating your savings to effortlessly build wealth and secure your financial future. By setting up automatic transfers, you can ensure that a portion of your income is consistently deposited into your savings account without any effort on your part.

One of the biggest challenges in saving money is the temptation to spend it instead. Life is full of unexpected expenses and tempting purchases, making it difficult to resist the urge to dip into your savings. However, by automating your savings, you remove the emotional and impulsive decision-making process from the equation.

Automatic transfers allow you to prioritize saving by designating a specific amount or percentage of your income to be automatically deposited into your savings account each month. This ensures consistency in your savings habits, regardless of any financial setbacks or unexpected expenses that may arise.

There are various ways to automate your savings, depending on your preferences and financial situation. Some options include setting up a direct deposit with your employer, scheduling recurring transfers from your checking account to your savings account, or utilizing mobile banking apps that round up your purchases and deposit the extra change into your savings.

- Direct Deposit: By setting up a direct deposit with your employer, you can allocate a portion of your paycheck to be automatically directed to your savings account. This allows you to save before you even have the chance to spend.

- Recurring Transfers: Schedule regular transfers from your checking account to your savings account. Decide on a set frequency, such as weekly, bi-weekly, or monthly, to ensure consistent savings contributions.

- Round-Up Apps: Take advantage of mobile banking apps that round up your purchases to the nearest dollar and deposit the extra change into your savings. This painless strategy allows you to save effortlessly without even noticing.

Automating your savings not only helps you build a financial safety net but also makes saving money a seamless part of your everyday life. With consistent contributions to your savings account, you can create a sense of financial security and work towards achieving your long-term goals.

Start automating your savings today and take control of your financial future. By incorporating this simple and effective strategy, you can enjoy peace of mind knowing that your savings are growing steadily, regardless of life's unpredictable twists and turns.

Choosing the Perfect Savings Account: Finding the Right Fit

When it comes to saving money, one of the most crucial steps is selecting the ideal savings account that suits your needs and financial goals. By carefully considering the range of options available, you can ensure that your money is not only secure but also grows over time. In this section, we will explore the factors to consider when choosing a savings account, as well as the different types of savings accounts you can explore.

Assessing Your Financial Objectives: Before diving into the world of savings accounts, it's essential to have a clear understanding of your financial objectives. Are you saving for a short-term goal, such as a vacation or a down payment on a house, or are you looking to build a long-term financial safety net? Understanding your goals will help you determine the timeframe, liquidity requirements, and potential returns you are seeking from your savings account.

Considering Account Types: Savings accounts come in various forms, each with its own benefits and considerations. Traditional savings accounts offer ease of access, low to moderate interest rates, and the security of federally insured deposits. Money market accounts, on the other hand, often provide higher interest rates and check-writing capabilities, making them suitable for those who want their savings to earn more while maintaining some liquidity. Certificates of Deposit (CDs) offer higher interest rates, but with less accessibility, as they require a fixed term commitment.

Evaluating Fees and Minimum Balance Requirements: Another significant aspect to consider when choosing the right savings account is the associated fees and minimum balance requirements. Some accounts may charge fees for transactions, withdrawals, or account maintenance, which can eat into your savings. Additionally, certain accounts may have minimum balance requirements, requiring you to maintain a specific amount of money in the account to avoid penalties or account closures. It's essential to carefully review these terms and choose an account that aligns with your financial situation and goals.

Researching Interest Rates: Interest rates play a significant role in determining how much your savings will grow over time. While traditional savings accounts may offer lower interest rates, they often provide stability and ease of access. On the other hand, certain online banks or credit unions may offer higher interest rates, enabling you to maximize your savings. Considering the trade-offs between interest rates and account accessibility will help you find the optimal balance for your long-term savings goals.

By considering your financial objectives, the different types of savings accounts available, associated fees, and interest rates, you can confidently navigate the world of savings accounts and select the one that best aligns with your needs. Remember, choosing the perfect savings account is a crucial step towards achieving financial stability and working towards your dreams!

Avoiding Temptations and Staying Motivated

In our pursuit of financial stability and achieving our savings goals, it is crucial to navigate the challenges that can hinder our progress. Resisting temptations and staying motivated are key factors that can make or break our saving journey. By developing a strong mindset and implementing effective strategies, we can overcome temptations and maintain our motivation throughout the process.

One strategy to avoid temptations is to create a detailed budget that clearly outlines our expenses and income. By understanding where our money is going, we can identify unnecessary expenses and prioritize our savings goals. Additionally, having a budget helps us make conscious decisions before purchasing something that may divert us from our savings objectives.

Another tactic to resist temptations is to limit exposure to unnecessary temptations. This can involve unsubscribing from email newsletters that promote unnecessary spending, avoiding retail therapy trips, or reducing time spent on online shopping platforms. Curating our environment to minimize temptations can significantly enhance our ability to stay on track with our saving plans.

It is also important to celebrate small milestones along the way to stay motivated. Saving can sometimes be a long-term endeavor, and acknowledging the progress we have made can provide a sense of accomplishment and drive us to continue our efforts. Setting achievable short-term goals and rewarding ourselves when we reach them can create a positive feedback loop that fuels our motivation.

Furthermore, connecting with a supportive community can boost our motivation. Surrounding ourselves with like-minded individuals who share similar financial goals can provide a sense of accountability and encouragement. Whether it's joining an online savings group or having regular discussions with friends or family members, having a support system can help us stay motivated and on track.

Lastly, keeping the end goal in mind can serve as a powerful motivator. Visualizing the financial freedom and security that saving will bring can inspire us to overcome challenges and resist temptations. Whether it's picturing a dream vacation, a comfortable retirement, or the ability to pursue our passions without financial constraints, reminding ourselves of the ultimate rewards can help us stay focused and committed to our saving journey.

Seeking Expert Financial Guidance

In the pursuit of managing and growing one's finances, it is crucial to seek guidance from financial professionals who possess a deep understanding of the complexities and intricacies of the financial world. Engaging with experienced advisors can provide valuable insights and strategies to help individuals achieve their financial goals.

1. Consider engaging a Certified Financial Planner (CFP), who can offer comprehensive financial planning services tailored to your specific needs and objectives. These professionals possess an in-depth understanding of various investment options, risk management, tax planning, and estate planning.

2. Financial advisors who specialize in retirement planning can assist in developing a personalized retirement strategy that aligns with your desired lifestyle during your golden years. They can help you navigate retirement income solutions, understand and maximize social security benefits, and make strategic investment decisions.

3. For individuals looking to invest in stocks, bonds, mutual funds, or other market instruments, seeking guidance from a knowledgeable investment advisor is crucial. These professionals can assess your risk tolerance, time horizon, and financial goals to create a tailored investment portfolio and provide ongoing monitoring and guidance.

4. Tax advisors or Certified Public Accountants (CPAs) can assist in minimizing tax liabilities through strategic planning and ensuring compliance with relevant tax laws. They can provide guidance on deductibles, credits, and tax-efficient investment strategies.

5. If you are considering purchasing a home or need assistance with mortgage planning, consulting a mortgage broker or loan officer can be beneficial. They can help you navigate the intricacies of mortgage products, interest rates, and repayment options.

6. Estate planning attorneys can help individuals create wills, establish trusts, and develop comprehensive estate plans to protect and distribute assets according to their wishes. They can also assist in minimizing estate taxes and ensuring a smooth transition of wealth to future generations.

- Seeking professional financial advice empowers individuals to make well-informed decisions, develop effective financial plans, and navigate complex financial landscapes.

- Being proactive and engaging with experienced advisors can provide individuals with peace of mind, knowing they have a sound financial strategy in place.

- Remember, financial advisors are there to provide guidance and support, and finding the right advisor who understands your unique situation and goals is essential for long-term financial success.

FAQ

Why is saving money important?

Saving money is essential for several reasons. Firstly, it provides financial security and a safety net for unexpected expenses or emergencies. It also allows individuals to meet their future goals and aspirations, such as buying a house or starting a business. Additionally, saving money can help individuals achieve financial independence and retire comfortably.

How can I start saving money if I have a limited income?

Even with a limited income, there are several ways you can start saving money. Firstly, create a budget to track your expenses and identify areas where you can cut back. Reduce unnecessary expenses such as eating out or buying luxury items. Consider setting up automatic transfers from your paycheck to a separate savings account, ensuring a portion of your income goes towards savings. It's also beneficial to prioritize saving goals and start small – every little bit counts!

What are some effective strategies to save more money?

There are numerous strategies you can employ to save more money. Firstly, set specific saving goals to stay motivated and on track. Create a realistic budget and stick to it, consistently tracking your expenses. Minimize impulse purchases and unnecessary expenses. Consider finding ways to increase your income, such as taking on a side job or freelancing. Look for opportunities to save on regular expenses, such as switching to a more affordable phone plan or seeking out discounts and coupons.

How can I make my savings grow over time?

There are several strategies to make your savings grow over time. One option is to open a high-yield savings account, which offers a higher interest rate than a regular savings account. Investing in stocks or other financial instruments can also potentially grow your savings, although it carries risks and requires proper research and understanding. Another option is to contribute to retirement accounts such as a 401(k) or an IRA, taking advantage of potential employer matches or tax benefits.